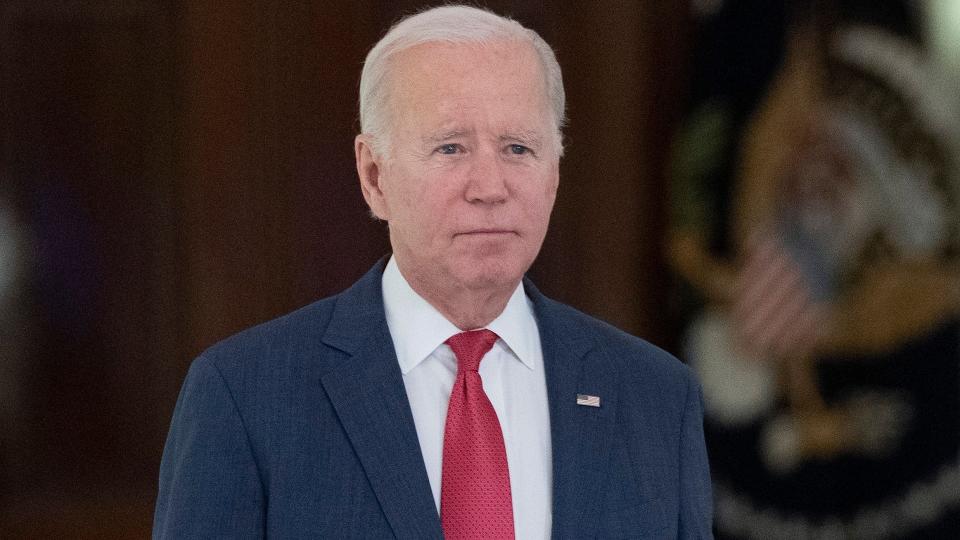

Student Loan Forgiveness: Who Will Be Hurt the Most if Biden’s Program Is Canceled?

The Supreme Court will make a ruling about President Joe Biden’s student loan forgiveness program in February, and millions of borrowers are awaiting the outcome. If the program ends up being canceled, certain groups of borrowers may be more affected than others.

See: What Is the Highest Income Level for Food Stamps in 2023?

Find: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

As CNBC reported, low- and middle-income borrowers will miss out the most. A White House analysis suggested that 87% of the debt cancellation benefits will go to Americans earning less than $75,000 annually.

Under the Biden plan, up to $10,000 in federal student debt relief may be offered to borrowers who earned less than $125,000 — or $250,000 for households — in 2020 or 2021.

That amount increases to $20,000 in student loan cancellation for Pell Grant recipients, who generally come from low-income households. Pell Grants “usually are awarded only to undergraduate students who display exceptional financial need and have not earned a bachelor’s, graduate, or professional degree,” the Department of Education explained on its website.

“In general, this plan really helps low-income people across the board,” Andre Perry, senior fellow at Brookings Metro, said during an August Brookings Institution podcast.

Women, Persons of Color Shouldering Student Loan Debt

In addition, many Black students could also be disproportionately affected by any student loan forgiveness cancellation. For example, a Brookings Institution report noted that, “the moment they earn their bachelor’s degrees, Black college graduates owe $7,400 more on average than their white peers. But over the next few years, the Black-white debt gap more than triples to a whopping $25,000.”

Women are another group that may be hampered by a lack of student loan forgiveness, as they hold two-thirds of the country’s $1.54 trillion student debt, according to the American Association of University Women (AAUA). The AAUA indicated that student debt is the second-highest source of household debt after housing.

Compounding the issue is the fact that women take two years longer than men to repay student loans, on average.

“From the moment women graduate from college, most face a gender pay gap — which compounds as they age. This makes it even harder to pay off their larger share of student debt. As a result, women often put off saving for retirement, buying a home or starting a business,” according to the AAUA.

Seniors Taking On More Student Loan Debt

Finally, older Americans could also be affected if the program were to be canceled. According to AARP, borrowers aged 50 and older hold 22% of the total amount of the country’s student debt, a figure representing more than a five-fold increase from 2004.

Take Our Poll: Do You Think Student Loan Debt Should Be Forgiven?

More: Student Loans: 9 Million Borrowers Mistakenly ‘Approved’ for Forgiveness — What Happens Now?

This is due to a combination of factors, including older Americans returning to school, or being “on the hook for loans that pay for their children’s education, either by taking out PLUS loans — federal money borrowed by parents — or cosigning for other debt from private lenders,” according to AARP.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Student Loan Forgiveness: Who Will Be Hurt the Most if Biden’s Program Is Canceled?

雅虎香港財經

雅虎香港財經