12 Best Robotics Stocks to Buy According to Hedge Funds

In this article, we will look at the 12 best robotics stocks to buy according to hedge funds. If you want to explore more robotics stocks popular among hedge funds, you can also read 5 Best Robotics Stocks to Buy.

The robotics sector is closely connected with numerous other sectors like agriculture, aviation, construction, defense, health, industrials, and technology. According to an article published by Boston Consulting Group (BCG), the robotics sector offers significant upside potential in the long run. Broadly speaking, there are more than 500 companies in the world that are solely working on the advancement of the robotics sector through various aspects. BCG believes that the size of the global robotics sector will increase from $25 billion in 2021 to $160 billion - $260 billion by the end of this decade (see the biggest robotics companies).

Robots are expected to take over low-paying jobs that do not require significant skills and are repetitive as the cost of labor has increased significantly across the world. Even a country like China has seen the wages of factory workers double since 2007. Meanwhile, during the same period, India has seen an increase of 50% in the wage of factory workers. Another catalyst in the growth of the robotics industry is the advancement of the artificial intelligence (AI) industry and 5G networks. As AI advances, it will create ease in the communication between machines and humans, which will undoubtedly expand the horizon of the robotics industry. AI is expected to boost the applicability of robots across various sectors. Meanwhile, the expansion of the 5G network will make advanced technology more accessible. Some of the best robotics stocks capitalizing on the emerging trends in the industry include Teradyne, Inc. (NASDAQ:TER), Stryker Corporation (NYSE:SYK), and Intuitive Surgical, Inc. (NASDAQ:ISRG).

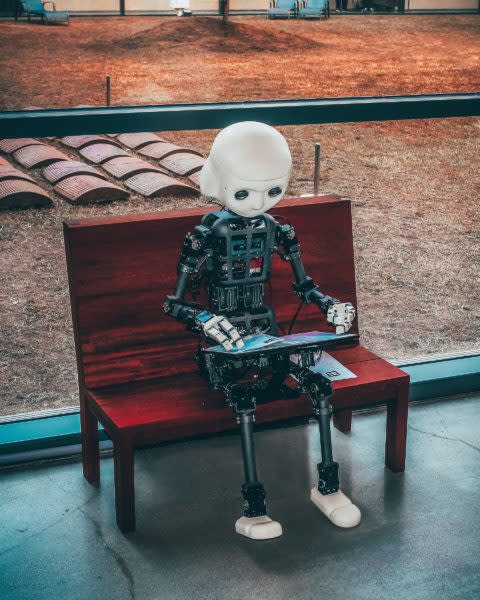

Photo by Andrea De Santis on Unsplash

Our Methodology

We have picked the best robotics stocks that are most popular among hedge funds as of Q3 2022. Insider Monkey’s database of 920 elite funds was used to gauge the hedge fund sentiment on these stocks. The business fundamentals, analyst ratings, and growth plans have been discussed to provide a holistic investment context.

12 Best Robotics Stocks to Buy According to Hedge Funds

12. ABB Ltd (NYSE:ABB)

Number of Hedge Fund Holders: 16

ABB Ltd (NYSE:ABB) is a Zürich, Switzerland-based company that is integrating the power of software with robotics to enhance productivity and efficiency across numerous industries.

In a research note issued on October 31, Daniela Costa at Goldman Sachs gave ABB Ltd (NYSE:ABB) stock a Buy rating and increased the target price from $37.70 to $38.75. The revised target price provides an upside potential of over 26% from the closing price as of November 22. The analyst believes that ABB Ltd (NYSE:ABB) stock is exposed to the positive impact of late-cycle capital expenditure.

The company reported better-than-expected top-line and order growth during Q3 2022. Furthermore, the margins were also positively welcomed by the market amidst this challenging macroeconomic environment. Experts believe that the company is well-positioned to benefit from some of the important rising trends like automation, decarbonization, and a shift towards renewable energy sources.

11. Accuray Incorporated (NASDAQ:ARAY)

Number of Hedge Fund Holders: 17

Accuray Incorporated (NASDAQ:ARAY) is a Sunnyvale, California-based manufacturer of radiotherapy solutions for alternative cancer treatment. The company also has robotic radiation therapy delivery solutions in its portfolio.

In October, Accuray Incorporated (NASDAQ:ARAY) partnered with General Electric Company’s healthcare division (NYSE:GE) for precision radiation therapy. The partnership is expected to allow the entity to reach more patients with personalized solutions. Furthermore, Accuray Incorporated (NASDAQ:ARAY) is a pioneer of the CyberKnife System, which uses robotics to deliver radiation treatments. Accuray Incorporated (NASDAQ:ARAY) is not restricted to the US but also has a significant presence in the Chinese market. The company generated 20% of its top line from the Chinese market in FY22. Experts think Accuray Incorporated (NASDAQ:ARAY) has strong potential to expand its operations and gain a higher market share in the long run.

As of Q3 2022, Accuray Incorporated (NASDAQ:ARAY) was held by 17 hedge funds.

10. AeroVironment, Inc. (NASDAQ:AVAV)

Number of Hedge Fund Holders: 18

AeroVironment, Inc. (NASDAQ:AVAV) is an Arlington, Virginia-based defense contractor widely known for designing and manufacturing drones and unmanned ground vehicles.

The company recently acquired Telerob, which is a known provider of unmanned ground robotics solutions used in the disposal of biological and chemical waste, explosives, and hazardous material. AeroVironment, Inc. (NASDAQ:AVAV) is deeply focused on establishing its footprint in the robotics industry. Defense contractors around the world have come into the limelight since the start of the conflict between Russia and Ukraine in late February 2022. Global spending on defense has increased significantly, given the tension between Russia, Europe, and the US. In September 2022, AeroVironment, Inc. (NASDAQ:AVAV) received a significant amount of orders for its drones and tactical missile systems from the Department of Defense and the US Army.

