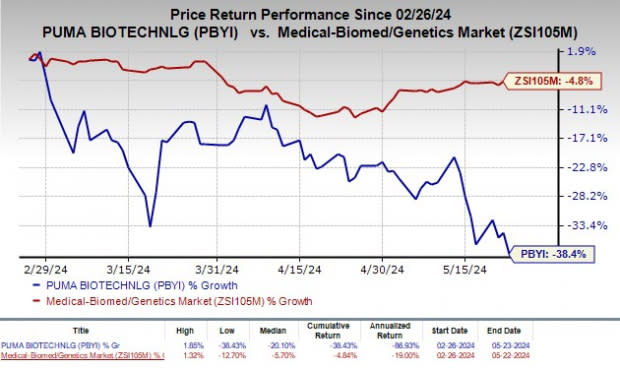

Puma Biotechnology (PBYI) Falls 38% in 3 Months: Here's Why

Shares of Puma Biotechnology, Inc. PBYI have plunged 38.4% in the past three months compared with the industry’s decline of 4.8%.

The company’s sole marketed product, Nerlynx (neratinib), is approved for the treatment of early-stage HER2-positive breast cancer in patients who have been previously treated with Roche’s RHHBY Herceptin-based adjuvant therapy.

Demand for Nerlynx has been declining in recent quarters. Owing to this, sales of the drug have been falling over the past couple of quarters. Being the only marketed product, Nerlynx sales comprise the majority of PBYI’s top line.

Declining sales of Nerlynx have been the primary reason for the stock’s decline.

Image Source: Zacks Investment Research

While the breast cancer market holds immense commercial potential, Nerlynx faces intense competition in the targeted space. Approved treatments include Roche's Herceptin and Novartis' Tykerb. A few other companies are also developing treatments targeting this disease.

The declining sales, coupled with stiff competition in the target market, remain a headwind for PBYI.

Also, currently, Puma Biotechnology has no approved product in its portfolio other than Nerlynx. As a result, the company is heavily dependent on Nerlynx for growth.

We note that Puma Biotechnology in-licensed global development and commercialization rights for alisertib, an aurora kinase A inhibitor, from Japan’s Takeda in 2022. The company is currently focusing on developing alisertib for the treatment of various cancer indications.

PBYI believes that alisertib has huge potential in HR-positive, HER2-negative breast cancer, triple-negative breast cancer, head and neck cancer and small cell lung cancer.

The company is conducting ALISCA-Lung1, a phase II study (PUMA-ALI-4201) evaluating alisertib as a monotherapy for the treatment of patients with extensive stage small cell lung cancer. Interim data from the study is expected in the fourth quarter of 2024.

PBYI also expects to begin the phase II ALISCA-Breast1 study on alisertib for treating human epidermal growth factor receptor 2-negative, hormone receptor-positive metastatic breast cancer in the fourth quarter of 2024.

If successfully developed, alisertib, has the potential to boost the company’s position in the anticancer drug market and lower its heavy dependence on Nerlynx for revenues.

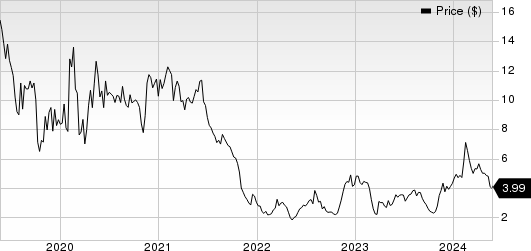

Puma Biotechnology, Inc. Price

Puma Biotechnology, Inc. price | Puma Biotechnology, Inc. Quote

Zacks Rank & Stocks to Consider

Puma Biotechnology currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Krystal Biotech, Inc. KRYS and Marinus Pharmaceuticals, Inc. MRNS, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Krystal Biotech’s 2024 earnings per share have improved from $1.61 to $2.06. Earnings per share estimates for 2025 have improved from $3.69 to $4.33. Year to date, shares of KRYS have surged 31.9%.

KRYS’s earnings beat estimates in two of the trailing four quarters and missed the same on the remaining two occasions, the average negative surprise being 21.46%.

In the past 60 days, estimates for Marinus Pharmaceuticals’ 2024 loss per share have narrowed from $2.44 to $1.87, while loss per share estimates for 2025 have narrowed from $1.97 to 90 cents. Year to date, shares of MRNS have plunged 88%.

MRNS’s earnings beat estimates in two of the trailing four quarters, met the same once and missed the same once, the average surprise being 3.27%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Krystal Biotech, Inc. (KRYS) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經