Teledyne's (TDY) Q1 Earnings Lag Estimates, '24 EPS View Down

Teledyne Technologies Inc. TDY reported first-quarter 2024 adjusted earnings of $4.55 per share, which missed the Zacks Consensus Estimate of $4.64 by 1.9%. However, the bottom line improved 0.4% from $4.53 recorded in the year-ago quarter.

The company recorded GAAP earnings of $3.72 per share, down 0.3% from the prior-year period’s earnings figure of $3.73.

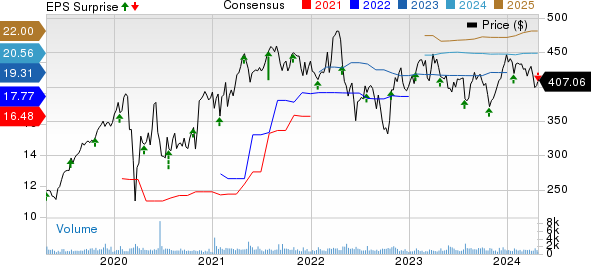

Teledyne Technologies Incorporated Price, Consensus and EPS Surprise

Teledyne Technologies Incorporated price-consensus-eps-surprise-chart | Teledyne Technologies Incorporated Quote

Operational Highlights

Total sales were $1.35 billion, which missed the Zacks Consensus Estimate of $1.40 billion by 3.6%. The top line also dropped 2.4% from $1.38 billion reported in the year-ago quarter.

This improvement can be attributed to higher year-over-year sales recorded in its Aerospace and Defense Electronics business segment.

Segmental Performance

Instrumentation: Sales in this segment slipped 0.9% year over year to $330.4 million, driven by lower sales from test and measurement instrumentation and environmental instrumentation product lines.

The adjusted operating income increased 5.9% year over year to $89.4 million.

Digital Imaging: Quarterly sales in this division declined 4.1% year over year to $740.8 million. The decrease was due to lower sales of industrial imaging cameras and micro-electro-mechanical systems.

The adjusted operating income dropped 3.7% year over year to $161.8 million.

Aerospace and Defense Electronics: Sales in this segment totaled $185.7 million, up 7.2% from that recorded in the prior-year quarter. The improvement was driven by higher sales of aerospace and defense electronics.

The adjusted operating income increased 10.4% year over year to $52.1 million.

Engineered Systems: Revenues in this division declined 10.5% year over year to $93.2 million due to lower sales of engineered products and energy systems.

This segment's operating income declined 73% to $2.7 million.

Financial Condition

Teledyne’s cash and cash equivalents totaled $912.4 million as of Mar 31, 2024 compared with $648.3 million as of Dec 31, 2023. The total long-term debt was $2.65 billion compared with $2.64 billion as of Dec 31, 2023.

Cashflow from operating activities totaled $291 million at the end of Mar 31, 2024 compared with $203 million as of Mar 31, 2023.

Capital expenditure for the fourth quarter amounted to $15.9 million, down from $24.2 million recorded in the prior-year quarter.

TDY generated free cash flow of $275.1 million at March 2024-end, indicating a 54% year-over-year increase.

Guidance

Teledyne expects to generate adjusted earnings in the band of $4.40-$4.50 per share for the second quarter of 2024. The Zacks Consensus Estimate for TDY’s second-quarter earnings is pegged at $5.07, higher than the company's guided range.

For 2024, Teledyne has lowered its expected adjusted earnings to the range of $19.25-$19.45 per share from its prior guidance range of $20.35-$20.68. The Zacks Consensus Estimate for earnings is pegged at $20.56 per share, higher than the company’s new guidance range.

Zacks Rank

Teledyne currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

RTX Corporation’s RTX first-quarter 2024 adjusted earnings per share of $1.34 beat the Zacks Consensus Estimate of $1.23 by 8.9%. The bottom line also improved 9.8% from the year-ago quarter’s level of $1.22.

RTX’s first-quarter net sales were $19,305 million, which surpassed the Zacks Consensus Estimate of $18,412.6 million by 4.8%. The top line also improved 12% from $17,214 million recorded in the first quarter of 2023.

Lockheed Martin Corporation LMT reported first-quarter 2024 adjusted earnings of $6.33 per share, which beat the Zacks Consensus Estimate of $5.80 by 9.1%. However, the bottom line declined 1.6% from the year-ago quarter's recorded figure of $6.43.

Its net sales were $17.20 billion, which surpassed the Zacks Consensus Estimate of $16.19 billion by 6.2%. The top line also increased 13.7% from $15.13 billion reported in the year-ago quarter.

Hexcel Corporation HXL reported first-quarter 2024 adjusted earnings of 44 cents per share, which came in line with the Zacks Consensus Estimate.

In the first quarter, the company’s net sales totaled $472.3 million, which missed the Zacks Consensus Estimate of $475 million by 0.6%. However, the top line witnessed an improvement of 3.2% from the year-ago quarter’s reported figure of $457.7 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經