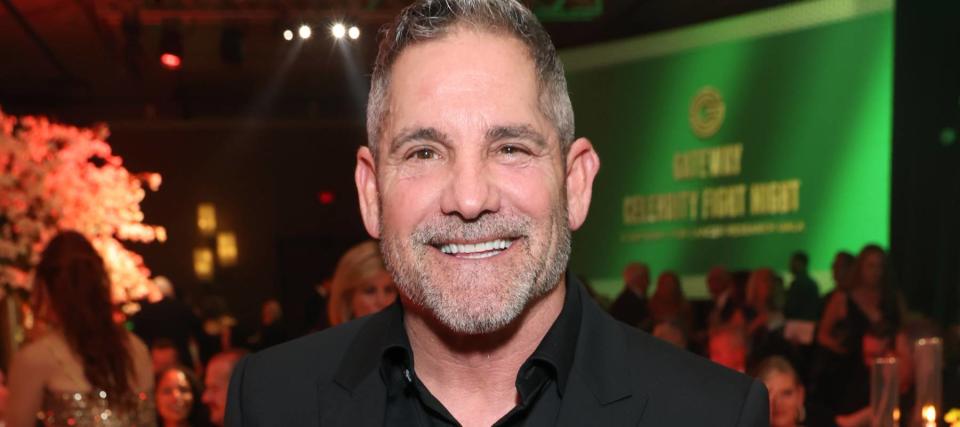

Grant Cardone calls America's middle class 'oppressed' and 'naive' — here's why

While economists and policymakers focus much of their attention on the middle class, real estate mogul Grant Cardone believes the category itself is becoming irrelevant.

“The number one problem with the middle class is that you guys bought the idea of a middle class,” he said in a YouTube Short, in which he goes on to call middle-class Americans “oppressed” and “naive” people.

Don't miss

Jeff Bezos told his siblings to invest $10K in his startup called Amazon, and now their stake is worth over $1B — 3 ways to get rich without having to gamble on risky public stocks

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Here’s why he insists the middle class dream is a fallacy and what ordinary people can do to escape it.

Middle class fallacy?

Cardone’s key issue with the middle class dream is that it’s fueled by excessive debt and consumerism. He talks about how student debt, mortgages and car loans can trap people in lifelong debt servicing.

“That ain’t freedom, man,” he said.

It’s true that ordinary families have borrowed excessively to keep up with the cost of homes, cars and education. At the end of 2023, American households collectively had $17.5 trillion in total debt, $12.25 trillion of which was tied to mortgage balances, according to the New York Federal Reserve Bank. Credit card, auto loans and student debt have also been on the rise.

Coupled with heightened interest rates, this debt burden is looking increasingly precarious.

Read more: This little-known investment strategy can save you thousands on your taxes

There’s also a demographic shift underway. Pew Research found that the number of Americans considered middle class has been steadily shrinking. In 1971, 61% of the country’s population met their definition of “middle class.” In 2021, that ratio was down to 50%.

More American adults, according to Pew’s data, are either dropping into lower-income or rising into upper-income categories. With that in mind, Cardone’s solution is to study people in the upper-income category and try to incorporate some of their strategies to escape the middle-income trap.

Invest for growth

“The way to get out is to study the people at the top of the food chain,” Cardone recommended.

Millionaires and billionaires, he suggests, are lending and investing their money instead of borrowing it.

In particular, he points to legendary investor Warren Buffett, who was the seventh richest man in the world at $135.6 billion as of May 10, according to Forbes's real-time billionaires list. Buffett has previously recommended passive investments in low-cost index funds to help ordinary investors build wealth. He’s also famously resistant to borrowed capital.

“It's insane to risk what you have and need for something you don't really need,” he once told CNBC.

Resisting debt and investing in appreciating assets should be an escape plan for anyone looking to avoid the middle-income debt trap or the lower-income financial trap.

Unlike Buffett, however, Cardone prefers to invest in real estate. His company, Cardone Capital, says its portfolio consists of 39 multifamily properties and over 500,000 square feet of commercial office space.

Investors looking to follow this game plan can consider real estate investment trusts (REITs) or firms that offer investments in commercial real estate or even vacation rental homes.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

雅虎香港財經

雅虎香港財經