Corcept (CORT) Posts Positive Data From Cushing's Syndrome Study

Corcept Therapeutics Incorporated CORT announced positive data from one part of the pivotal phase III GRACE study, which evaluated its lead pipeline candidate, relacorilant, for treating patients with all etiologies of endogenous Cushing’s syndrome.

The GRACE study consists of two parts. The above mentioned data was from the open-label portion of the study in which patients with Cushing’s syndrome and either hypertension, hyperglycemia or both were treated with relacorilant for a period of 22 weeks.

Data from the open-label phase of the study showed that treatment with relacorilant led to clinically meaningful and statistically significant improvements in hypertension, hyperglycemia as well as other key secondary and exploratory endpoints.

Per the company, patients who experienced pre-specified improvements in either or both symptoms were allowed to enter the GRACE study’s randomized withdrawal phase, in which half of the patients were treated with relacorilant while the other half was given placebo for a period of 12 weeks.

The primary endpoint of the GRACE study is to see the maintenance of blood pressure control in the randomized withdrawal phase, while maintenance of glycemic control was a key secondary endpoint.

A new drug application for relacorilant in Cushing’s syndrome is likely to be submitted later in the second quarter of 2024.

Relacorilant enjoys orphan drug designation for the treatment of Cushing’s syndrome both in the United States and the European Union.

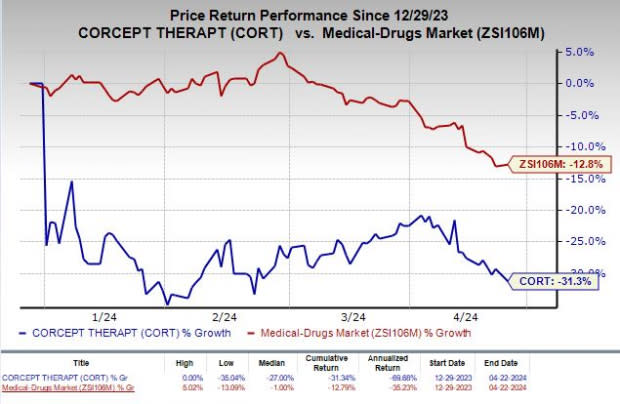

Shares of Corcept have plunged 31.3% year to date compared with the industry’s decline of 12.8%.

Image Source: Zacks Investment Research

This month has been a positive one for Corcept as it completed enrollment in several studies on relacorilant targeting other indications.

Earlier this month, the company completed enrollment in the GRADIENT study, which is evaluating relacorilant for treating patients whose Cushing’s syndrome is caused by adrenal adenoma. Data from the same is expected in the fourth quarter of 2024.

Also, during the ongoing month, the company completed enrollment in the phase III ROSELLA study, which is investigating relacorilant in combination with Abraxane (nab-paclitaxel) for treating patients with recurrent, platinum-resistant ovarian cancer.

Data from the ROSELLA study is expected by 2024-end.

Meanwhile, a phase Ib study is evaluating relacorilant in combination with Merck’s PD-1 checkpoint inhibitor, Keytruda (pembrolizumab), for treating patients with adrenal cancer with cortisol excess completed enrolment. Data from the study is expected in mid-2024.

Zacks Rank & Other Stocks to Consider

Corcept currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the healthcare sector are ADMA Biologics, Inc. ADMA, Ligand Pharmaceuticals Incorporated LGND and ANI Pharmaceuticals, Inc. ANIP, each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Year to date, shares of ADMA have rallied 37.2%.

ADMA’s earnings beat estimates in three of the trailing four quarters and met the same once, the average surprise being 85.00%.

In the past 60 days, estimates for Ligand’s 2024 earnings per share have improved from $4.42 to $4.56. Year to date, shares of LGND have decreased 4%.

Earnings of LGND beat estimates in each of the trailing four quarters, the average surprise being 84.81%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have improved from $4.12 to $4.43. Year to date, shares of ANIP have jumped 19%.

Earnings of ANIP beat estimates in each of the trailing four quarters, the average surprise being 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經