Encompass Health (EHC) Stock Down Despite Q1 Earnings Beat

Encompass Health Corporation EHC shares lost 0.4% since it reported first-quarter 2024 results on Apr 24. Although it beat estimates thanks to rising patient revenue, strong discharges and a robust pipeline for bed additions. Investors might be concerned regarding elevated operating expenses despite cost control measures undertaken by the company.

EHC reported first-quarter 2024 adjusted earnings per share (EPS) of $1.12, which outpaced the Zacks Consensus Estimate by 20.4%. The bottom line rose 27.3% year over year.

Net operating revenues amounted to $1.3 billion, which advanced 13.4% year over year in the quarter under review. The top line beat the consensus mark by 3.6%.

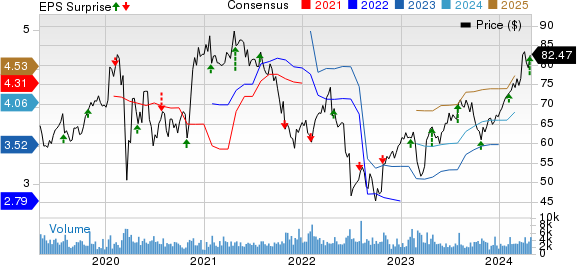

Encompass Health Corporation Price, Consensus and EPS Surprise

Encompass Health Corporation price-consensus-eps-surprise-chart | Encompass Health Corporation Quote

Q1 Operations

EHC’s net patient revenue per discharge grew 2.8% year over year in the first quarter, which was higher than our growth estimate of 1.6%. Total discharges of 61.1 million improved 10% year over year and surpassed our estimate of 59.6 million.

Total operating expenses increased 12.9% year over year to $1.11 billion, which was higher than our estimate of $1.08 billion. The metric witnessed a year-over-year rise due to elevated salaries and benefits and other operating expenses.

Net and comprehensive income of $138.8 million grew 22.5% year over year in the quarter under review.

Adjusted EBITDA advanced 19.2% year over year to $273 million, which beat our estimate of $253.5 million. Strong discharge growth provided an impetus to the performance of the metric.

Encompass Health added 51 beds to its existing hospitals in the first quarter.

Financial Update (as of Mar 31, 2024)

Encompass Health exited the first quarter with cash and cash equivalents of $134.4 million, which increased nearly one-fold from the 2023-end figure.

Total assets of $6.2 billion increased 2.1% from 2023-end.

Long-term debt, net of the current portion, amounted to $2.7 billion, down 0.2% from the figure as of Dec 31, 2023. The current portion of long-term debt totaled $25.6 million.

Total shareholders’ equity of $2.4 billion rose 4.7% from the 2023-end figure.

EHC generated net cash from operations of $238.8 million in the first quarter, which climbed 4.8% year over year. Adjusted free cash flow of $167.6 million increased 5.6% year over year.

Capital Deployment Update

Encompass Health did not buy back shares in the first quarter. The company had a leftover capacity of around $198 million under its buyback authorization as of Mar 31, 2024.

Management paid out a quarterly cash dividend of 15 cents per share.

2024 Outlook Revised

Net operating revenues are projected to be between $5.25 billion and $5.325 billion, the mid-point of which indicates an improvement of 10.2% from the 2023 reported figure of $4.8 billion.

Adjusted EBITDA is anticipated to be in the range of $1.030-$1.065 billion in 2024, the midpoint of which suggests 7.9% growth from the 2023 figure of $971.1 million.

Adjusted EPS from continuing operations is expected to stay within $3.86-$4.11, the mid-point of which implies a 9.5% rise from the 2023 figure of $3.64.

Adjusted free cash flow is estimated to lie between $475 million and $570 million for 2024. Maintenance capex is anticipated within $185-$195 million.

The company expects to open six de novo hospitals with a total addition of 280 beds. It also expects to add another 93 beds to existing hospitals, inclusive of a 40-bed freestanding hospital.

Growth Targets Reaffirmed

Over the 2023-2027 period, management aims to inaugurate six to ten de novos each year as well as make bed additions in the range of 80-120 each year. It also targets to bring about a CAGR of 6-8% in discharges in the same time frame.

Zacks Rank

Encompass Health currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported first-quarter 2024 results so far, the bottom-line results of Universal Health Services, Inc. UHS, Molina Healthcare, Inc. MOH and Humana Inc. HUM beat the respective Zacks Consensus Estimate.

Universal Health reported first-quarter 2024 adjusted EPS of $3.70, which beat the Zacks Consensus Estimate by 17.8%. The bottom line rose 58.1% year over year from the year-ago period. Net revenues amounted to $3.8 billion in the quarter under review, which grew from $3.5 billion a year ago. The top line outpaced the consensus mark by 2%. Adjusted EBITDA net of NCI rose 24.9% year over year to $525.8 million.

In the Acute Care Hospital Services segment, adjusted admissions (adjusted for outpatient activity) advanced 4.5% year over year on a same-facility basis. Adjusted patient days rose 3.4% year over year. Net revenues stemming from UHS’ acute care services improved 9.6% year over year on a same-facility basis. Adjusted admissions in the Behavioral Health Care Services unit declined 0.8% year over year on a same-facility basis, while adjusted patient days increased 2% year over year. On a same-facility basis, net revenues derived from Behavioral Healthcare Services increased 10.4% year over year.

Molina Healthcare’s first-quarter 2024 adjusted EPS of $5.73 beat the Zacks Consensus Estimate by 5%. However, the bottom line dipped 1.4% year over year. Total revenues amounted to $9.9 billion, which improved 21.9% year over year. Also, the top line outpaced the consensus mark by 4.3%. Premium revenues of $9.5 billion climbed 21% year over year.

Investment income soared 52.1% year over year to $108 million. Adjusted general and administrative expense ratio deteriorated 10 basis points year over year to 7.1% in the first quarter. MOH’s adjusted net income dipped 0.9% year over year to $334 million. The consolidated medical care ratio (medical costs as a percentage of premium revenues), or MCR, was 88.5% in the quarter under review. As of Dec 31, 2023, total membership advanced 9% year over year to around 5.7 million.

Humana delivered first-quarter 2024 earnings of $7.23 per share, which beat the Zacks Consensus Estimate by 20.1%. However, the figure declined from earnings of $9.38 per share in the year-ago period. Adjusted revenues rose 14.3% from the previous year, reaching $29.3 billion. Also, the top line exceeded the consensus estimate by 2.6%.

Total premiums amounted to $28.3 billion, which improved 10.6% year over year in the first quarter. Services revenues increased 6.3% year over year to almost $1.1 billion. Investment income of $288 million increased 49.2% year over year in the quarter under review. HUM reported an operating income of $1.2 billion in the first quarter, down from the year-ago income of $1.7 billion. The Insurance segment’s adjusted revenues rose 10.8% year over year to $28.7 billion, while adjusted operating income came in at $903 million. As of Mar 31, 2024, the total medical membership of the segment was 16.17 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經