Honeywell (HON) to Acquire Civitanavi & Boost Aerospace Unit

Honeywell International Inc. HON recently announced its plan to purchase Civitanavi Systems S.p.A. for about €200 million ($217 million) to boost its portfolio of aerospace navigation solutions.

Based in Pedaso, Italy, Civitanavi is a leading provider of position navigation and timing technology solutions for the aerospace, defense and industrial end markets. The company is well recognized for its high-performance Fiber Optic Gyro technology in the navigation sector. It’s worth noting that Honeywell and Civitanavi share a history of long-term collaboration in developing advanced inertial navigation solutions.

Acquisition Rationale

The latest buyout is in sync with Honeywell’s policy of acquiring businesses to strengthen its business and expand its market share. The inclusion of Civitanavi’s expertise in inertial navigation, georeference and stabilization systems will strongly complement Honeywell’s navigation and sensors business. This will help Honeywell in expanding its autonomous operations offerings for the aerospace industry.

With the buyout, Honeywell expects to strengthen its foothold in the European Union. Management expects the transaction to be completed in third-quarter 2024, conditioned on the fulfillment of certain customary closing conditions.

Other Notable Buyouts

In December 2023, HON inked a deal to acquire Carrier’s Global Access Solutions business for an all-cash deal of $4.95 billion. This acquisition positions the company to become a leading provider of security solutions for the digital age. The acquisition is expected to close by the end of the third quarter of 2024.

Also, in June 2023, the company acquired Compressor Controls Corporation. The buyout fortifies HON’s expertise in industrial control, automation and process solutions while simultaneously bolstering its sustainability portfolio with new carbon capture control solutions.

Zacks Rank, Price Performance and Estimate Revisions

Honeywell, with approximately $133.8 billion market capitalization, currently carries a Zacks Rank #3 (Hold). The company is set to gain from strength in its commercial aviation aftermarket and original equipment businesses driven by solid demand in the air transport and business aviation markets. However, softness in its productivity solutions and services business remains a concern.

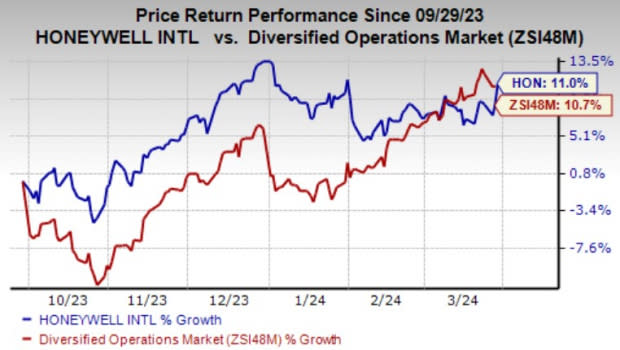

Image Source: Zacks Investment Research

In the past six months, the company’s shares have gained 11% compared with the industry’s growth of 10.7%.

The Zacks Consensus Estimate for its earnings is pegged at $9.96 for 2024, suggesting an increase of 0.1% from the 30-day-ago figure.

Stocks to Consider

Some better-ranked companies from the same space are discussed below.

Carlisle Companies Incorporated CSL currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CSL delivered a trailing four-quarter average earnings surprise of 7.6%. In the past 30 days, the Zacks Consensus Estimate for CSL’s 2024 earnings has increased 2.7%.

Vector Group Ltd VGR currently sports a Zacks Rank #1. It delivered a trailing four-quarter average earnings surprise of 10.2%. In the past 30 days, the consensus estimate for VGR’s 2024 earnings has been stable.

Griffon Corporation GFF presently sports a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 42%. The Zacks Consensus Estimate for GFF’s fiscal 2024 earnings has decreased 4.6% in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Vector Group Ltd. (VGR) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經