| 前收市價 | 44.59 |

| 開市 | 44.36 |

| 買盤 | 39.00 x 800 |

| 賣出價 | 0.00 x 800 |

| 今日波幅 | 43.50 - 44.66 |

| 52 週波幅 | 28.81 - 47.39 |

| 成交量 | |

| 平均成交量 | 1,015,814 |

| 市值 | 9.457B |

| Beta 值 (5 年,每月) | 1.35 |

| 市盈率 (最近 12 個月) | 35.68 |

| 每股盈利 (最近 12 個月) | 1.25 |

| 業績公佈日 | 2024年6月25日 - 2024年7月01日 |

| 遠期股息及收益率 | 1.20 (2.69%) |

| 除息日 | 2024年5月17日 |

| 1 年預測目標價 | 49.67 |

Barrons.com

Barrons.comJefferies CEO Just Sold $65 Million of Company Stock. He’s Buying a Yacht.

CEO Rich Handler said the boat will be a “gift to myself and my family” and that he doesn’t plan to sell any more shares.

Bloomberg

BloombergBankers Hit With Millions in Breakup Fees for Ditching New Jobs

(Bloomberg) -- Bankers are applying the idea of a “breakup fee,” a longtime fixture in corporate takeovers, to a very different kind of acquisition target: each other.Most Read from BloombergDubai Grinds to Standstill as Cloud Seeding Worsens FloodingTesla Asks Investors to Approve Musk’s $56 Billion Pay AgainChina Tells Iran Cooperation Will Last After Attack on IsraelWhat If Fed Rate Hikes Are Actually Sparking US Economic Boom?Red Lobster Considers Bankruptcy to Deal With Leases and Labor Cos

Bloomberg

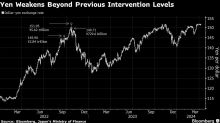

BloombergYen Drop Deepens After US Data, Raising Intervention Risk

(Bloomberg) -- The yen plunged through a level that Wall Street has warned could push Japanese authorities to step into the market to support the currency and then kept on going. Most Read from BloombergUS Sees Imminent Missile Strike on Israel by Iran, ProxiesUS Slams Strikes on Russia Oil Refineries as Risk to Oil MarketsChinese Cement Maker Halted After 99% Crash in 15 MinutesVietnam Tycoon Lan Sentenced to Death Over $12 Billion FraudUS Inflation Refuses to Bend, Fanning Fears It Will StickT