Here's Why Investors Should Avoid J.B. Hunt (JBHT) Stock Now

J.B. Hunt Transport Services, Inc.’s JBHT top line continues to grapple with lower revenues across all the business segments, mainly due to a combination of lower volume and customer rates. JBHT’s fourth-quarter 2023 revenues of $3,303.70 million surpassed the Zacks Consensus Estimate of $3,236.2 million but fell 9.5% year over year. Total operating revenues, excluding fuel surcharge revenue, fell 6% year over year. The downfall was due to a 12% and 7% decline in volume in Integrated Capacity Solutions (ICS) and Truckload (JBT), respectively, a 10% and 13% decline in revenue per load, excluding fuel surcharge revenue in Intermodal (JBI) and JBT, respectively, and a 12% decline in stops in Final Mile Services (FMS). These were partially offset by a 6% increase in volume in JBI, a 3% increase in productivity (revenue per truck per week excluding fuel surcharge revenue) in Dedicated Contract Services (DCS), and the revenue contribution from the acquisition of the brokerage assets of BNSF Logistics.

Higher net interest expense is likely to mar J.B. Hunt’s bottom line. JBHT continues to incur higher interest expenses owing to higher interest rates and debt issuance costs. Net interest expense for 2023 increased 16.2% year over year due to higher effective interest rates.

J.B. Hunt’s weak cash position is worrisome. JBHT's cash and cash equivalents stood at $53.34 million at the end of the fourth quarter of 2023, much lower than the long-term debt of $1,326.10 million.

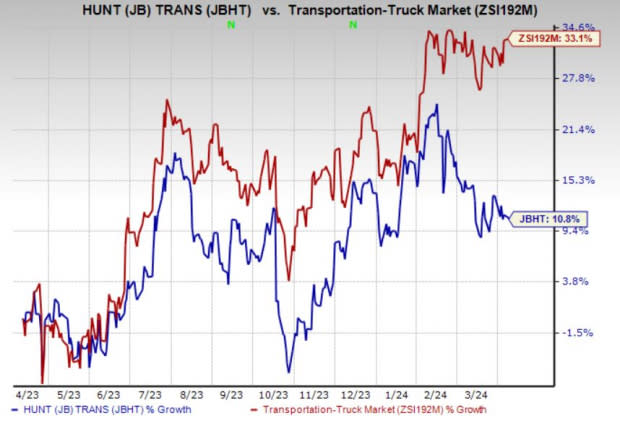

Partly due to these headwinds, shares of JBHT have gained 10.8% in the past year but underperformed its industry’s growth of 33.1%.

Image Source: Zacks Investment Research

Despite such headwinds, JBHT’s consistent efforts to reward its shareholders through dividend payments and share repurchases. Concurrent with the fourth quarter of 2023 earnings release, JBHT’s board of directors has approved a dividend hike of 2%, thereby raising its quarterly cash dividend from 42 cents per share to 43 cents. The raised dividend will be paid out on Feb 23, 2024, to all its shareholders of record as of Feb 9. The move reflects JBHT’s intention to utilize free cash to enhance its shareholders’ returns. The company is also active on the buyback front, having resumed the same in the fourth quarter of 2020 after a temporary pause amid coronavirus concerns. In the fourth quarter of 2023, JBHT purchased almost 137,000 shares for $25 million. As of Dec 31, 2023, JBHT had approximately $392 million remaining under its share repurchase authorization.

Zacks Rank and Stocks to Consider

JBHT currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Zacks Transportation sector are Air Lease Corporation (AL) and Kirby Corporation KEX. Each stock presently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Air Lease has an impressive earnings surprise history. The company's earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 20.15%.

The Zacks Consensus Estimate for 2024 earnings has been revised 27.7% upward over the past 90 days. AL has an expected earnings growth rate of 29.96% for 2024. Shares of AL have gained 31.7% in the past year.

KEX has an impressive earnings surprise history. The company's earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 5.75%.

KEX has an expected earnings growth rate of 32.80% for 2024. Shares of KEX have gained 41.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Air Lease Corporation (AL) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經