Amazon (AMZN) to Deploy Cashierless Technology at More Stores

Amazon AMZN continues to enjoy solid momentum with its cashierless technology by delivering an enhanced shopping experience to customers, which has been the primary factor behind its solid success in the retail sector. The stock has gained 19.3% on a year-to-date basis.

This is evident from its latest plan to deploy the technology this year into more third-party stores, including stadium stores and Hudson News locations at airports.

The company’s Just Walk Out technology, which allows customers to shop and leave without going through a checkout line, is currently available at 140 establishments.

Expanding Cashierless Technology

The latest move bodes well for Amazon’s strengthening efforts to bolster the coverage of its cashierless technology.

With the underlined technology, the company helps customers save time by avoiding checkout queues and paying for items shopped via their smartphones from anywhere.

The company has started deploying the technology at hospital stores as well in order to enable hospital employees and visitors to avail of the same service. It recently rolled out the Just Walk Out technology at St. Joseph’s/Candler Hospital in Savannah, GA.

Amazon’s deal with Panera Bread, a United States-based cafe chain, to deploy Amazon One across 10-20 Panera cafes remains noteworthy.

The strong network of Amazon Go stores, wherein the underlined technology was first introduced, remains a positive. Reportedly, there are 22 Amazon Go stores in the United States, out of which seven are located in Washington.

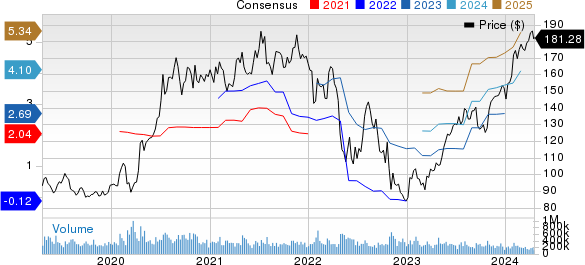

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Bottom Line

We believe that the growing endeavors to expand the cashierless technology will continue to aid Amazon’s retail prospects and drive its momentum among third-party brick-and-mortar stores.

This, in turn, will help the company bolster its physical presence in the retail industry.

Moreover, this is expected to bolster Amazon’s presence in the promising self-checkout systems market.

Per a report from Fortune Business Insights, the global self-checkout systems market is expected to hit $5.64 billion in 2024 and reach $18.01 billion by 2032 by witnessing a CAGR of 15.6% between 2024 and 2032.

According to a report from Grand View Research, the market is likely to see a CAGR of 13.4% between 2023 and 2030. Further, the report suggests that the U.S. market for the same is expected to witness a CAGR of 11.9% in the same time frame.

We believe Amazon’s strong prospects in this booming market will aid it in winning investors’ confidence in the near term, as well as to benefit its financial performance.

The Zacks Consensus Estimate for 2024 revenues stands at $641.45 billion, indicating year-over-year growth of 11.6%.

The consensus mark for 2024 EPS is pegged at $4.08 per share, implying a year-over-year rise of 40.7%.

Zacks Rank & Stock to Consider

Currently, Amazon carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the retail-wholesale sector are American Eagle Outfitters AEO, The Gap GPS and JD.com JD. These three companies sport a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

American Eagle Outfitters shares have gained 6.9% year to date. The long-term earnings growth rate for AEO is projected at 12.53%.

The Gap shares have gained 2.8% year to date. GPS’ long-term earnings growth rate is projected at 12%.

JD.com shares have lost 10.5% year to date. The long-term earnings growth rate for JD is projected at 43.75%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經