David Tepper Stock Portfolio: Top 10 Stock Picks

In this article we delve into the David Tepper Stock Portfolio: Top 10 Stock Picks. Click to skip ahead to the David Tepper Stock Portfolio: Top 5 Stock Picks.

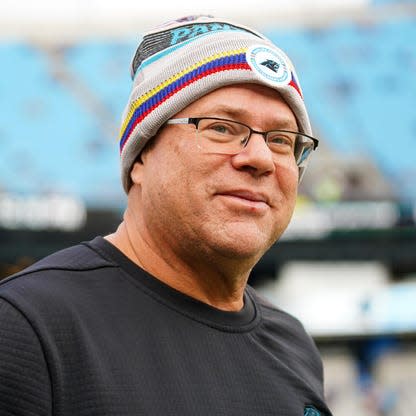

Alphabet Inc. (NASDAQ:GOOG), Amazon.com, Inc. (NASDAQ:AMZN), and Meta Platforms, Inc. (NASDAQ:META) are some of the top stock picks of billionaire money manager and Carolina Panthers owner David Tepper.

David Tepper co-founded the Miami Beach, Florida-based hedge fund Appaloosa Management in 1993. Tepper earned a Bachelor of Arts in economics from the University of Pittsburgh and later an MBA from Carnegie Mellon’s business school, which was named after him in 2004. He worked as a credit analyst with Goldman Sachs for seven years, specializing in distressed debt, before leaving the firm in 1992 and launching his own fund a year later.

Appaloosa has been one of the best performing hedge funds in the world since inception, generating annualized returns of about 25% through 2018 and elevating Tepper to billionaire status more than a decade prior to that. Tepper’s net worth is currently estimated by Forbes at $15.4 billion, ranking him the 98th richest person in the world.

Tepper, who is in the process of closing his firm to outside money and converting Appaloosa into a family office, has taken a bearish stance on equities in recent quarters. His fund’s 13F AUM has declined for six straight quarters, including by 59% during the first half of 2022. Considering 70% of the firm's assets were in-house as of 2020, returning money to shareholders

That bearish stance persisted in Q3, as Tepper’s fund didn’t make a single addition to its 13F portfolio or even increase the size of any of its existing holdings. On the other hand, it sold off eight of its former holdings and reduced the size of 12 other holdings. All told, Appaloosa’s 13F AUM stood at just $1.36 billion at the end of Q3, down from $6.96 billion at the end of Q1 2021.

Appaloosa remained heavily invested in communications and consumer discretionary stocks, while utilities and telecommunications stocks jumped to the highest weighting in its 13F portfolio. It’s also the greatest exposure Appaloosa’s 13F portfolio has had to telecommunications stocks since 2003. Energy stocks also had double-digit weighting in Appaloosa’s 13F portfolio for the seventh straight quarter.

In this article, we’ll take a look at the stocks that David Tepper has maintained the strongest conviction in while his overall market outlook continues to be decidedly bearish.

Our Methodology

The following data is gathered from Appaloosa Management’s latest 13F filing with the SEC. We follow hedge funds like Appaloosa Management because Insider Monkey’s research has uncovered that their consensus stock picks can deliver outstanding returns.

All hedge fund data is based on the exclusive group of 900+ funds tracked by Insider Monkey that filed 13Fs for the Q3 2022 reporting period.

David Tepper Stock Portfolio: Top 10 Stock Picks

10. Antero Resources Corporation (NYSE:AR)

Value of Appaloosa Management‘s 13F Position: $32.8 Million

Number of Hedge Fund Shareholders: 65

Meta Platforms, Inc. (NASDAQ:META), Alphabet Inc. (NASDAQ:GOOG), and Amazon.com, Inc. (NASDAQ:AMZN) are a few of the prominent holdings in David Tepper’s stock portfolio. Also cracking the top 10 is Antero Resources Corporation (NYSE:AR), one of several energy companies that Tepper is bullish on. He trimmed the size of several of those holdings during Q3, including AR, which was cut by 13% to 1.25 million shares.

