| 前收市價 | 4.2700 |

| 開市 | 4.3100 |

| 買盤 | 4.2200 x 2900 |

| 賣出價 | 4.3500 x 1300 |

| 今日波幅 | 4.2701 - 4.3000 |

| 52 週波幅 | 3.0900 - 4.5000 |

| 成交量 | |

| 平均成交量 | 695,667 |

| 市值 | 54.365B |

| Beta 值 (5 年,每月) | 0.45 |

| 市盈率 (最近 12 個月) | 12.62 |

| 每股盈利 (最近 12 個月) | 0.3400 |

| 業績公佈日 | 2024年7月31日 |

| 遠期股息及收益率 | 0.14 (3.23%) |

| 除息日 | 2024年3月27日 |

| 1 年預測目標價 | 5.70 |

Bloomberg

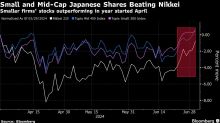

BloombergMizuho Seeks to Back More Strategic Deals By Japan’s Mid-Caps

(Bloomberg) -- A growing number of Japan’s mid-cap companies are considering buyouts and other strategic options, according to Mizuho Financial Group Inc., which is seeking to increase lending and advisory services to the sector.Most Read from BloombergDemocrats Weigh Mid-July Vote to Formally Tap Biden as NomineePowerful Hurricane Beryl Aims at Jamaica After Grenada StrikeTrump Immunity Ruling Means Any Trial Before Election Unlikely‘Upflation’ Is the New Retail Trend Driving Up Prices for US C

Insider Monkey

Insider MonkeyDid Mizuho Financial Group, Inc. (MFG) Outperform Expectations in the Last Quarter?

We recently compiled a list of the 10 Best Bank Penny Stocks to Buy Now. In this article, we are going to take a look at where Mizuho Financial Group, Inc. (NYSE:MFG) stands against the other bank penny stocks. The US banking sector in 2024 faces various challenges and opportunities. Although the industry has recovered […]

Reuters

ReutersJapan's Mizuho posts big jump in Q4 profit, forecasts growth ahead

Mizuho Financial Group reported a big jump in fourth-quarter profit on Wednesday that beat expectations, helped by its overseas business and demand for loans at home, and it forecast higher profit in the current financial year. For the January-March fourth quarter, Mizuho reported a group net profit of 36.7 billion yen ($235 million), compared with 12.3 billion yen in the same period a year earlier. The results also compared to expectations for a 30.8 billion yen quarterly profit, based on the average full-year estimate by 11 analysts polled by LSEG.