Chip Delivery Times Shrank in August, But Some Shortages Drag On

(Bloomberg) -- Chip delivery times shrank again in August, a sign the global shortage is easing further, but some types of semiconductors remain hard to find.

Most Read from Bloomberg

Terra Co-Founder Do Kwon Faces Arrest Warrant in South Korea

Ugly Selloff Pushes Stocks Down Most Since 2020: Markets Wrap

Xi Returns to World Stage With Putin to Counter US Dominance

Stocks Swing Higher in Choppy Trade, Dollar Dips: Markets Wrap

Lead times -- the gap between when a chip is ordered and when it is delivered -- averaged 26.8 weeks in August, according to research by Susquehanna Financial Group. That was a day shorter than they were in the prior month.

The shorter wait times reflect slowing demand for some kinds of technology -- namely, phones and personal computers -- according to Susquehanna analyst Chris Rolland. But parts of the market remain overheated, with orders coming in faster than chipmakers can fill them.

“We believe over-ordering trends and inventory builds have yet to work through the system,” he said in a research note.

In the personal computer market, the supply chain has largely returned to normal operations, Dell Technologies Inc. Chief Financial Officer Tom Sweet said Thursday. Many component costs are getting cheaper as availability has improved and demand has weakened, though Dell is working on clearing its inventories before being able to take advantage of more favorable component prices, Sweet said.

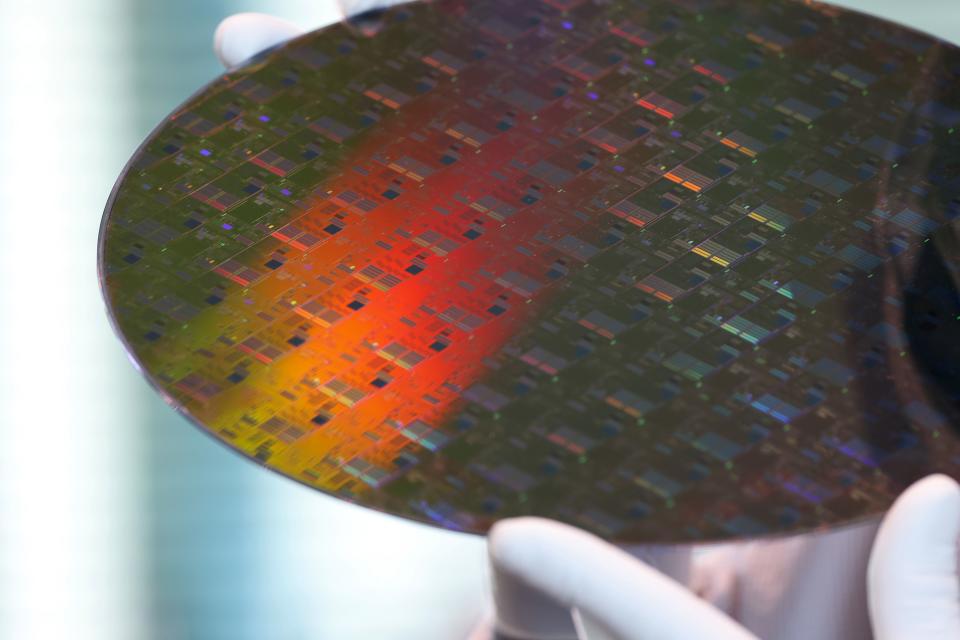

The chip industry often struggles to match supply with demand, partly because the components take months to manufacture. Semiconductor makers also are serving a much larger swath of the economy these days, with chips going into cars, factory equipment and appliances.

In the past, investors have viewed extended lead times as a sign that the industry was building up too much inventory -- a precursor to a slump. But the supply chain disruptions caused by the pandemic created unprecedented shortages. Getting back down to 10- to 14-week wait times would be “healthy,” Rolland said.

The wait for some power management, microcontroller and optoelectronic devices remains extended, Rolland said. Companies such as Microchip Technology Inc. and Infineon Technologies AG are still scrambling to fill those kinds of orders.

Other chipmakers, though, are already suffering from a drop-off in demand. That includes Nvidia Corp. and Intel Corp., which rely heavily on the PC market.

Chip investors have already been bracing for a steep downturn. The Philadelphia Stock Market Semiconductor Index has fallen 33% this year.

(Updates with Dell CFO comments in fifth paragraph)

Most Read from Bloomberg Businessweek

The Ethereum Merge Ups the Stakes—and Reshapes the Crypto Universe

It’s White-Collar Jobs That Are at Risk in the Next Recession

Chinese Manufacturers Get Around US Tariffs With Some Help From Mexico

A Dubious Truck, a Whistleblower Army, and Inept Spies: Inside the Very Weird Nikola Saga

©2022 Bloomberg L.P.

雅虎香港財經

雅虎香港財經