Here's something Wall St. forecasters always get wrong: Morning Brief

Monday, October 21, 2019

Don't count on Wall St. to predict an earnings recession

As of Friday, Wall Street’s top stock market strategists as a consensus expect the S&P 500 (^GSPC) to deliver 10.4% of earnings per share growth in 2020. It’s a number so rosy that many of the strategists themselves expect that number to come down as more information comes in over the next few weeks.

While earnings growth forecasts may come down, don’t expect the average to reflect a decline.

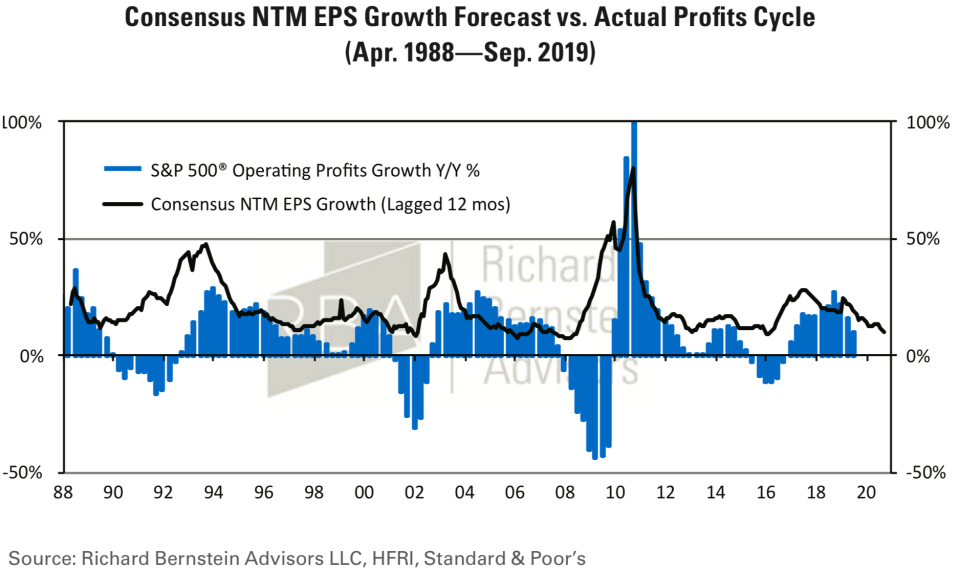

“Bottom-up earnings expectations (i.e., those derived by aggregating individual company forecasts) have NEVER forecasted a profits recession before one occurred, and current forecasts might be following that historical pattern,” observed Richard Bernstein of Richard Bernstein Advisors.

What’s peculiar about the current forecast for the 500 largest companies is that it’s contradicting what the experts are seeing in smaller companies.

“Estimates for small and mid- cap stocks have begun to fall, and that makes sense because smaller companies tend to be more sensitive to economic cycles,” Bernstein noted. “However, larger capitalization stocks’ earnings forecasts are still increasing!”

This is a bit disappointing because value in the stock market is driven by earnings. And if you can’t get an accurate read on future earnings, then you certainly can’t calculate the fair price of the market with any kind of precision.

Bernstein characterizes what would be a gloomier-than-expected outlook for earnings as a “smoke alarm” for investors, who themselves are rarely prepared for bad news.

“The fact that bottom-up forecasts have never predicted a profits recession, that small and mid-cap earnings estimates are falling, and that large cap stocks’ estimates are rising seems to suggest more risk than investors are anticipating,” he said.

And so, we have a case for some volatility as expectations change and markets adjust. What should you do about this?

The late Jack Bogle might say, “Don’t do something. Just stand there!” Bogle might be joking, but what he said is a reminder that investing in stocks is a long-term investors game.

There’s no telling what the market will do in the next year. But for those willing to stomach some short-term volatility, U.S. stocks have a funny way of eventually rewarding patient investors.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Earnings

Pre-market

6:45 a.m. ET: Halliburton (HAL) is expected to report earnings of 34 cents per share on $5.93 billion in revenue

Post-market

Top News

Pound choppy as UK parliament in turmoil over Brexit deal [Yahoo Finance UK]

Christine Lagarde sums up Trump's hold over the US-China trade war [Yahoo Finance UK]

Facebook open to currency-pegged stablecoins for Libra project [Reuters]

CME dismisses Vanity Fair story on Trump trades as 'patently false' [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

India's finance minister: ‘We made our position very clear’ on China's new Silk Road

Why mortgage delinquencies are at a 12-year low

Susan Rice weighs in on 'the danger' surrounding big tech

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

雅虎香港財經

雅虎香港財經