ArcelorMittal (MT) Buys Italpannelli's Italy & Spain-Based Units

ArcelorMittal S.A.'s MT construction arm, ArcelorMittal Construction, has closed the acquisition of Italpannelli SRL in Italy and Italpannelli Iberica in Spain. This is ArcelorMittal's second acquisition of Italpannelli businesses, following its purchase of Italpannelli Germany near Trier in March 2023.

Italpannelli manufactures lightweight insulation panels for roofs and facades. It has two production units in Europe — Zaragoza (Spain) and Abruzzo (Italy). The two plants operate seven production lines with a total annual capacity of 13 million m2 of sandwich panels, principally supplying customers in central and eastern Europe, France, Germany, Italy, and Spain, and employ roughly 260 people.

ArcelorMittal Construction's business gains strategic value from the acquisition. It significantly increases the company's panel business' capabilities to deliver in new markets. The buyout also provides an enhanced geographic market offering, which gives access to new regions. Moreover, it expands the company's product portfolio to include long span decking with PVC membrane, section doors and tile-shaped or corrugated sandwich panels to better serve the agricultural, residential, and coldstore segments through various channels. Notable synergies with efficiency gains and cost benefits are also identified.

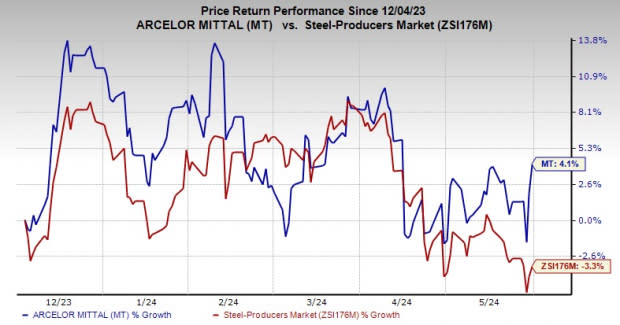

Shares of MT have gained 4.1% over past six months against a 3.3% decline of its industry.

Image Source: Zacks Investment Research

ArcelorMittal, on its first-quarter call, said that with low inventory levels, particularly in Europe, any uptick in actual demand could lead to a rebound in apparent demand. The company continues to project 3-4% growth in global steel consumption, excluding China, in 2024. This includes a projected increase of 1.5-3.5% in the United States, 2-4% in Europe, 0.5-2.5% in Brazil and 6.5-8.5% in India.

The company is optimistic about the medium to long-term prospects for steel demand. It is confident in its ability to execute its strategy for growth while providing capital returns to shareholders.

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Zacks Rank & Key Picks

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. ATI, Carpenter Technology Corporation CRS and Ecolab Inc. ECL.

ATI carries a Zacks Rank #2 (Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have soared 77% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company’s shares have soared 143.2%% in the past year.

The Zacks Consensus Estimate for Ecolab’s current-year earnings is pegged at $6.56 per share, indicating a year-over-year rise of 25.9%. ECL, a Zacks Rank #2 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company’s shares have rallied roughly 38.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經