'A paid hack': Nouriel Roubini calls out Kevin O'Leary for his ties to disgraced FTX — but here are 3 low-risk stocks for income help protect Mr. Wonderful's portfolio from missteps

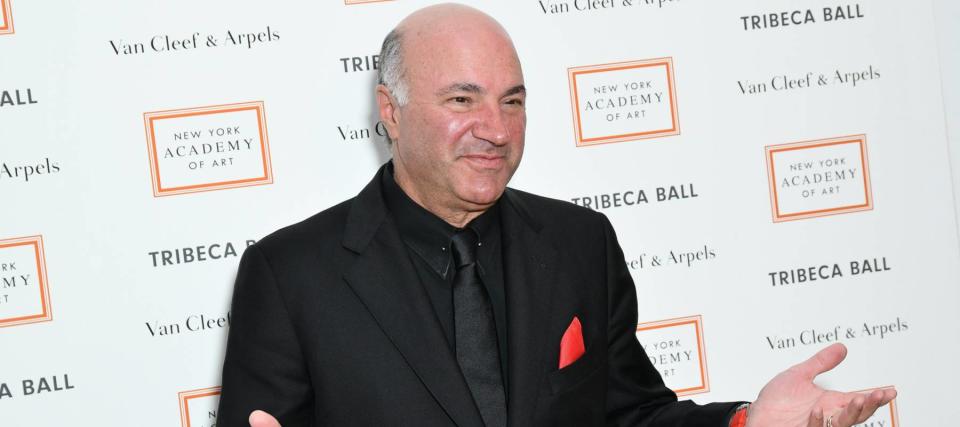

The downfall of cryptocurrency exchange FTX has impacted quite a few celebrities. That includes Kevin O’Leary — a star on CNBC’s Shark Tank program — who was a spokesperson and investor in the exchange.

He’s was called out by famed economist Nouriel Roubini.

“Kevin O’Leary is a paid hack for FTX,” Roubini said at Abu Dhabi Finance Week. “I hope that CNBC is going to get rid of him.”

To be sure, O’Leary has been one of the more outspoken proponents of cryptocurrency, but that’s not his entire investing strategy — far from it.

Don't miss

UBS says 61% of millionaire collectors allocate up to 30% of their overall portfolio to this exclusive asset class

The average home insurance policy is nearly 40% higher than it was 12 years ago — here's how to spend less on peace of mind

You could be the landlord of Walmart, Whole Foods and Kroger (and collect fat grocery store-anchored income on a quarterly basis)

Mr. Wonderful is actually a believer in investing in dividend stocks.

“When I started to do some research I found out one interesting fact that changed my investment philosophy forever,” he said in a Forbes interview. “Over the last 40 years, 71% of the market returns came from dividends, not capital appreciation.”

“So rule one for me is I’ll never own stuff that doesn’t pay a dividend. Ever.”

If you share the same view, here’s a look at the three top holdings at O’Leary’s flagship ETF — ALPS O’Shares U.S. Quality Dividend ETF (OUSA).

Home Depot (NYSE:HD)

Home Depot may not seem as exciting as crypto, but it’s the top holding at OUSA, accounting for 5.21% of the fund’s weight.

The home improvement retail giant has around 2,300 stores, with each one averaging approximately 105,000 square feet of indoor retail space, dwarfing many competitors.

While many brick-and-mortar retailers floundered during the pandemic, Home Depot grew its sales nearly 20% in fiscal 2020 to $132.1 billion.

And the company continued its momentum as the economy reopened.

In Q3 of Home Depot’s fiscal 2022, sales increased 5.6% year over year while earnings per share improved by 8.2%.

The company also raised its quarterly dividend by 15.2% to $1.90 per share earlier this year. At the current share price, it yields 2.4%.

Microsoft (NASDAQ:MSFT)

Tech stocks aren’t known for their dividends, but software gorilla Microsoft is an exception.

The company announced a 10% increase to its quarterly dividend to 68 cents per share in September. Over the past five years, its quarterly payout has grown by 62%.

So it shouldn’t come as a surprise that Microsoft is the second-largest holding in O’Leary’s OUSA.

Read more: Grow your hard-earned cash without the shaky stock market using these easy alternatives

Of course, 2022 hasn’t been nice to tech stocks, and Microsoft was caught in the sell-off as well. Year-to-date, shares have fallen by 29%.

But business is on the right track. In the September quarter, revenue increased 11% from a year ago to $50.1 billion. On a constant currency basis, revenue growth was a more impressive 16%.

Notably, revenue from Microsoft’s Intelligent Cloud segment rose 20% year over year to $20.3 billion.

Given the downturn in its share price, Microsoft could give contrarian investors something to think about.

Johnson & Johnson (NYSE:JNJ)

With deeply entrenched positions in consumer health, pharmaceuticals and medical devices markets, healthcare giant Johnson & Johnson has delivered consistent returns to investors throughout economic cycles.

Many of the company’s consumer health brands — such as Tylenol, Band-Aid, and Listerine — are household names. In total, JNJ has 29 products each capable of generating over $1 billion in annual sales.

Not only does Johnson & Johnson post recurring annual profits, but it also grows them consistently: Over the past 20 years, Johnson & Johnson’s adjusted earnings have increased at an average annual rate of 8%.

JNJ announced its 60th consecutive annual dividend increase in April and now yields 2.6%.

The stock is also demonstrating its resilience in this ugly market: while the S&P 500 is down double digits year to date, JNJ shares are actually up 3% during the same period.

The company is currently the third-largest holding in OUSA with a weighting of 4.38%.

What to read next

'Hold onto your money': Jeff Bezos says you might want to rethink buying a 'new automobile, refrigerator, or whatever' — here are 3 better recession-proof buys

Here are 3 easy money moves to give your bank account a boost today

You might have to pay 16% more for car insurance in 2023 — try this free service to get a better deal

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

雅虎香港財經

雅虎香港財經