Should You Buy ExxonMobil (XOM) Ahead of Q1 Earnings?

Eyes are now on Exxon Mobil Corporation XOM, which is scheduled to report first-quarter 2024 earnings on Apr 26, before the opening bell. Some investors may be deliberating whether to purchase the stock of the leading integrated energy company before Friday or wait for a better entry point, as an erroneous decision could significantly affect portfolio gains.

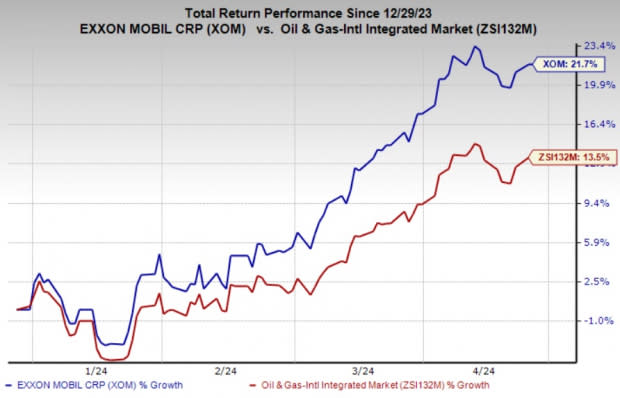

Incredible Price Performance

ExxonMobil has proven to be incredibly rewarding since the beginning of the year, gaining 21.7% year to date, surpassing the 13.5% rise of the composite stocks belonging to the Zacks Oil and Gas Integrated International industry. A solid pipeline of profitable upstream projects centered around the prolific Permian and Guyana assets is among the key factors that are leading to the outperformance.

Image Source: Zacks Investment Research

Highly favorable oil prices, as evidenced by the average spot West Texas Intermediate crude oil prices per barrel in January, February and March of $74.15, $77.25, and $81.28, respectively, according to the U.S. Energy Information Administration’s data, are also bolstering the energy major's price performance, and hence likely have backed XOM’s first-quarter earnings.

The Zacks Consensus Estimate for first-quarter earnings per share stands at $2.19, with revenues estimated at $86.6 billion. Notably, our proven model predicts an earnings beat for ExxonMobil this time around because the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. XOM has an Earnings ESP of +0.13% and a Zacks Rank #3.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Wait for a Better Entry Point

ExxonMobil's price chart may continue to show strength, given the company's anticipated closure of its substantial $59.5 billion all-stock acquisition deal with Pioneer Natural Resources PXD in the second quarter of 2024. This deal closure is poised to enhance ExxonMobil's presence in the Permian Basin, the most prolific basin in the United States, as Pioneer Natural is a leading oil producer in the region.

ExxonMobil's Permian production is thus set to more than double to 1.3 million barrels of oil equivalent per day (MMBoE/D). Additionally, the company has projected that this production figure will increase to an impressive 2 MMBoE/D by 2027.

Numerous major discoveries in the Stabroek Block, situated off the coast of Guyana, have also contributed to ExxonMobil's notable progress in its production outlook. The growth projects in Guyana offer advantages in terms of lower greenhouse gas intensity compared to many other oil and gas-producing resources worldwide.

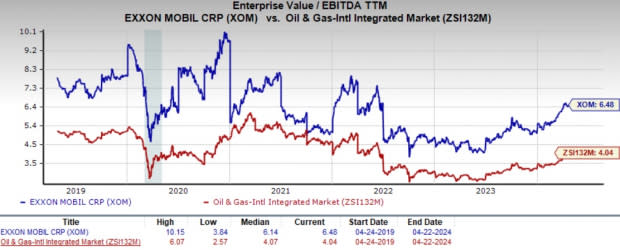

Despite the positive developments favoring the stock, investors should wait for a better entry point. This is because shares are somewhat expensive on a relative basis, with the current 6.48X trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization sitting above the 6.14X five-year median. Also, the company is trading at a premium to the Zacks Oil and Gas International Integrated industry average of 4.04X.

Image Source: Zacks Investment Research

Closing Thoughts

Investors should refrain from rushing to buy XOM, which is lagging behind its peers in terms of shareholder returns, before Friday. Instead, they should monitor the stock closely for a more appropriate entry point.

Other Stocks to Consider

Here are two other firms that you may want to consider, as these, too, have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

EOG Resources, Inc. EOG currently has an Earnings ESP of +0.67% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

EOG Resources is scheduled to release first-quarter earnings on May 2. The Zacks Consensus Estimate for EOG’s quarterly earnings is pegged at $2.74 per share, implying a 1.9% increase from the prior-year reported figure.

Diamondback Energy FANG currently has an Earnings ESP of +1.66% and a Zacks Rank #3.

Diamondback is scheduled to release first-quarter earnings on Apr 30. The Zacks Consensus Estimate for FANG’s quarterly earnings is pegged at $4.27 per share, indicating a 4.2% increase from the prior-year reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經