Global Banks Start Targeting a New Breed of Real Estate Risk

(Bloomberg) -- At some of the world’s biggest banks, loans to commercial real estate face new litmus tests that promise to shape the sector’s access to financing.

Most Read from Bloomberg

Key Engines of US Consumer Spending Are Losing Steam All at Once

GameStop Shares Surge as Gill’s Reddit Return Shows Huge Bet

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Homebuyers Are Starting to Revolt Over Steep Prices Across US

AMLO Protege Sheinbaum Becomes First Female President in Mexico

At issue is the carbon emissions of buildings and the expected cost of upgrades needed to stay on the right side of new green regulations. The European Union just passed its Energy Performance of Buildings Directive (EPBD), which forms part of a growing array of net zero regulations. And too-big-to-fail banks are starting to react.

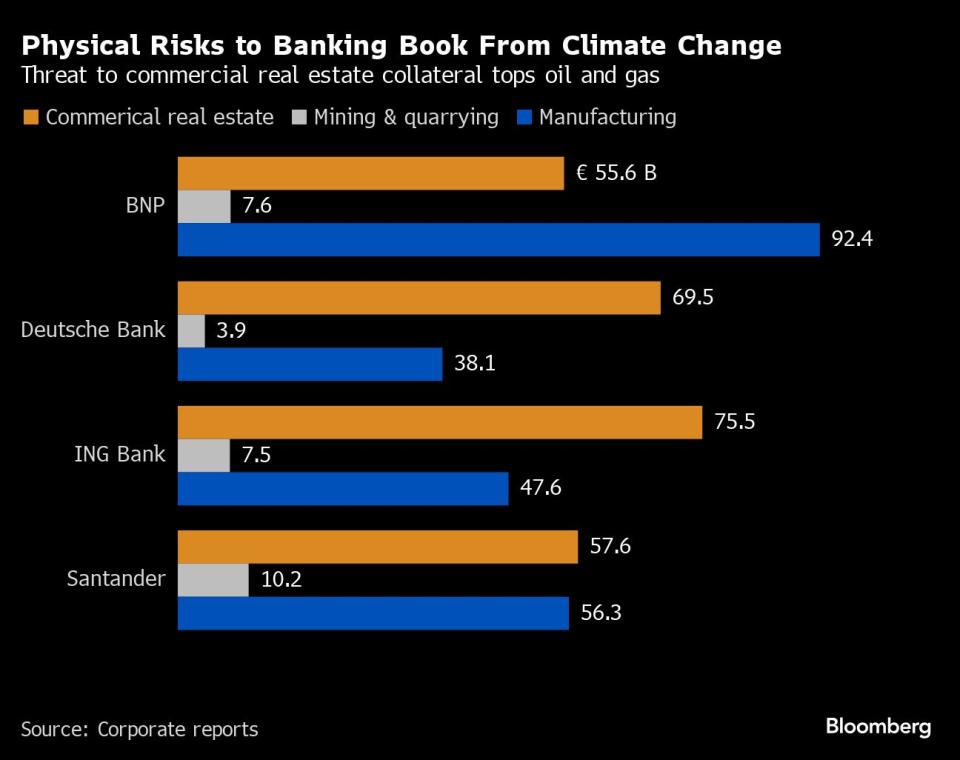

BNP Paribas SA, the European Union’s largest bank, now targets cuts that could be as deep as 41% of the emissions intensity of its commercial real estate portfolio through 2030. Others, including Banco Santander SA, Barclays Plc, ING Groep NV and NatWest Group Plc, have either already taken — or are exploring — similar measures.

The development marks a new frontier in how banks handle the risks in their loan books. CRE portfolios, already battered by higher interest rates and volatile post-pandemic occupancy rates, are now emerging as a fresh headache for banks whose books are overloaded with old properties badly in need of investments to meet new green requirements.

Read More: Big Banks’ CRE Exposure Rises 40% When REIT Debt Is Factored in

Roxana Isaiu, chief product officer at ESG data and benchmarking provider GRESB, says her firm has recently started meeting with bankers eager to navigate new green requirements for buildings. “The signals from the regulators are clear,” said Isaiu, who has so far focused mostly on equity investors.

