CMS Energy's (CMS) Arm to Invest $24M in Smart Technologies

CMS Energy Corp. CMS recently revealed that its primary subsidiary, Consumers Energy, plans to invest approximately $24 million in smart technologies in 2024 to avert power outages for its customers. As part of this plan, Consumers Energy has already deployed more than 100 automatic transfer reclosers (ATRs) and approximately 3,000 line sensors throughout Michigan.

Benefits of Smart Technology Installation

ATRs are capable of isolating outages by detecting power loss and immediately rerouting power in the opposite direction. Meanwhile, line sensors can detect grid faults and provide their locations, thereby preventing outages before they occur.

Deploying these state-of-the-art technologies in its transmission and distribution systems will reduce outage events for CMS customers and strengthen its grid reliability, which should boost its customer base and revenue growth. In 2023, ATRs successfully avoided outages for approximately 70,000 CMS customers.

Consumers Energy Focuses on Grid Hardening

The goal of smart grids is to maximize system resiliency, flexibility and stability while minimizing costs and environmental effects. With the entire utility industry currently going through the clean energy transition, smart grids are thus the need of the hour, as the demand for electricity continues to rise, backed by global economic development, along with rising data center growth. Also, as severe and unpredictable weather events like tornadoes and wildfires pose a risk for utilities’ infrastructure, industry players are increasingly focusing on strengthening their grids.

Realizing this, utility providers like CMS Energy have been investing heftily in grid-hardening technologies, such as ATRs and line sensors. The latest announcement is a bright example of that. To this end, CMS earlier submitted a five-year Reliability Roadmap in September 2023. As part of this Roadmap, CMS Energy plans to invest $9 billion in Michigan to ensure no customer goes without electricity for more than 24 hours and no single interruption affects more than 100,000 users. The plan also includes investments in iron poles and overhead powerlines.

Growth Prospects

Realizing the importance of smart grids in electricity transmission and distribution, several economies across the globe are increasing their investments in this space. This has been boosting the growth prospects of this market.

Per a report from the Mordor Intelligence firm, the smart grid market is projected to witness a CAGR of 11% over the 2022-2027 period. This should bode well for CMS Energy, along with other utility companies like Duke Energy DUK, American Electric Power AEP and DTE Energy Company DTE, which are also deploying smart technologies in their operations to reap the benefits of the growing smart grid market.

Duke Energy uses smart meters to boost its transmission and distribution system's reliability and flexibility. The company continues to enhance customers' experience with the Self-Optimizing Grid (“SOG”), its flagship grid improvement program. In 2023, CMS’ SOG investments helped avoid approximately 330,000 customer interruptions across its six-state electric service area, preventing customers from having more than 1.4 million hours of lost outage time during major events.

The stock boasts a long-term earnings growth rate of 6.3%. The Zacks consensus estimate for DUK’s 2024 sales indicates an improvement of 3.3% from the previous year’s reported sales.

American Electric is developing smart grids to automatically reroute electricity to critical facilities like hospitals, medical offices and fire stations. Its Distribution Automation Circuit Reconfiguration is a new technology that detects power outages and automatically reroutes power, ensuring uninterrupted service.

The stock boasts a long-term earnings growth rate of 5.8%. The Zacks Consensus Estimate for AEP’s 2024 sales implies an improvement of 8.4% from the previous year’s reported level.

DTE Energy is adding significantly more technology to its system by installing 10,000 smart devices, known as reclosers, effectively automating the entire system by 2029. Through this and its other investments in smart grid technology, DTE is committed to reducing power outages by 30% and cutting outage durations in half by 2029.

The stock boasts a long-term earnings growth rate of 6%. The consensus estimate for DTE’s 2024 sales implies an improvement of 4.4% from the previous year’s reported figure.

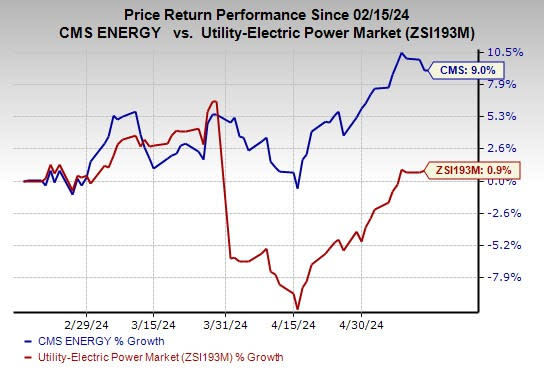

Price Movement

In the past three months, shares of CMS Energy have risen 9% compared with the industry’s average growth of 0.9%.

Image Source: Zacks Investment Research

Zacks Rank

CMS Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經