Antero Resources Corporation (NYSE:AR) trailing twelve month (TTM) revenue has soared to $8.4 billion compared to just $3.08 billion in 2020. Thanks to the natural gas company’s cost of revenue rising only marginally during that time, its gross profit has soared from negative $514 million in 2020 to $4.73 billion over the TTM period. Jefferies analyst Lloyd Byrne has a ‘Buy’ rating and $47 price target on AR, noting that the option value on energy stocks is up again and could stay higher for longer without the need for added investment.

Hedge fund ownership of Antero Resources Corporation (NYSE:AR) rose for eight straight quarters through Q2, tripling during that time and hitting an all-time high before dipping slightly in Q3. D E Shaw, Two Sigma Advisors, and Steve Cohen’s Point72 Asset Management are some of the biggest shareholders of Antero Resources.

9. Microsoft Corporation (NASDAQ:MSFT)

Value of Appaloosa Management‘s 13F Position: $54.7 Million

Number of Hedge Fund Shareholders: 272

David Tepper trimmed his fund’s Microsoft Corporation (NASDAQ:MSFT) holding by 6% during Q3 to 235,000 shares. Microsoft is in a dead heat with Amazon.com, Inc. (NASDAQ:AMZN) (another favored stock of Tepper’s) as the single most popular ticker among hedge funds. No fewer than 250 funds have been long MSFT each quarter over the past two years. The Bill & Melinda Gates Foundation Trust, managed by Michael Larson, is the largest Microsoft shareholder among the select group of funds tracked by Insider Monkey.

Microsoft Corporation (NASDAQ:MSFT) shares are down by 28% this year and a weakening PC market is cause for minor concern, with the company’s More Personal Computing segment contracting slightly in Q1 of Microsoft’s fiscal year (FY) 2023. The company’s other segments continue to steam ahead though regardless of the broader economic conditions, as intelligent cloud revenue grew by 20% year-over-year and overall operating income was up by 6% to $21.5 billion. Microsoft is also a major free cash flow (FCF) machine, topping $63 billion in FCF over the past year.

Carillon Tower also believes Microsoft Corporation (NASDAQ:MSFT) is performing well in spite of what the stock market might lead you to believe, as noted in its Q3 2022 investor letter:

“Despite reporting very good quarterly results, Microsoft Corporation (NASDAQ:MSFT) underperformed the overall market in August. Technology stocks in general underperformed in August due to fears over slowing global economic growth, potentially leading to cuts in corporate information technology budgets.”

8. UnitedHealth Group Incorporated (NYSE:UNH)

Value of Appaloosa Management‘s 13F Position: $75.8 Million

Number of Hedge Fund Shareholders: 112

David Tepper’s position in UnitedHealth Group Incorporated (NYSE:UNH) was left unchanged during Q3 at an even 150,000 shares. The billionaire money manager sold off 29,000 UNH shares during the first half of 2022. United Health hit an all-time high in hedge fund ownership during Q3 after a 16% jump in the number of funds long UNH during the quarter. Andreas Halvorsen’s Viking Global and Steve Cohen’s Point72 Asset Management were among the funds that added UNH to their 13F portfolios during Q3.

Healthcare is a relatively safe industry to invest in during a recession, as most people are not willing to compromise their health and avoid having necessary surgical procedures or other interventions carried out regardless of their economic health. If anything, and especially given the rising costs associated with healthcare, it will make people increasingly more willing to invest in health insurance. That’s evidenced by the strong performance of UnitedHealth Group Incorporated (NYSE:UNH), which has grown revenue by 14% year-over-year through the first nine months of 2022. The company’s EPS is also projected to rise by about 16% this year to $20.95 at the midpoint of the health insurer’s guidance range.