While the EU’s rollout of EPBD is likely to play out over several years, it’s already clear that buildings that fall behind risk turning into stranded assets that can no longer be sold or rented. The EU estimates that about 85% of buildings in the bloc were built before 2000, with 75% of these having a “poor energy performance.”

The costs of retrofitting commercial real estate to comply with new environmental regulations are “increasing all the time,” said Sven Bienert, project lead at Carbon Risk Real Estate Monitor (CRREM), which helps the real estate sector tackle emissions. “Many banks have not yet realized that the collateral value of their loans could be diminishing.”

For lenders, this is a “significant risk on their balance sheets,” he said.

The risks vary from country to country, with the Netherlands standing out as an example of a place whose commercial real estate is more energy efficient than most, according to Isaiu. But even there, one-third of the market doesn’t meet the energy performance certificate level (EPC) of C, which is a minimum requirement that’s been in place since the start of 2023, she said.

And European initiatives to help tackle the issue are “coming much slower than anybody would have expected,” Isaiu said.

Banks that find they’re saddled with CRE assets that are too costly to retrofit may turn to private markets to offload such risk. There’s also evidence that some banks are starting to explore so-called synthetic securitizations that shield them from the potentially higher capital costs associated with emissions, by transferring that risk to outside investors.

Read More: Hedge Fund Veteran Pitches First-Ever CO2 Risk Transfers

Unlike private equity or private credit investors, banks often have less access to relevant energy-performance data for their CRE portfolios, making it harder for them to manage such risks.

The commercial real estate sector’s ability to keep up with the planned transition to a lower-carbon economy is “heavily reliant” on retrofitting the existing building stock, BNP said in an emailed response to questions. For the roughly 80% of existing buildings that are expected to be around in 2050, there needs to be a “significant acceleration in renovations,” the bank said.

That has implications for the kinds of loans BNP is willing to provide, and the types of bond underwriting it takes on. For example, the bank now says its origination desks will include climate impact as “a decision criterion” before providing debt financing for CRE. BNP, which ranks as the world’s biggest underwriter of green bonds, says it’s also exploring ways to increase its share of financing of green assets.

Santander, Spain’s biggest bank, started analyzing the emissions risk of its CRE assets last year, and is still figuring out how it might go about decarbonizing the portfolio, a spokesperson told Bloomberg. The bank has yet to make its conclusions public.

In the UK, Barclays now targets a 51% reduction in emissions intensity in the CRE portfolio of its home market by 2030. A spokesperson for the bank said Barclays is working closely with clients to address risks tied to financed emissions, but notes that the situation requires “systemic change” to policies that are often beyond Barclays’ control.

The EU estimates that buildings in the region guzzle more than 40% of the energy consumed, which makes their environmental risk hard for banks to ignore. The bloc has set a goal of cutting greenhouse gas emissions in the building sector by 60% through 2030, and bank finance will inevitably play a key part in that process.

Banks that fall behind not only risk being reprimanded by regulators, but increasingly face the threat of climate litigation. BNP, for example, is grappling with an ongoing climate lawsuit alleging the bank has failed to live up to its so-called duty of vigilance, which under French law is an obligation that companies ensure their business doesn’t have a negative impact on a number of parameters, including the environment.

Click here for a charticle mapping out CRE risks in the US

BNP says it’s also looking at its portfolio of residential real estate loans, but has stopped short of setting explicit targets for financed emissions due to the sheer complexity of the area. That complexity is in large part driven by the myriad of differing national regulations across EU member states.

Local regulations are still evolving and the national implementation of the European directive on the energy performance of buildings remains unclear, BNP says. It wants policymakers to do more to help the finance industry cope with such challenges.

“We are talking about a retail sector with 75% of the European residential dwellings that ought to be renovated by 2030 thus impacting millions of households,” BNP said. The bank says any restrictions on financing shaped by green policies should be enacted “without penalizing access to housing in a tight macro-economic environment.”

However, reducing the financed emissions of the residential book is now a “strategic initiative” at BNP, the bank said. It expects to provide an update on how the sector’s access to financing will be affected in 2025.

“This is an emerging issue for the banking sector,” Bienert said. “Some of the loan books will see more hits than others.”

--With assistance from Gina Turner and Alastair Marsh.

(Adds comments from CRREM in seventh, eighth and final paragraphs.)

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Budget Geeks Who Helped Solve an American Economic Puzzle

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.

雅虎香港財經

雅虎香港財經