Champs and Chumps: Nike and weed won the week

This week’s champ is Nike.

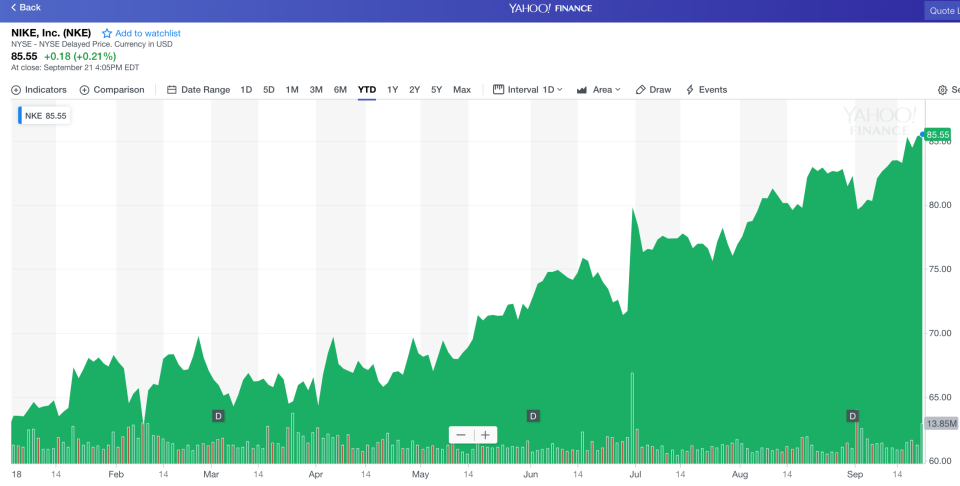

President Trump hasn’t been talking about Nike (NKE) stock lately. That’s probably because it’s been jumping, skying like Mike to fresh all-time highs. The stock hit its highest mark since the creation of the company, and since it has repeatedly touted its new partnership with unemployed quarterback Colin Kaepernick.

NKE is actually up there with the best-performing stocks in the Dow Jones Industrial Average, up 36% in 2018.

Susquehanna partners upgraded their outlook for the stock yesterday. Piper Jaffray’s Craig Johnson thinks it still has room to run, with a $95 dollar price target. Reuters reported Nike has sold out of 61% more merchandise since they signed Kaepernick.

This week’s chump is weed shorts — bearish investors who bet against cannabis stocks like Tilray (TLRY), which rose to $300 per share on Wednesday (before reentering the stratosphere). Other weed stocks like Aurora Cannabis (ACBFF), Canopy Growth Corporation (CGC), and New Age Beverage (NBEV) have been on a crazy run as well.

Short sellers are people who “rent” out stock at a high price, betting it will fall, and then they buy at the new lower price and pocket the difference. These guys have bet against the chronic to the tune of $1.5 billion since the end of the second quarter and lost a good bit of money doing it.

Since the start of August, shares of publicly traded pot stocks have gained 30% on average, according to IHS Markit. So not only have cannabis stock valuations been growing like plants, but short sellers have also been paying 450% to 600% for the privilege of renting the short bets. That’s got to sting.

—

See also:

Wall Street managers have cost Americans more than $600 billion over the past decade

It’s the end of the world as we know it, and investors feel bullish

The dollar’s status as the world’s funding currency is in question

Why Trump’s trade war hasn’t tanked the market or the economy yet

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

雅虎香港財經

雅虎香港財經