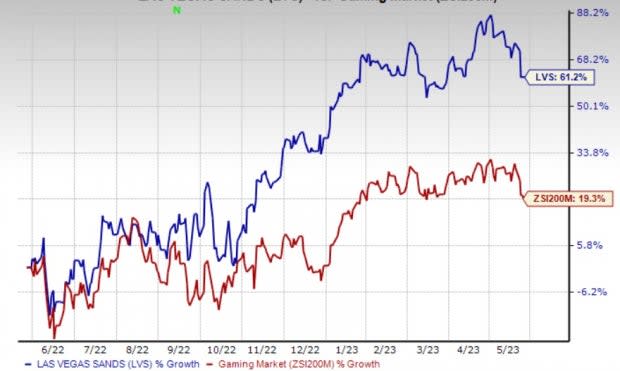

Las Vegas Sands (LVS) Surges 61% in a Year: What's Driving It?

Las Vegas Sands Corp. LVS has gained 61.2% in the past year compared with the industry’s increase of 19.3%. The company is benefiting from Macau’s recovery on the back of resilient customer demand and spending. However, high market competition and debt risks continue to be headwinds.

The Zacks Rank #3 (Hold) company’s sales and earnings in 2023 are likely to witness growth of 133.4% and 251.7% year over year, respectively. In the past 30 days, earnings estimates for 2023 have witnessed upward revisions of 2.2%.

Growth Drivers

Las Vegas Sands is optimistic about Macau’s recovery. During first quarter, LVS reported significant improvement in property visitation, gaming volumes, retail sales and hotel occupancy in the Macau region. The region appeared resilient backed by strong customer demand and robust spending at the premium mass level from the gaming and retail perspective.

With easing of restrictions, and recovery in travel and tourism, the company anticipates generating strong cash flows from this region in the days ahead.

Also, Las Vegas Sands is quite confident about growth prospects in Singapore, which is one of the top spots for gambling. Management announced to continue investing in the expansion of Marina Bay Sands to reinforce its dominant position.

During first-quarter 2023 conference call, the company said that it has equaled its 2019 rolling volumes in Singapore. It emphasized increasing investment in the Singapore market and boosting offerings throughout 2023. LVS anticipates demand in Singapore to be robust after travel and tourism spending return to normal.

Las Vegas Sands, one of the leading companies in the gaming and lodging industry, has a solid business model, extensive non-gaming revenue opportunities, high-quality assets and attractive property locations. The strong portfolio has somewhat aided the company in withstanding the economic downturn in China. Meanwhile, with the economy recovering in the United States, LVS’ business is expected to witness growth.

Image Source: Zacks Investment Research

Concerns

Maintaining liquidity has become an arduous task for most companies during current scenario. Total debt outstanding (excluding finance leases and financed purchases) was $15.97 billion compared with $15.95 billion as of Dec 31, 2022. As of Mar 31, unrestricted cash balances amounted to $6.53 billion compared with $6.31 billion in the previous quarter.

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are Royal Caribbean Cruises RCL, Bluegreen Vacations Holding Corporation BVH and Crocs, Inc. CROX. While RCL and BVH flaunt a Zacks Rank #1 (Strong Buy), CROX carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Royal Caribbean Cruises has a trailing four-quarter earnings surprise of 28.1%, on average. The stock has gained 36.7% in the past year.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates rises of 20.4% and 42.9%, respectively, from the year-ago period’s levels.

Bluegreen Vacations has a trailing four-quarter earnings surprise of 24.7%, on average. The stock has increased 24.2% in the past year.

The Zacks Consensus Estimate for BVH’s 2023 sales and EPS indicates increases of 3.6% and 17.6%, respectively, from the year-ago levels.

Crocs has a trailing four-quarter earnings surprise of 19.6%, on average. The stock has surged 100.2% in the past year.

The Zacks Consensus Estimate for CROX’s 2023 sales and EPS indicates improvements of 13.2% and 5.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經