ARK Investment Management was the leading hedge fund investor in AeroVironment, Inc. (NASDAQ:AVAV) during the third quarter of the year.

9. Helix Energy Solutions Group, Inc. (NYSE:HLX)

Number of Hedge Fund Holders: 20

Helix Energy Solutions Group, Inc. (NYSE:HLX) is a Houston, Texas-based oil, gas, and renewable energy offshore services company. Through its robotics segment, the company provides inspection, construction, trenching, repair, and maintenance services to the renewable energy, oil, and gas markets.

On October 26, Gregory Lewis at BTIG upgraded Helix Energy Solutions Group, Inc. (NYSE:HLX) stock from a Neutral to a Buy rating with a target price of $10. The analyst thinks that spending in the offshore drilling industry will sharply increase as Brent crude oil prices are hovering around the $90 per barrel level. Meanwhile, the forwards for 2024 are hovering around the $75 per barrel mark. The spending in offshore drilling is anticipated to rise by 20% in 2022. This will be the biggest YoY increase since 2016. The higher demand has driven up the day rates at the rigs and the cost of supply boats. The analyst believes that the economy is in the early phase of the expansion cycle in the oil and gas services industry, which is likely to benefit a company like Helix Energy Solutions Group, Inc. (NYSE:HLX).

8. iRobot Corporation (NASDAQ:IRBT)

Number of Hedge Fund Holders: 23

iRobot Corporation (NASDAQ:IRBT) is a Bedford, Massachusetts-based company known for its robot vacuum and mops. The company claims to have manufactured over 40 million robots in the past three decades.

Analysts think Robot Corporation (NASDAQ:IRBT) has superior innovation capabilities and strong relationships with retailers. Amazon.com, Inc. (NASDAQ:AMZN) has shown interest in acquiring the company and has valued it at $1.7 billion. Presently, the Federal Trade Commission (FTC) is closely reviewing the impact of this deal on the outlook of the robotics industry. Analysts think iRobot Corporation (NASDAQ:IRBT) can also provide investors with a decent merger arbitrage opportunity with a spread of 5.5%. Furthermore, iRobot Corporation (NASDAQ:IRBT) has slashed its employee headcount by 8% and lowered its presence through brick-and-mortar retail locations to streamline costs, which is expected to help the company protect its margins.

Of the 920 hedge funds in Insider Monkey’s database, iRobot Corporation (NASDAQ:IRBT) was held by 23 funds as of Q3 2022.

7. Oceaneering International, Inc. (NYSE:OII)

Number of Hedge Fund Holders: 23

Oceaneering International, Inc. (NYSE:OII) is a Houston, Texas-based company that provides applied technology and engineering services. The company brings into use the power of robotics across various industries like aerospace, biotechnology research, military, and oil and gas. The robots execute critical tasks in the extreme environment for humans.

Oceaneering International, Inc. (NYSE:OII) has the distinction of providing software support for robotics projects undertaken by NASA at its Johnson Space Center in Houston. The company reported that the subsea robotics segment of the business received orders worth $300 million during Q3 2022. The contracts require Oceaneering International, Inc. (NYSE:OII) to provide services like autonomous underwater vehicle solutions. The company claims that the contracts are with international energy corporations and entities involved in marine construction. Based on these positive developments, Oceaneering International, Inc. (NYSE:OII) was given a target price of $16 by Scott Gruber at Citi on October 19.

6. UiPath Inc. (NYSE:PATH)

Number of Hedge Fund Holders: 26

UiPath Inc. (NYSE:PATH) is a New York-based company that makes software related to robotic process automation (RPA). The company is considered a leader in the field of RPA by Stamford, Connecticut-based technological research and consulting firm Gartner.

As part of restructuring efforts to control costs, UiPath Inc. (NYSE:PATH) reported on November 15 that it had slashed its employee headcount by 6%. Furthermore, the company reported strong preliminary results for Q3 2022 on the same day. UiPath Inc. (NYSE:PATH) posted revenue of $260 million as opposed to the company’s forecast of $243 million to $245 million and the analysts’ forecast of $247.1 million. UiPath Inc. (NYSE:PATH) also revealed that it finished the third quarter with an annual recurring revenue (ARR) of $1.11 billion. Analysts have a long-term bullish outlook on UiPath Inc. (NYSE:PATH) in the robotics segment.

ClearBridge Investments shared its stance on UiPath Inc. (NYSE:PATH) in its Q3 2022 investor letter. Here’s what the firm said:

“Over the last three months, we similarly exited UiPath Inc. (NYSE:PATH) due to a change to our original thesis as we believe a new go-to-market strategy for its automation software could impact near-term execution. While we think process automation is a growing market, in a slowing macro environment single solutions may be more vulnerable than the platform solutions of software providers who can bundle products to meet a wide range of needs. In addition, the company has a material component of sales sourced in Europe where the economy is more vulnerable.”

In addition to UiPath Inc. (NYSE:PATH), Teradyne, Inc. (NASDAQ:TER), Stryker Corporation (NYSE:SYK), and Intuitive Surgical, Inc. (NASDAQ:ISRG) are among the best robotics stocks in the market currently.

Click to continue reading and see the 5 Best Robotics Stocks to Buy According to Hedge Funds.

Suggested Articles:

Disclose. None. 12 Best Robotics Stocks to Buy According to Hedge Funds is originally published on Insider Monkey.

雅虎香港財經

雅虎香港財經