Amazon (AMZN) Q1 Earnings & Sales Beat Estimates, Rise Y/Y

Amazon.com AMZN delivered first-quarter 2024 earnings of 98 cents per share compared with 31 cents in the year-ago quarter.

AMZN’s net income, totaling $10.4 billion, is inclusive of a pre-tax valuation loss of $2 billion in non-operating expenses associated with its investment in Rivian Automotive.

The adjusted bottom-line figure was $1.13 per share, topping the Zacks Consensus Estimate by 36.1%.

Net sales of $143.31 billion rose 13% year over year. The figure came closer to the higher end of the management’s guidance of $138-$143.5 billion and surpassed the Zacks Consensus Estimate of $142.53 billion.

Amazon witnessed a $0.2 billion impact of unfavorable fluctuations in foreign exchange rates.

Solid momentum across North America and International segments contributed well.

The growing momentum of the Amazon Web Services (“AWS”) segment contributed well.

Strength in the advertising business also benefited the company in the reported quarter.

Moreover, AMZN has gained 15.1% over a year, outperforming the industry’s growth of 8%.

AWS’s growing investments in generative AI are likely to continue aiding it in gaining momentum among cloud customers in the near term.

Amazon’s strong global presence, growing Prime momentum, improving Alexa skills, expanding smart device portfolio, and increasing efforts toward gaining strong traction among small and medium businesses are likely to drive its financial performance in the days ahead.

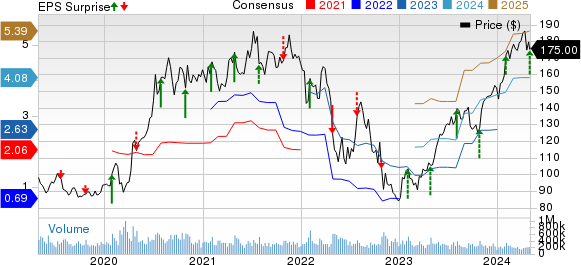

Amazon.com, Inc. Price, Consensus and EPS Surprise

Amazon.com, Inc. price-consensus-eps-surprise-chart | Amazon.com, Inc. Quote

Top-Line Details

Product sales (42.5% of sales) increased 6.9% year over year to $60.9 billion. Service sales (57.5% of sales) rose 17.1% from the year-ago quarter to $82.4 billion.

By segment, North America revenues (60% of sales) rose 12% from the year-ago quarter to $86.3 billion, which beat the Zacks Consensus Estimate of $85.3 billion.

International revenues (22% of sales) increased 10% year over year to $31.9 billion, which missed the consensus mark of $32.7 billion.

AWS revenues (18% of sales) rose 17% year over year to $25.04 billion, which surpassed the consensus mark of $24.3 billion.

Strengthening relationships with third-party sellers remained another positive. In the reported quarter, sales generated by third-party seller services rose 16% on a year-over-year basis to $34.6 billion, which marginally beat the Zacks Consensus Estimate of $34.5 billion.

Sales from robust advertising services increased 24% year over year to $11.8 billion, which marginally lagged the consensus mark of $11.9 billion.

AMZN experienced year-over-year growth of 6% in its physical store sales, which were $5.2 billion in the reported quarter. The figure topped the consensus mark of $5.1 billion.

The company’s online store sales were $54.7 billion, up 7% year over year. The figure marginally lagged the Zacks Consensus Estimate of $54.8 billion.

Strength in Prime was a positive. Amazon witnessed 11% growth in its subscription services sales, which were $10.72 billion in the reported quarter. The figure beat the consensus mark of $10.68 billion.

Growing momentum with the Same-Day Delivery service worldwide was a positive. Also, the expanding original content and an international slate of content on Prime Video continued to accelerate Prime engagement.

Operating Details

Operating expenses were $128.01 billion, up 4.4% from the year-ago quarter. As a percentage of revenues, the figure contracted 690 basis points (bps) on a year-over-year basis to 89.3%.

The cost of sales, fulfillment and other operating expenses increased 7.1%, 6.8% and 2.2% year over year to $72.6 billion, $22.3 billion and $228 million, respectively.

Technology and infrastructure, sales and marketing, and general and administrative expenses were $20.4 billion, $9.7 billion and $2.7 billion, down 0.1%, 5% and 9.9% year over year, respectively.

Overall operating income was $15.3 billion compared with $4.8 billion in the year-ago quarter.

Operating income for AWS was $9.4 billion, up 83.9% year over year.

The North America segment reported an operating income of $4.98 billion compared with $898 million in the prior-year quarter. The International segment reported an operating income of $903 million against an operating loss of $1.2 billion in the year-ago quarter.

Balance Sheet & Cash Flow

As of Mar 31, 2024, cash and cash equivalents were $72.9 billion, down from $73.4 billion as of Dec 31, 2023.

Marketable securities totaled $12.2 billion as of Mar 31, 2024, down from $13.4 billion as of Dec 31, 2023.

The long-term debt was $57.6 billion at the end of the reported quarter, down from $58.3 billion at the end of the previous quarter.

In the first quarter, AMZN generated $18.99 billion of cash from operations, down from $42.5 billion in the fourth quarter.

On a trailing 12-month basis, the operating cash flow came in at $99.1 billion. The free cash flow was $50.1 billion.

Guidance

For second-quarter 2024, Amazon expects net sales between $144 billion and $149 billion. Net sales are expected to grow 7-11% from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for net sales is pegged at $150.21 billion.

Management projects an unfavorable foreign exchange impact of 60 bps.

Operating income is anticipated between $10 billion and $14 billion.

Zacks Rank & Other Stocks to Consider

Currently, Amazon carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Arista Networks ANET, Badger Meter BMI and Dell Technologies DELL. While Arista Networks and Badger Meter sport a Zacks Rank #1 (Strong Buy) at present, Dell Technologies carry Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Arista Networks have gained 4.2% in the year-to-date period. The long-term earnings growth rate for ANET is 17.48%.

Shares of Badger Meter have gained 17.5% in the year-to-date period. The long-term earnings growth rate for BMI is 15.57%.

Shares of Dell Technologies have gained 52.3% in the year-to-date period. The long-term earnings growth rate for DELL is projected at 12%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經