Here's Why You Should Add Sallie Mae (SLM) to Your Portfolio

Sallie Mae SLM is well-positioned for growth on the back of a solid loan balance and strategic acquisitions. Hence, adding the stock to your portfolio seems a wise idea now.

The Zacks Consensus Estimate for Sallie Mae’s 2024 earnings has been revised upward marginally over the past 30 days. This indicates that analysts are optimistic regarding its earnings growth potential. The company currently carries a Zacks Rank #2 (Buy).

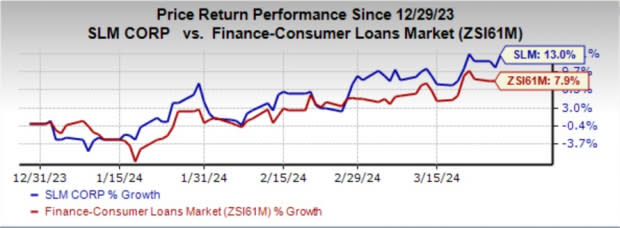

Over the past three months, shares of SLM have gained 13% compared with the industry’s growth of 7.9%.

Image Source: Zacks Investment Research

Revenue Strength: Sallie Mae has been focused on improving its net interest income (NII) by increasing the amount of cash and cash equivalents held in order to gain from yields on cash and other short-term investments. Moreover, the elevated average loan balance has supported the growth of NII. Over the past six years (ending 2023), NII witnessed a compound annual growth rate (CAGR) of 5.6%. In fact, the company’s objective to grow the Private Education Loan portfolio will continue to support its NII in the near term. This is expected to drive revenue growth in the upcoming period.

Although, Sallie Mae’s revenues are projected to decline 2.3% in 2024, it will rebound and grow in 2025 by 2.8%.

Earnings Growth: Sallie Mae witnessed earnings growth of 12.04% in the past three to five years, higher than the industry’s average of 3.72%. Further, the company’s earnings are projected to grow 11.2% in 2024 and 8.5% in 2025.

Strategic Acquisitions: The company’s expansion efforts have been strengthened on the back of investments in varied product offerings and inorganic activities. In July 2023, the company acquired several key assets, technology, intellectual property and experienced staff of Scholly, a scholarship publishing and servicing platform. Such inorganic moves are expected to contribute to the company's goal of becoming a comprehensive provider of educational solutions for students and driving loan originations.

Superior Return on Equity (ROE): Sallie Mae’s trailing 12-month ROE reflects its superiority in terms of utilizing shareholders’ funds. The company’s ROE of 36.86% compares favorably with the industry’s figure of 11.63%.

Stock Seems Undervalued: The company has price-to-cash flow (P/CF) and price-to-earnings (P/E) (F1) of 6.93 and 7.88 compared with the industry’s P/CF and P/E (F1) of 7.20 and 10.37, respectively.

The stock has a Value Score of B. Our research suggests that stocks with a Value Score of A or B, when combined with Zacks Rank #1 (Strong Buy) or 2, offer the highest upside potential.

Other Finance Stocks to Consider

EZCORP, Inc.’s EZPW earnings estimates for 2024 have increased 12.9% over the past 60 days. Shares of EZPW have gained 27% over the past three months. At present, EZPW sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Mr. Cooper Group Inc.’s COOP 2024 earnings estimates have been revised upward by 2% over the past 60 days. Shares of COOP have climbed 19.8% in the past three months. Currently, COOP carries a Zack Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SLM Corporation (SLM) : Free Stock Analysis Report

EZCORP, Inc. (EZPW) : Free Stock Analysis Report

MR. COOPER GROUP INC (COOP) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經