Fidelity National Partners With Commerce Bank to Boost Loyalty Program

Fidelity National Information Services, Inc. FIS recently teamed up with Commerce Bank, a Midwest regional bank with more than $30 billion in assets, to deliver a comprehensive end-to-end loyalty program management platform to the latter. FIS has been entrusted to manage Commerce Bank’s loyalty program and offer an innovative rewards system for the bank’s cardholders.

This will be made possible through the utilization of FIS’ loyalty engagement solutions and underlying APIs. Therefore, Commerce Bank’s loyalty program will gain advantages in customer marketing with enhanced insights, quicker product launches and streamlined back-end processes, including fulfillment, reporting, customer service and related tasks.

Commerce Bank will also take the help of FIS to simplify the process for customers to redeem reward points at the point of sale, offering instant cash savings and encouraging more engaged cardholder behavior. The Premium Payback service of FIS delivers a smooth, real-time experience without requiring behind-the-scenes settlements with cardholders before applying rewards.

Benefits of the Recent Move to FIS

The latest partnership reflects FIS’ expertise in helping organizations modernize the ways their customers manage and maximize their finances. The increased utilization of its integrated solutions is likely to drive revenues for the company.

FIS consistently invests in innovative technologies and introduces solutions to enhance the payment infrastructure. It advances its solution offerings through ongoing software development, acquisitions and equity investments, enabling it to cross-sell additional solutions to existing clients and attract new customers. FIS also collaborates with other entities to deliver comprehensive solutions to its clients.

In August 2024, FIS joined forces with Neural Payments to expand the reach of enhanced peer-to-peer payments among the former’s client base.

FIS’ Share Price Performance

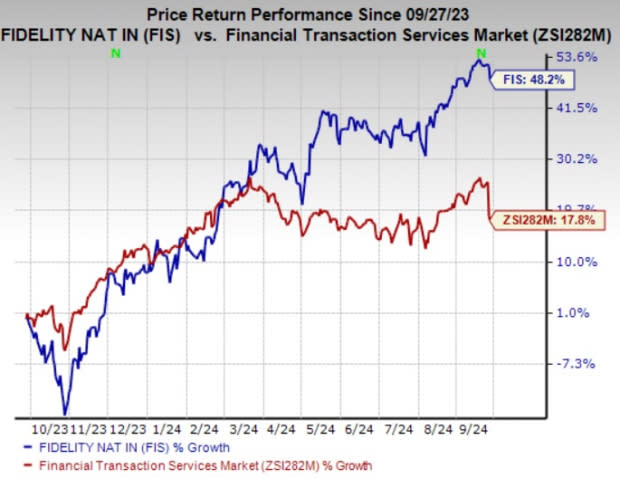

Shares of Fidelity National have gained 48.2% in the past year compared with the industry’s 17.8% growth.

Image Source: Zacks Investment Research

FIS’ Zacks Rank & Other Stocks to Consider

FIS currently sports a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks in the Business Services space are RCM Technologies, Inc. RCMT, Trane Technologies plc TT and Duolingo, Inc. DUOL, each of which currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of RCM Technologies outpaced estimates in three of the last four quarters and matched the mark once, the average surprise being 17.49%. The Zacks Consensus Estimate for RCMT’s 2024 earnings indicates an improvement of 10.4% from the year-agofigure. The same for revenues implies growth of 5.3% from the year-ago number. The consensus mark for RCMT’s earnings has moved 2.2% north in the past 60 days.

Trane Technologies’ earnings outpaced estimates in each of the trailing four quarters, the average surprise being 8.05%. The Zacks Consensus Estimate for TT’s 2024 earnings indicates an improvement of 20.2% from the year-ago figure. The same for revenues implies growth of 10.6% from the prior-year reading. The consensus mark for TT’s earnings has moved 0.5% north in the past 30 days.

The bottom line of Duolingo outpaced estimates in each of the last four quarters, the average surprise being 92.09%. The Zacks Consensus Estimate for DUOL’s 2024 earnings is pegged at $1.87 per share, which indicates a more than five-fold increase from the year-ago figure. The same for revenues implies growth of 38.6% from the year-ago actual. The consensus mark for DUOL’s earnings has moved 7.5% north in the past 60 days.

Shares of RCM Technologies, Trane Technologies and Duolingo have gained 6.1%, 93.6% and 220.6%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Trane Technologies plc (TT) : Free Stock Analysis Report

RCM Technologies, Inc. (RCMT) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經