Distillate Capital still likes UnitedHealth Group Incorporated (NYSE:UNH)’s valuation even after the stock has greatly outperformed the market this year, as the fund stated in its Q2 2022 investor letter:

“UnitedHealth Group was among the 2 largest trims at around 1% each. Each stock was up 1% in the quarter compared to the 16% price decline for the S&P 500 and the positions were reduced as the valuations became somewhat less appealing, though still attractive enough to warrant inclusion.”

7. Macy’s, Inc. (NYSE:M)

Value of Appaloosa Management‘s 13F Position: $94 Million

Number of Hedge Fund Shareholders: 31

Macy’s, Inc. (NYSE:M) had been a top five stock pick of Tepper’s for several quarters until Q3, when the stock’s underperformance dropped it to the seventh-most valuable holding in his 13F portfolio. The position was left unchanged during the third quarter at an even 6 million shares, but lost $15 million of its value after shares fell by 14.5%. Numerous other funds bailed on Macy’s during Q3, as there was a 24% drop in ownership of the stock.

Macy’s, Inc. (NYSE:M) has been a big winner for Tepper so far in Q4, with shares gaining close to 50%. The fashion retailer’s faltering sales growth has been driving off many investors, as same-store sales slumped by 1.5% yeae-over-year in Q2, which then accelerated to a 3% decline in Q3. The company does have some positives going for it though which could be enticing Tepper.

Among other things, it’s done a good job managing its inventory levels ahead of the holiday season, an issue that has been plaguing numerous other retailers. That should ensure that Macy’s delivers solid profits during the holiday quarter, with the company raising its 2022 adjusted EPS forecast by $0.07 following the release of its Q3 results. Macy’s, Inc. (NYSE:M) also pays out an attractive dividend that currently yields 2.7%.

6. EQT Corporation (NYSE:EQT)

Value of Appaloosa Management‘s 13F Position: $103 Million

Number of Hedge Fund Shareholders: 57

Closing out the first half of David Tepper’s stock portfolio is EQT Corporation (NYSE:EQT), a holding which Tepper trimmed by 12% during Q3 to 2.53 million shares. Hedge fund ownership of EQT has risen for three straight quarters, climbing by 24% during that time. Cliff Asness’ AQR Capital and Louis Navellier’s Navellier & Associates were some of the funds to add EQT to their 13F portfolios during the third quarter.

EQT Corporation (NYSE:EQT) is another energy company Tepper likes which has had blowout results in this year. EQT’s TTM revenue has skyrocketed to $12.4 billion from just $2.66 billion in 2020. TTM gross profit has hit $8.2 billion, compared to a loss of $627 million two years ago. Piper Sandler analyst Mark Lear has an ‘Overweight’ rating on EQT and raised his price target on the stock to $63 from $62 earlier this month, but notes that the industry’s capex could rise in the final quarter of this year and into 2023 given growing service costs.

ClearBridge Investments Mid Cap Strategy is bullish on EQT Corporation (NYSE:EQT)’s position in the natural gas space, as relayed in its Q3 2022 investor letter:

“We also added natural gas company EQT (NYSE:EQT) in the energy sector. As one of the lowest-cost domestic producers, EQT stands to benefit from its position as a leading supplier of natural gas to a world suffering from critically low energy reserves. The Russian invasion of Ukraine and threats to hold natural gas exports hostage have spurred a surge in European energy prices, generating long-term agreements by European countries to purchase U.S. natural gas.

This strong demand and elevated prices have helped EQT strengthen its balance sheet and position it to take advantage as opportunities emerge for natural gas to plug the gaps in the global energy transition from fossil fuels to renewables.”

See where Amazon.com, Inc. (NASDAQ:AMZN), Meta Platforms, Inc. (NASDAQ:META), and Alphabet Inc. (NASDAQ:GOOG) rank in David Tepper’s portfolio by clicking the link below.

Click to continue reading and see the David Tepper Stock Portfolio: Top 5 Stock Picks.

Suggested articles:

Disclosure: None. David Tepper Stock Portfolio: Top 10 Stock Picks is originally published at Insider Monkey.

雅虎香港財經

雅虎香港財經