Citigroup (C) Faces Penalty of $78.4M for 2022 Flash Crash

Citigroup Inc. C has been fined $78.4 million by a pair of British regulators due to the bank’s deficiencies in the systems and controls. These flaws led a trader to make an inputting error that caused a flash crash in May 2022.

The penalty amount consisted of £27.8 million from the Financial Conduct Authority (FCA) and £33.9 million from the Bank of England’s (BoE) Prudential Regulation Authority (PRA).

According to the FCA, a trader from Citigroup meant to sell a basket of equities worth $58 million but accidentally made a basket valued at $444 billion, which passed through the trading algorithm. The bank’s flawed control systems failed to ‘hard block’ the transaction, which had prevented the error from transpiring. Also, the company's system allowed the trader to ignore a pop-up alert by manually overriding it.

Although C's controls blocked $255 billion of the transaction, the remaining $189 billion worth of shares got through the trading algorithm. The algorithm cut the order into smaller portions to be sold throughout the day. Approximately $1.4 billion in equities had already been sold across various European exchanges before the trader could cancel the order.

This mistake triggered a mass sell-off, causing the OMX Stockholm 30 Index to decrease by nearly 8% within five minutes and evaporating approximately €300 billion in market value.

Joint executive director of enforcement and market oversight at the FCA, Steve Smart, stated, “We expect firms to look at their own controls and ensure that they are appropriate given the speed and complexity of financial markets.”

Later, Citigroup agreed to settle the case without any disagreement, which led to a reduction of the penalty amount by 30%.

Citigroup’s executives, in a statement seen by the Financial Times, Reuters and Bloomberg, noted, “We are pleased to resolve this matter from more than two years ago, which arose from an individual error that was identified and corrected within minutes,” they further added, “We immediately took steps to strengthen our systems and controls, and remain committed to ensuring full regulatory compliance.”

Prior to this, in August 2020, a Citigroup employee intended to transfer interest payments of $7.8 million on a loan owed by the cosmetics company Revlon. Instead, the employee mistakenly transferred the entire payoff amount of approximately $900 million to Revlon's creditors, owing to a manual adjustment error.

Such significant blunders highlight recurring issues with the bank’s manual input processes and system controls. However, the bank is now focused on investing in its risk management and controls system as well as platform enhancements to improve control systems and safeguard against any potential errors.

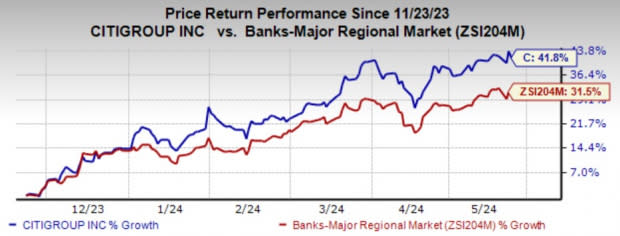

In the past six months, Citigroup’s shares have gained 41.8% compared with the industry’s growth of 31.5%.

Image Source: Zacks Investment Research

Currently, C carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Legal Issues Faced by Finance Companies

In March, JPMorgan JPM was charged with a fine of $348.2 million for failing to monitor the trading activities of its clients and employees properly. The fine has been imposed on JPM by the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

Per the regulators, the misconduct occurred between 2014 and 2023.

In February, HSBC Holdings plc HSBC was fined £57.4 million by the BoE for “serious failings” over its measures to protect customer deposits between 2015 and 2022. The fine is the second-biggest fine ever imposed by the regulator, which reflects the seriousness of the failings.

The BoE’s PRA said that HSBC failed to accurately identify deposits eligible for Britain’s Financial Services Compensation Scheme (FSCS), which protects up to £85,000 in customer bank accounts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經