Donaldson (DCI) Q2 Earnings & Revenues Top Estimates, Rise Y/Y

Donaldson Company, Inc. DCI reported second-quarter fiscal 2024 (ended Jan 31, 2024) adjusted earnings of 81 cents per share, which surpassed the Zacks Consensus Estimate of 73 cents. The bottom line increased 15.9% year over year.

Revenue Results

In the fiscal second quarter, total revenues of $876.7 million outperformed the Zacks Consensus Estimate of $861 million. The top line increased 5.8% (up 5.3% at constant currency) in the reported quarter, driven by volume growth and benefits of pricing actions.

Region-wise, DCI’s net sales in the United States/Canada increased 8.8% year over year. The metric declined 3% year over year in Europe, the Middle East and Africa. However, the same increased 9% in Latin America and 9.1% in the Asia Pacific.

Donaldson started reporting revenues under three segments starting second-quarter fiscal 2023. The segments are Mobile Solutions, Industrial Solutions and Life Sciences.

A brief snapshot of segmental sales is provided below:

The Mobile Solutions segment’s (accounting for 62.7% of net sales) sales were $550.3 million, reflecting a year-over-year increase of 5.3%.

Results were benefited from an 11.3% improvement in aftermarket sales. However, sales declined 13.4% in Off-Road and 3% in On-Road businesses during the quarter.

Revenues generated from the Industrial Solutions segment (30.1%) were $263.4 million, increasing 6.9% year over year.

Results benefited from sales growth of 6% in Industrial Filtration Solutions and 12.4% in Aerospace and Defense.

Revenues generated from Life Sciences (7.2%) were $63 million, increasing 6% year over year.

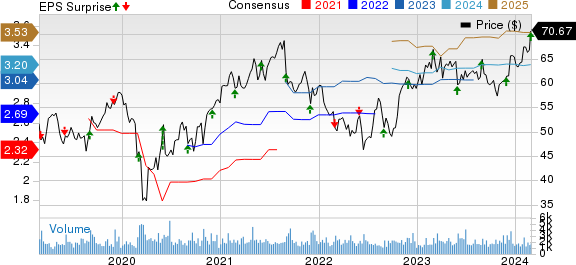

Donaldson Company, Inc. Price, Consensus and EPS Surprise

Donaldson Company, Inc. price-consensus-eps-surprise-chart | Donaldson Company, Inc. Quote

Margin Profile

In the fiscal second quarter, Donaldson’s cost of sales increased 4.4% year over year to $568.1 million. Gross profit jumped 8.5% to $308.6 million. The gross margin increased 90 basis points (bps) to 35.2% on the back of pricing benefits, deflation in freight and select material costs.

Operating expenses increased 6.4% year over year to $178.9 million. Operating profit in the quarter under review increased 11.5% to $129.7 million. The operating margin was 14.8%, increasing 80 bps year over year.

The effective tax rate in the quarter was 23.5% compared with 24.1% in the year-ago quarter.

Balance Sheet & Cash Flow

Exiting second-quarter fiscal 2024, Donaldson’s cash and cash equivalents were $193.8 million compared with $187.1 million in the fourth quarter of fiscal 2023. Long-term debt was $352 million compared with $496.6 million in the fourth quarter of fiscal 2023.

In the first six months of fiscal 2024, DCI generated net cash of $225 million from operating activities, reflecting an increase of 2% year over year. Capital expenditure (net) totaled $44.5 million compared with $57.6 million in the year-ago fiscal period. Free cash flow increased 10.8% to $180.5 million. In the same time frame, Donaldson repaid its long-term debt of $88.7 million.

DCI also used $86.6 million to repurchase treasury stocks and $60.3 million to pay out dividends during the first six months of fiscal 2024.

2024 Outlook

For fiscal 2024 (ending July 2024), Donaldson expects adjusted earnings per share of $3.24-$3.32 compared with $3.14-$3.30 mentioned earlier. Sales are anticipated to increase 3-7% from the fiscal 2023 reported level. Positive pricing is anticipated to have an accretive impact of 2%. Movement in foreign currencies is expected to positively impact sales by 1%.

On a segmental basis, Mobile Solutions’ sales are anticipated to increase 1-5% from the fiscal 2023 level. Sales growth for Industrial Solutions is anticipated to be 3-7% from the fiscal 2023 figure. The company expects its Life Sciences segment’s sales to increase approximately 20%.

Interest expenses are predicted to be approximately $23 million, while other income is projected to be $10-$12 million. The effective tax rate is anticipated to be 24-25%.

Capital expenditure for the fiscal year is expected to be $95-$110 million. Free cash flow conversion is anticipated to be 95-105%. Share buybacks are expected to account for 2% of the outstanding shares.

Zacks Rank & Other Key Picks

Donaldson carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks within the broader Industrial Products sector are presented below.

Atmus Filtration Technologies Inc. ATMU currently has a Zacks Rank #2. ATMU delivered a trailing four-quarter average earnings surprise of 20.3%. In the past 60 days, the Zacks Consensus Estimate for its 2024 earnings has increased 2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Tetra Tech, Inc. TTEK presently carries a Zacks Rank of 2. TTEK delivered a trailing four-quarter average earnings surprise of 14.4%. In the past 60 days, the Zacks Consensus Estimate for its 2024 earnings has increased 2.9%.

Brady Corporation BRC currently has a Zacks Rank of 2. BRC delivered a trailing four-quarter average earnings surprise of 6.3%. In the past 60 days, the Zacks Consensus Estimate for Brady’s 2024 earnings has remained stable.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

Atmus Filtration Technologies Inc. (ATMU) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經