Time to Buy Netflix (NFLX) Stock as Q1 Earnings Approach?

Financial results from Netflix NFLX are even more anticipated these days given that the streaming services giant no longer provides guidance for its subscriber growth. Still, Netflix sits at the top of the hill in regards to streaming subscribers with over 260 million users at the end of 2023.

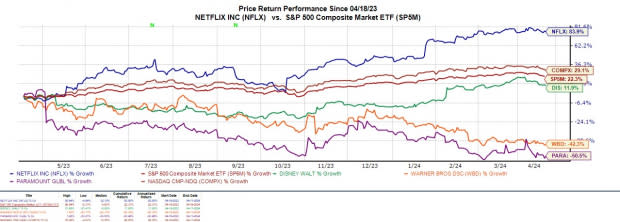

Even better, Netflix stock has soared +26% year to date to slightly top Disney’s DIS +25% while blowing away the struggling performances of many of its other streaming competitors such as Paramount Global PARAA, and Warner Bros. Discovery WBD.

However, let’s see if it's time to buy Netflix shares as its Q1 report approaches after market hours on Thursday, Apri 18.

Image Source: Zacks Investment Research

Q1 Preview

According to Zacks estimates, first quarter sales from Netflix are expected to be up 13% to $9.26 billion. The Zacks Consensus calls for a 56% increase in Q1 earnings to $4.51 per share versus $2.88 a share in the comparative quarter.

More intriguing, the Zacks ESP (Expected Surprise Preidciation) indicates Netflix could surpass its bottom line expectations with the Most Accurate Estimate having Q1 EPS at $4.53 and slightly above the Zacks Consensus.

Image Source: Zacks Investment Research

Streaming Estimates

Attributed to a cheaper alternative service with paid advertising, subscriber growth has kept Netflix in front of Disney Plus among other upcoming streaming services.

Based on Zacks estimates, Netflix is thought to have added 5.73 million global paid memberships during the first quarter. This would be a very stelar 227% increase from the 1.75 million paid subscribers Netflix added during Q1 2023. Most recently, Netflix added a shocking 13.12 million paid subscribers during Q4 which beat estimates of 8.84 million by 48%.

Image Source: Shutterstock

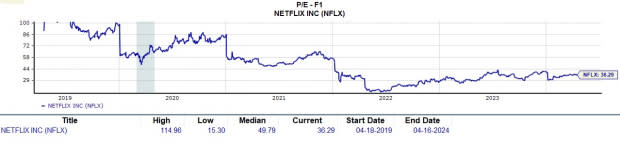

Checking Netflix’s P/E Valuation

Netflix shares currently trade at 36.2X forward earnings which is well below a five-year high of 114.9X and a slight discount to the median of 49.7X. Plus, annual earnings are projected to soar 42% in fiscal 2024 to $17.05 per share compared to $12.03 a share last year. Better still, FY25 EPS is projected to climb another 23%.

Image Source: Zacks Investment Research

Bottom Line

Given an incredible YTD rally to over $600 a share, Netflix stock currently lands a Zacks Rank #3 (Hold). Despite NFLX being more reasonably valued, reaching or exceeding Q1 expectations will be critical to reconfirming the company’s expansive growth trajectory.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Paramount Global (PARAA) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經