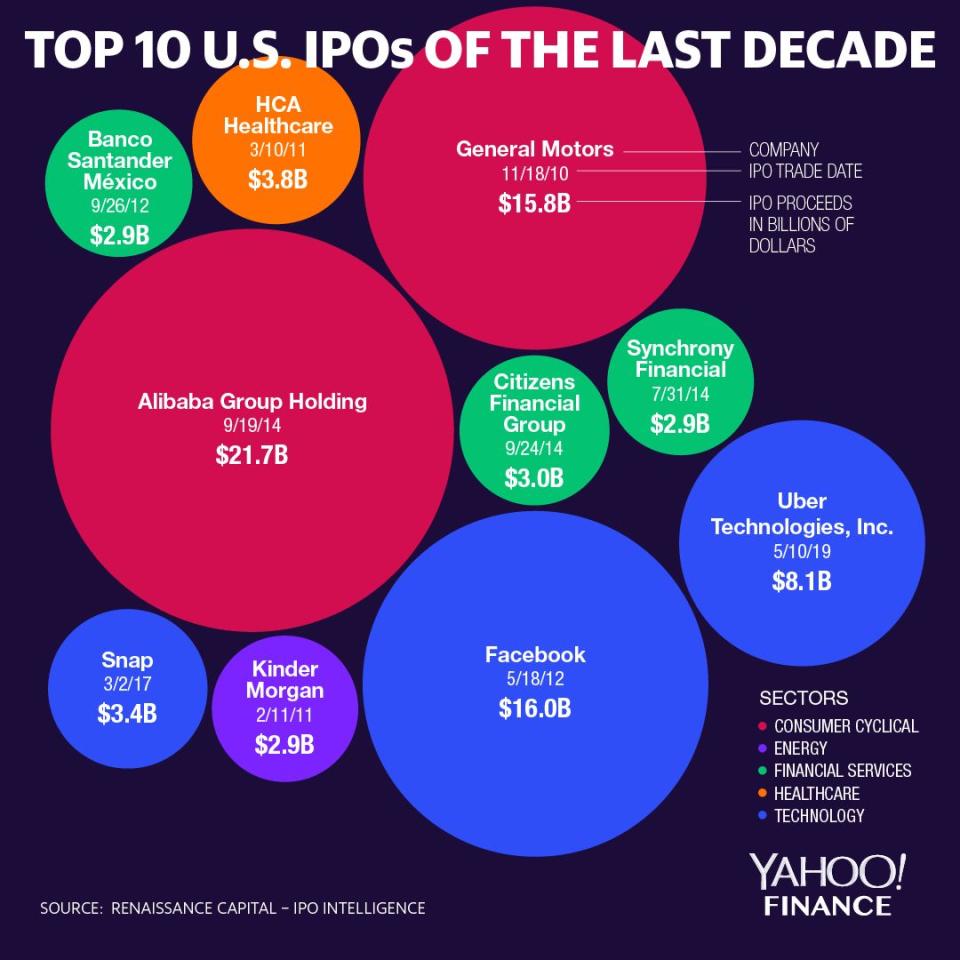

The top 10 US IPOs in the last decade and how their stock performed

So far, 2019 has been a hot year for IPOs. With ride-sharing company Uber (UBER) finally joining in on the party, other highly anticipated unicorns’ IPOs such as Airbnb, SpaceX, Slack and a handful of others expected to run out of the gate this year. Looking back on the past decade, these are the top 10 U.S. IPOs based on deal size at the time of debut, not including underwriter over-allotment.

1. Alibaba Group (BABA)

The Chinese e-commerce giants deal size was valued at a whopping $21.7 billion when it went public on September 19, 2014. Alibaba’s IPO is not only the biggest U.S. IPO in the last decade, but it is also still the largest IPO in the world.

Shares were priced at $68 per share and opened at $92.70 before closing their first day of trading at $93.89. The stock fell 3% one year after its IPO but has surged over 161% since going public.

