Integral Ad Science Holding Corp CEO Lisa Utzschneider Sells 30,407 Shares

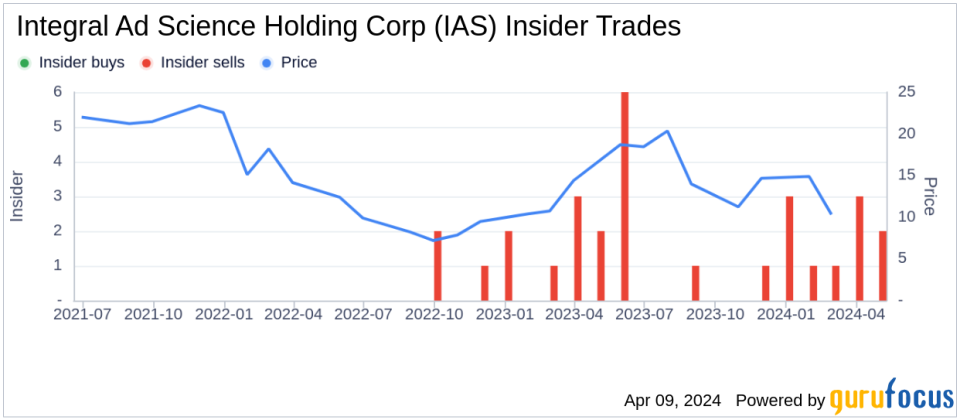

Integral Ad Science Holding Corp (NASDAQ:IAS), a global leader in digital ad verification, offering technologies that drive high-quality advertising media, has reported an insider sell transaction. CEO Lisa Utzschneider sold 30,407 shares of the company on April 8, 2024, according to a recent SEC Filing.Over the past year, the insider has sold a total of 136,250 shares and has not made any purchases of the company's stock. The insider transaction history for Integral Ad Science Holding Corp shows a pattern of 19 insider sells and no insider buys over the same timeframe.

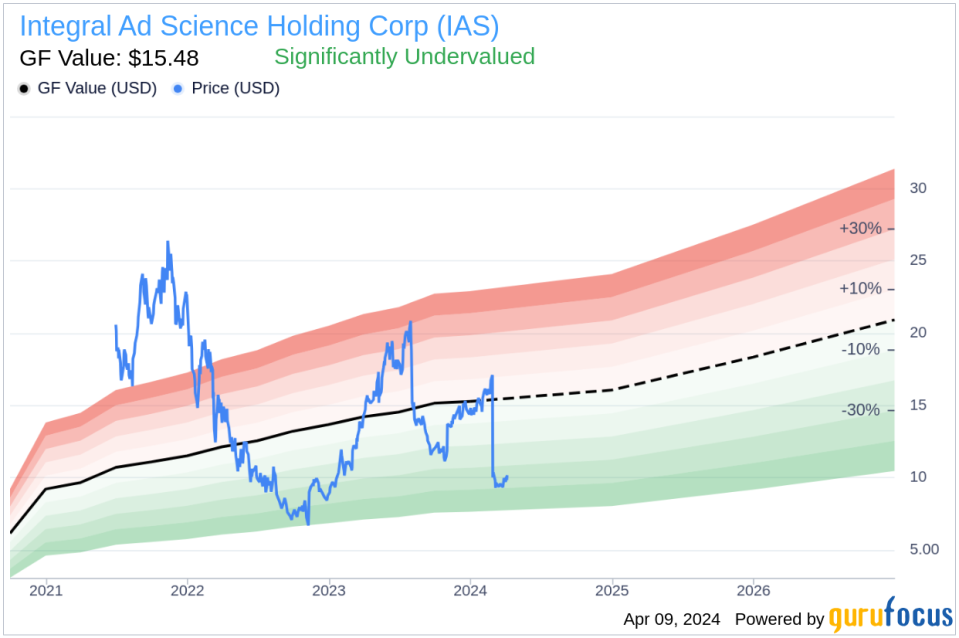

On the day of the insider's recent sell, shares of Integral Ad Science Holding Corp were trading at $10.05, giving the company a market cap of $1.61 billion. The price-earnings ratio stands at 252.00, which is significantly above both the industry median of 19.68 and the company's historical median price-earnings ratio.

The stock's price-to-GF-Value ratio is 0.65, with a GF Value of $15.48, indicating that Integral Ad Science Holding Corp is significantly undervalued according to GuruFocus's intrinsic value estimate. The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

雅虎香港財經

雅虎香港財經