NiSource (NI) Rides on Infrastructure Upgrade & Clean Assets

NiSource Inc.’s NI consistent investments to strengthen its existing infrastructure, stable returns from regulated assets and cost-saving initiatives should boost its earnings. The company’s focus on clean energy helps to enhance its overall performance.

However, this Zacks Rank #3 (Hold) company faces risks related to any delay in the completion of projects and weather fluctuations.

Tailwinds

NiSource is working on a long-term utility infrastructure modernization program. The company expects investments in the range of $3.3-$3.5 billion for 2024. It also projected an investment of $16.4 billion during 2024-2028.

NiSource has $2.1 billion of additional investment opportunities through 2028, which is not included in the base plan. These investments and renewable projects will boost the company’s clean power generation portfolio.

NiSource’s planned regulated investments will improve the reliability and safety of its services and provide efficient electric and natural gas services to its increasing customer base. More than 75% of NiSource’s capital expenditure starts providing returns in less than 18 months of investment.

The company is also gaining from its cost-saving initiatives and expects to lower operation and maintenance (O&M) expenses. These cost-saving measures will definitely boost its margins over the long term. NiSource achieved its goal of more than $50 million in cost-saving initiatives in 2023. It observed and incorporated efficiency by performing safer, better, more efficient and low-cost operations. NI is expected to maintain flat O&M expenses through the duration of the five-year plan.

Headwinds

NiSource is presently engaged in a number of capital projects, including environmental improvements in its electric generating stations, as well as the construction of new transmission facilities. A delay in completion increases capital costs and stretches the time limit of the company’s expected benefits from these projects.

Unfavorable fluctuations in weather during the summer and winter months, and economic conditions might adversely impact the demand for energy, which in turn may lower earnings.

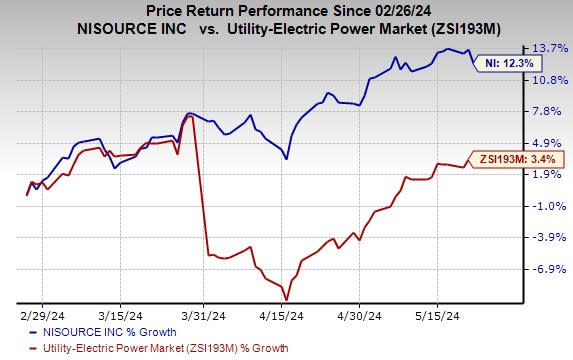

Price Performance

In the past three months, shares of the company have risen 12.3% compared with the industry’s 3.4% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same industry are DTE Energy DTE, Pinnacle West Capital Corporation PNW and Portland General Electric POR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DTE’s long-term (three to five years) earnings growth rate is 8.2%. The Zacks Consensus Estimate for DTE’s 2024 earnings per share (EPS) indicates an increase of 16.9% from the previous year.

PNW’s long-term earnings growth rate is 8.2%. The Zacks Consensus Estimate for 2024 EPS implies an improvement of 7.9% from the bottom line recorded in 2023.

The Zacks Consensus Estimate for POR’s 2024 EPS implies a year-over-year increase of 29.4%. The Zacks Consensus Estimate for sales indicates year-over-year growth of 10.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Portland General Electric Company (POR) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經