Virtu Financial (VIRT) Q1 Earnings Beat on Interest Income

Virtu Financial, Inc. VIRT reported first-quarter 2024 adjusted earnings per share (EPS) of 76 cents, which outpaced the Zacks Consensus Estimate by 28.8%. The bottom line advanced 2.7% year over year.

Total revenues improved 3.6% year over year to $642.8 million in the quarter under review.

The quarterly results benefited on the back of substantial growth in interest and dividends income coupled with strong revenue contribution from the Market Making segment. However, the upside was partly offset by a decline in net trading income and an elevated overall expense level.

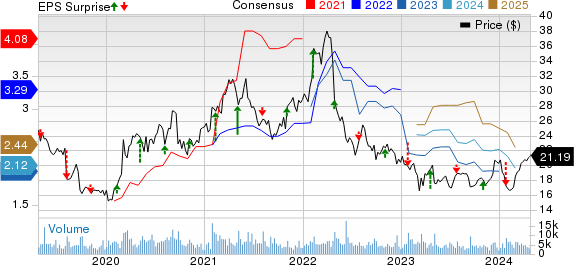

Virtu Financial, Inc. Price, Consensus and EPS Surprise

Virtu Financial, Inc. price-consensus-eps-surprise-chart | Virtu Financial, Inc. Quote

Q1 Performance Details

Adjusted net trading income slid 1.7% year over year to $366.9 million, which beat the Zacks Consensus Estimate of $335 million and our estimate of $320.9 million.

Revenues from commissions, net and technology services amounted to $118.6 million, which slipped 2.3% year over year in the first quarter. Yet, the metric beat the consensus mark and our estimate of $116 million. Interest and dividends income of $106 million climbed 28.9% year over year but fell short of the consensus mark and our estimate of $166 million.

Adjusted EBITDA declined 2.2% year over year to $202.8 million in the quarter under review but surpassed our estimate of $156.4 million. Adjusted EBITDA margin of 55.3% deteriorated 30 basis points year over year.

Total operating expenses increased 3.6% year over year to $503 million but was lower than our estimate of $548.5 million. The year-over-year rise was due to higher communication and data processing, interest and dividend expenses, and transaction advisory fees and expenses.

Segmental Update

Market Making: Adjusted net trading income was $273.7 million in the first quarter, down 1.5% year over year, and surpassing our estimate of $228.5 million. The segment’s revenues rose 4.4% year over year to $521 million, higher than the Zacks Consensus Estimate and our estimate of $511 million.

Execution Services: The unit recorded an adjusted net trading income of $93.2 million in the quarter under review, which fell 2.1% year over year. Yet, the metric beat our estimate of $92.4 million. Total revenues of $117.8 million dipped 0.6% year over year but surpassed the consensus mark and our estimate of $116 million.

Financial Update (as of Mar 31, 2024)

Virtu Financial exited the first quarter with cash and cash equivalents of $399.6 million, which plunged 51.3% from the 2023-end level. Total assets of $12.8 billion decreased 11.6% from the figure at 2023 end.

Long-term borrowings, net, amounted to $1.7 billion, down marginally from the 2023-end level. Short-term borrowings totaled $138.2 million.

Total equity of $1.4 billion inched up 1.3% from the level at 2023 end.

Share Repurchase and Dividend Update

As part of the Share Repurchase Program, Virtu Financial bought back 2 million shares worth $35.8 million in the first quarter of 2024. Management approved an increase of $500 million in its share repurchase authorization over the next two years. It had a leftover capacity of $568.6 million under its buyback authorization for future purchases.

VIRT announced a cash dividend of 24 cents per share. The dividend will be paid out on Jun 15, 2024, to shareholders of record as of Jun 1, 2024.

Zacks Rank

Virtu Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Sector Players

Here are some other Finance sector players that have reported first-quarter results so far. The bottom-line results of Morgan Stanley MS, American Express Company AXP and The Goldman Sachs Group, Inc. GS beat the respective Zacks Consensus Estimate.

Morgan Stanley reported first-quarter 2024 earnings of $2.02 per share, which surpassed the Zacks Consensus Estimate of $1.69. The figure also compared favorably with earnings of $1.70 per share reported in the year-ago quarter. MS’ net revenues of $15.14 billion beat the consensus estimate of $14.47 billion. The top line grew 4% year over year.

The Institutional Securities (IS) segment, which mainly runs its capital markets operations, posted revenues of $7.02 billion, which grew 3% year over year. Specifically, the company’s equity underwriting income jumped 113% and fixed income underwriting income was up 37%. On the other hand, advisory business was still a weak point, with advisory revenues declining 28%. Thus, total IB fees (in the IS segment) grew 16% to $1.45 billion.

American Express’ first-quarter 2024 EPS of $3.33 beat the Zacks Consensus Estimate by 12.1%. The bottom line climbed 38.8% year over year. Total revenues net of interest expense amounted to $15.8 billion, which beat the consensus estimate by 0.3%. The top line improved 10.6% year over year in the quarter under review. Network volumes of $419 billion rose 5% year over year in the first quarter.

AXP’s total interest income of $5.8 billion increased 31% year over year. Provision for credit losses escalated 20% year over year to $1.3 billion. The U.S. Consumer Services segment’s pre-tax income of $1.6 billion advanced 43% year over year. The Commercial Services segment recorded a pre-tax income of $878 million in the quarter under review, which rose 39% year over year. The International Card Services segment reported a pre-tax income of $252 million, which rose 33% year over year.

Goldman Sachs reported first-quarter 2024 EPS of $11.58, which surpassed the Zacks Consensus Estimate of $8.54. Also, the bottom line increased 16.3% from the year-earlier quarter. Net earnings of $4.13 billion rose 27.8% from the year-ago quarter. Net revenues of $14.21 billion increased 16.3% from the year-ago quarter. Also, the top line surpassed the consensus estimate of $12.89 billion.

Provision for credit losses was $318 million against a net provision benefit of $171 million in the first quarter of 2023. The Asset & Wealth Management division of GS generated revenues of $3.79 billion in the reported quarter, up 17.8% year over year. Firmwide assets under supervision were a record $2.85 trillion, up from $2.67 trillion reported in the prior quarter. The Global Banking & Markets division has recorded revenues of $9.73 billion, which increased 15.2% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經