| 前收市價 | 8.77 |

| 開市 | 8.82 |

| 買盤 | 0.00 x 0 |

| 賣出價 | 0.00 x 0 |

| 今日波幅 | 8.34 - 8.82 |

| 52 週波幅 | 6.41 - 10.25 |

| 成交量 | |

| 平均成交量 | 429,250 |

| 市值 | 30.761B |

| Beta 值 (5 年,每月) | 1.17 |

| 市盈率 (最近 12 個月) | 15.47 |

| 每股盈利 (最近 12 個月) | 0.55 |

| 業績公佈日 | 2024年7月25日 - 2024年7月29日 |

| 遠期股息及收益率 | 0.09 (1.08%) |

| 除息日 | 2023年12月28日 |

| 1 年預測目標價 | 無 |

Motley Fool

Motley Fool1 Chip Manufacturing Stock Making a Big Bet on AI

One of Japan's largest tech manufacturers is making a splash in the software industry.

Reuters

ReutersIndia gives green light to chip plants worth $15.2 billion

NEW DELHI (Reuters) -India gave the go-ahead to construction of three semiconductor plants worth 1.26 trillion rupees ($15.2 billion) by firms including Tata Group and CG Power on Thursday, as the country pursues its goal of becoming an electronics powerhouse. India, which is seeking to rival countries such as Taiwan in chipmaking, expects its semiconductor market to be worth $63 billion by 2026, but does not yet have a chipmaking facility. Prime Minister Narendra Modi wants to make India a chipmaker for the world as his government tries to overcome setbacks faced in its bid to offer $10 billion in incentives to the industry.

- Reuters

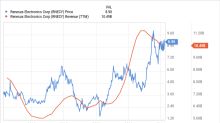

UPDATE 5-Japan chipmaker Renesas to buy software firm Altium for $5.9 bln

Japan's Renesas Electronics on Thursday said it would buy electronics design firm Altium for $5.9 billion in cash, as the acquisitive automotive chipmaker looks to offer digital device design to customers. The acquisition places Renesas at the forefront of dealmaking and investment in Japan's chips industry, with the government making efforts to improve competitiveness and boost supply chain resilience against geopolitical shocks. Renesas, which manufactures chips for automakers such as Toyota and Nissan, aims to provide device design through the purchase of Altium, which offers digital tools for engineers and designers devising circuit boards.