2. Facebook (FB)

Facebook’s debut on the public market on May 18, 2012 was one of the most highly anticipated IPOs over the past decade. The social media company’s deal size was valued at $16 billion at the time of its IPO and was priced at $38 per share. The Nasdaq’s technological glitches hampered Facebook’s first day of trading and shares closed flat at $38.23. As excited as investors were to get in on Facebook’s IPO, the first year of trading was rough. It was considered an epic IPO flop, as shares tumbled nearly 40% a little over a year after going public. Nevertheless, investors who stuck around were richly rewarded. The stock has soared 395% since its IPO.

3. General Motors (GM)

This year will mark automaker General Motors’ 10-year IPO anniversary. GM had a hefty $15.8 billion offering valuation at the time of its IPO on November 18, 2010. Shares were priced at $33 and closed their first day of trading 3% higher at $34.19 per share. GM stock fell 34% in its first year of trading and is up a modest 15% since its debut.

4. Uber Technologies (UBER)

In one of the most highly anticipated IPOs in recent history, ride-sharing company Uber Technologies made its public market debut on the New York Stock Exchange on May 10. With an offering size of $8.1 billion, Uber lands on number four on the list. Despite the hype and initial fanfare, Uber’s IPO was a major disappointment right out of the gate. Shares priced at $45 but then started trading below that at $42 per share and then closed its first day of trading at $41.60. Rival Lyft (LYFT) beat Uber and hit the market first, but Lyft hasn’t had a smooth ride, either. Shares priced at $72 per share but are now trading below $50 per share as of May 13.

5. HCA Healthcare (HCA)

HCA Healthcare’s IPO on March 10, 2011 was the largest health care IPO in the past decade. The company’s offering was valued at $3.8 billion at the time of its initial public offering and shares were priced at $30 per share. The stock closed its first day of trading at $31.02 per share and sank nearly 15% in its first year. Despite the tepid start, HCA has skyrocketed over 312% since its IPO.

6. Snap (SNAP)

Social media giant Snap was perhaps the most anticipated tech IPO since Facebook. It debuted on the public market on March 2, 2017 with a $3.4 billion deal size. Shares priced at $17 and closed their first day of trading at $24.48.

Snap jumped 5% in its first year, but has been on a precipitous decline. With a slew of executive departures, the company has been struggling to regain its footing as shares plunged 38% since its IPO.

7. Citizens Financial Group (CFG)

Citizens Financial Group went public on September 24, 2014 with a $3 billion deal size. Shares priced at $21.50 and closed their first day of trading at $23.08 and stayed relatively unchanged exactly one year later at $23.24. In the more than four years since the company has been public, the stock has jumped 67%.

8. Banco Santander México (BSMX)

In the same year as Facebook, Spanish bank Banco Santander’s Mexican unit debuted on the U.S. market on September 26, 2012 with a $2.9 billion deal size.

Shares were priced at $12.18 and closed the first day of trading up nearly 6% at $12.91. The bank’s stock rallied 17% in its first year, but has plunged more than 34% since its IPO.

9. Synchrony Financial (SYF)

Synchrony Financial’s initial public offering on July 31, 2014 was considered the biggest IPO of the year at the time with a deal size of $2.9 billion. Synchrony is the North American retail finance unit that was spun off of General Electric’s finance division. Shares priced at $23 and closed completely flat on its first day on the market. Since its IPO, the stock has risen 52%.

10. Kinder Morgan (KMI)

Oil and gas pipeline giant Kinder Morgan debuted on the New York Stock Exchange on February 11, 2011 with a $2.9 billion deal size. At the time, it was the largest private equity-backed IPO in U.S. history. Shares were priced at $30 and rose 3.5% on its first day of trading. One year post-IPO, the stock rallied nearly 8% but has since plummeted more than 34% since its debut.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

Key factors to consider before jumping into hot IPOs, according to UBS

Inverted yield curve could be a good thing for stocks: Citi

Why Warren Buffett isn’t buying the Lyft IPO

Legendary investor Alan Patricof: A company's leader is more important than its product

雅虎香港財經

雅虎香港財經