Element's (ESI) Q4 Earnings In Line, Revenues Lag Estimates

Element Solutions Inc. ESI recorded earnings of 32 cents per share in fourth-quarter 2023 compared with earnings of 5 cents in the year-ago quarter. The figure was in line with the Zacks Consensus Estimate.

The company generated net sales of $573.4 million, flat year over year. The figure missed the Zacks Consensus Estimate of $588.6 million. Organic net sales fell 3%.

The company’s circuitry and semiconductor businesses returned to organic growth in the reported quarter. ESI also delivered adjusted EBITDA growth of 11% in the quarter.

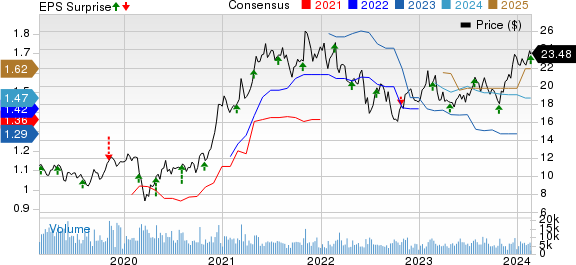

Element Solutions Inc. Price, Consensus and EPS Surprise

Element Solutions Inc. price-consensus-eps-surprise-chart | Element Solutions Inc. Quote

Segment Highlights

Net sales in the Electronics segment rose 4% year over year to $352 million in the reported quarter. Organic net sales were down 1% from the previous year's reported figure. The figure fell short of our estimate of $416.9 million.

In the Industrial & Specialty segment, net sales declined 6% year over year to $221 million, with organic net sales dropping 7%. The figure was above our estimate of $148.3 million.

FY23 Results

Earnings for full-year 2023 were 48 cents per share, down from 75 cents per share a year ago. Net sales declined around 8% year over year to $2,333.2 million.

Financial Position

Element Solutions ended 2023 with cash and cash equivalents of $289.3 million, up around 9% year over year. Long-term debt was $1,921 million at the end of the quarter, up around 2% year over year.

Cash from operating activities was $334 million in 2023. Free cash flow was $282 million for the year.

Outlook

ESI expects adjusted EBITDA in the range of $510-$530 million for 2024. For first-quarter 2024, it sees adjusted EBITDA in the band of $120-$125 million.

The company anticipates generating a free cash flow in the range of $280-$300 million for 2024.

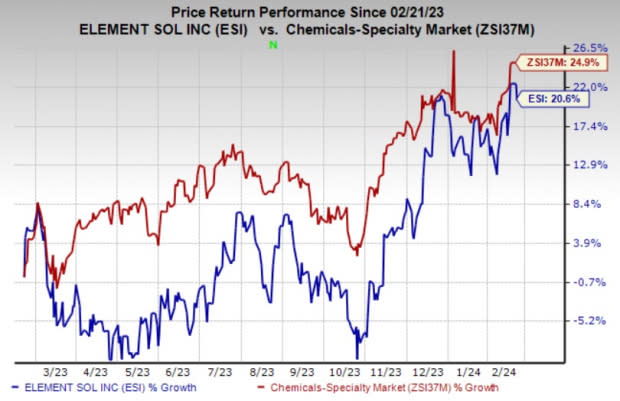

Price Performance

Shares of Element Solutions have gained 20.6% in a year compared with a 24.9% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ESI currently has a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include, Carpenter Technology Corporation CRS, Alpha Metallurgical Resources Inc. AMR and Hawkins, Inc. HWKN.

The consensus estimate for Carpenter Technology’s current fiscal year earnings is pegged at $4.00, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have gained around 35% in the past year. CRS currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alpha Metallurgical Resources’ current-year earnings has been revised upward by 8.8% in the past 60 days. It currently carries a Zacks Rank #1. AMR delivered a trailing four-quarter earnings surprise of roughly 9.6%, on average. AMR shares are up around 120% in a year.

The consensus estimate for Hawkins’ current fiscal year earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26.2%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised 4.3% upward in the past 30 days. HWKN, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 30.6%. The company’s shares have rallied roughly 72% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經