| 前收市價 | 56.41 |

| 開市 | 56.88 |

| 買盤 | 56.36 x 1100 |

| 賣出價 | 57.64 x 800 |

| 今日波幅 | 56.65 - 57.63 |

| 52 週波幅 | 36.40 - 58.44 |

| 成交量 | |

| 平均成交量 | 18,762,591 |

| 市值 | 200.226B |

| Beta 值 (5 年,每月) | 1.21 |

| 市盈率 (最近 12 個月) | 11.91 |

| 每股盈利 (最近 12 個月) | 4.80 |

| 業績公佈日 | 2024年7月12日 |

| 遠期股息及收益率 | 1.40 (2.45%) |

| 除息日 | 2024年2月01日 |

| 1 年預測目標價 | 62.27 |

- Benzinga

Market Reaction To Bank Earnings Is Mixed, JPMorgan Analysts Project Further Decline In Net Interest Income

As the U.S. financial sector grapples with recent earnings releases, investor reactions have been mixed. Some stocks are witnessing declines. Others are posting gains. See below. Banks Q1 Earnings Reports And Market Reactions, So Far Company Ticker Mkt Cap ($ mn) Price ($) Rating JPMorgan Price Target End Date Q1 Earnings Date EPS Revenue Stock Reaction (since earnings) as of April 18, 2:40 PM ET Citigroup Inc. C 119,590.80 62.84 N 64 Dec-24 Apr 12 Beat Beat -4.46% Wells Fargo WFC 206,396.90 57.

Zacks

ZacksTop Research Reports for Eli Lilly, Linde & Caterpillar

Today's Research Daily features new research reports on 16 major stocks, including Eli Lilly and Company (LLY), Linde plc (LIN) and Caterpillar Inc. (CAT).

Bloomberg

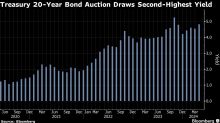

BloombergHigh Yields Lure Buyers to US Treasuries, Including 20-Year Sale

(Bloomberg) -- Investors flocked to Treasury yields near the highest levels of the year on Wednesday, including in an auction of 20-year bonds.Most Read from BloombergDubai Grinds to Standstill as Cloud Seeding Worsens FloodingElon Wants His Money BackRed Lobster Considers Bankruptcy to Deal With Leases and Labor CostsTesla Asks Investors to Approve Musk’s $56 Billion Pay AgainSingapore Loses ‘World’s Best Airport’ Crown to QatarThe rally trimmed yields across the market by as much as 10 basis p