GSK Outperforms Industry on Strength in Key Drugs & Vaccines

GSK plc GSK boasts a diversified base and presence in different geographical areas. The company has made significant progress in expanding its presence in emerging markets by acquiring product portfolios from companies like Bristol-Myers and UCB.

The spin-off of the Consumer unit in 2022 has allowed it to focus on drug development. In July 2022, GSK de-merged its Consumer Healthcare segment into a standalone company. The independent Consumer Healthcare company has been named Haleon HLN.

Haleon was a consumer health joint venture, an over-the-counter medicines business, jointly created by GSK and partner Pfizer PFE in 2019. GSK has been regularly selling its stake in Haleon, and as of January 2024, GSK held slightly over 4% of the issued share capital of Haleon. Pfizer held a 32% stake in Haleon, which will now be reduced to 24% as Pfizer plans to sell some shares in an underwritten offering and also some shares directly to Haleon.

Vaccines and Specialty Medicines now represent around two-thirds of GSK’s sales compared with 46% in 2017. In fact, new products launched since 2017 contributed sales of £11 billion in 2023.

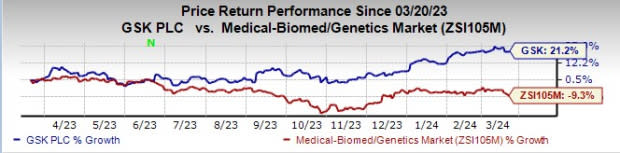

GSK’s stock has gained 21.2% in the past year against the decline of 9.3% for the industry.

Image Source: Zacks Investment Research

GSK boasts a broad vaccine portfolio that targets infectious diseases like meningitis, shingles, flu, polio and many more. GSK has more than 20 marketed vaccines in its portfolio. The company achieved strong vaccine growth of 25% at CER in 2023, driven by strong sales for its shingles vaccine, Shingrix and meningitis portfolio and exceptional contribution from the new RSV vaccine, Arexvy. Arexvy had an exceptional launch and generated £1.2 billion in sales in 2023.

Sales of the shingles vaccine, Shingrix, grew 60% at CER in 2022 and 17% in 2023, supported by the post-pandemic rebound and strong uptake and new market launches. GSK expects continued strong sales of Shingrix in 2024, mostly to be driven by outside U.S. markets where the vaccine is now approved in 39 countries. Arexvy sales are expected to be strong in 2024, driven by further penetration in the U.S. market, as well as early adoption from international launches. Over time, GSK expects Arexvy to generate more than £3 billion in annual sales.

GSK is also focusing on accelerating the vaccine pipeline, particularly the expanded use of the RSV vaccine, pentavalent vaccine and the 5-in-1 meningococcal vaccine, MenABCWY, to drive long-term growth. It has a leading suite of vaccine platform technologies, including next-generation mRNA, multiple antigens presenting system, or MAPS, as well as adjuvant systems.

GSK’s products in the Specialty Medicines segment, like Dovato, Nucala, and Juluca, are doing well and have become key drivers of top-line growth.

In Specialty Medicines, GSK has 71 assets in clinical development, with two-thirds to prevent and treat infectious diseases and HIV.

Promising candidates in late-stage development include gepotidacin (uncomplicated urinary tract infection [UTI] and urogenital gonorrhoea), bepirovirsen (chronic hepatitis B), depemokimab (severe eosinophilic asthma, eosinophilic granulomatosis with polyangiitis, hypereosinophilic syndrome and chronic rhinosinusitis with nasal polyps), tebipenem (complicated UTIs), camlipixant (refractory chronic cough). GSK is also focused on developing innovative ultra-long-acting HIV regimens for treatment and prevention, which can extend the dosing intervals of the injections. GSK expects sales from its new long-acting regimens to be around £2 billion by 2026.

GSK plans to launch more than 20 new products/line extensions by 2026, with more than 10 having blockbuster potential.

Conclusion

GSK has its share of problems. Competitive pressure on HIV and respiratory drugs has risen. The dolutegravir HIV franchise patent expires in the 2028-2029 period, and U.S. sales of Shingrix are slowing down. GSK needs to invest in R&D to strengthen its pipeline. Nonetheless, continued sales growth of its specialty drugs and vaccines like Shingrix and Arexvy, contribution from new products and positive pipeline updates should drive the stock in the future quarters.

Zacks Rank & A Stock to Consider

GSK currently has a Zacks Rank #3 (Hold).

GSK PLC Sponsored ADR Price and Consensus

GSK PLC Sponsored ADR price-consensus-chart | GSK PLC Sponsored ADR Quote

A better-ranked biotech stock is ADMA Biologics ADMA, which sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents, while that for 2025 has increased from 32 cents to 50 cents. In the past year, shares of ADMA Biologics have risen 101.0%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same once. ADMA delivered a four-quarter average earnings surprise of 85.0%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Haleon PLC Sponsored ADR (HLN) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經