- Bloomberg

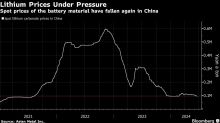

Lithium’s Ongoing Slump Has Traders Searching for Recovery Signs

(Bloomberg) -- Lithium industry watchers hoping the battery metal was poised to rebound from an epic slump have been hit by the realization prices have fallen again this month, with inventories piling up as electric vehicle demand signals stay gloomy.Most Read from BloombergHow Long Can High Rates Last? Bond Markets Say Maybe ForeverNvidia Sales Grow So Fast That Wall Street Can’t Keep UpJain Raises $5.3 Billion in Biggest Hedge Fund Debut Since 2018Tech Keeps a Lid on US Stocks as Nvidia Tumble

- InvestorPlace

3 Lithium Stocks That Can Make Millionaires by 2030

Lithium stocks have plunged on the back of a steep correction in lithium. It’s worth noting that the markets tend to react to the extremes. Currently, the sentiment for lithium stocks is bearish, and quality stocks seem deeply undervalued. I believe this is a golden opportunity to consider some lithium stocks to buy for the long term. The most important point to note is that the correction in lithium is temporary. Analysts expect that by the end of 2025, there will be a “modest deficit” of 40,00

- InvestorPlace

3 Growth Stocks to Buy After a 50% Correction: June 2024

Growth stocks have a high beta, and the price action can be significant even on small positive or negative catalysts. The flip side is that there is a risk of significant wealth erosion in a quick time. The way to eliminate this risk is diversification across blue-chip and growth stocks. However, any deep correction also provides a good opportunity to consider buying quality growth stocks. This column focuses on three growth stocks that have declined by 50% in the last few quarters. I believe th