ManpowerGroup (MAN) Stock Shows No Change Since Q4 Earnings Beat

ManpowerGroup Inc. MAN reported impressive fourth-quarter 2023 results, with earnings and revenues beating the Zacks Consensus Estimate. The better-than-expected earnings, however, failed to impress investors as the stock price has stayed unchanged since the earnings release on Jan 30.

Quarterly adjusted earnings of $1.45 per share surpassed the consensus mark by 19.8%. The bottom line, however, declined 30.3% year over year, mainly due to restructuring costs and Argentina-related non-cash currency translation losses.

Revenues of $4.63 billion surpassed the consensus mark by 1.5% but declined 3.7% year over year on a reported basis. Revenues fell 5% on a constant-currency (cc) basis.

Segmental Revenues

Revenues from America of $1.07 billion were in line with our expectations but tumbled 9.1% year over year on a reported basis and 4.5% at cc. In the United States, revenues reached $702.3 million, lagging our estimate of $713.3 million and declining 14.3% year over year. In the Other Americas subgroup, revenues of $372.3 million surpassed our projection of $365.7 million and inched up 2.7% on a reported basis and 17.7% at cc.

Revenues from Southern Europe of $2.11 billion beat our prediction of $2.03 billion and improved marginally on a reported basis. Yet, the metric fell 4.1% at cc.

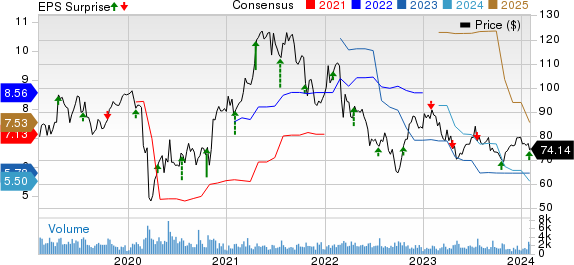

ManpowerGroup Inc. Price, Consensus and EPS Surprise

ManpowerGroup Inc. price-consensus-eps-surprise-chart | ManpowerGroup Inc. Quote

Revenues from France were $1.21 billion, beating our estimate of $1.18 billion. The reading was up 1.2% on a reported basis. Nonetheless, the same was down 4.1% at cc.

Revenues from Italy amounted to $415.1 million, beating our forecast of $400.8 million. It improved 0.6% on a reported basis. However, the measure contracted 4.6% at cc.

The Other Southern Europe sub-segment generated revenues of $487 million, which outshined our expectations of $449.9 million. It declined 1.4% year over year on a reported basis. The reported figure was down 3.7% at cc.

Northern Europe revenues declined 6.1% on a reported basis and 10.1% at cc to $913.7 million, lagging our estimate of $923.5 million. APME revenues totaled $552.2 million compared with our expectation of $541.5 million. The figure was down 4.5% on a reported basis and 2.7% at cc.

Operating Performance

The company registered an operating loss of $39.5 million, down by more than 100% year over year on a reported basis and a current currency basis.

Key Balance Sheet & Cash Flow Figures

ManpowerGroup exited the quarter with a cash and cash equivalent balance of $581.3 million compared with the prior quarter’s $571.1 million. Long-term debt was $990.5 million compared with $948.5 million in the preceding quarter.

The company generated $113.7 million in cash from operating activities. Capital expenditures were $23.1 million. It spent $50 million on repurchasing common stock in the quarter.

Q1 Outlook

ManpowerGroup expects earnings per share (EPS) in the range of 88 cents-98 cents for the first quarter of 2024. The Zacks Consensus Estimate is currently pegged at $1.01, higher than the guided range. Revenues are projected to decline 5-9% year over year on a reported basis and 4-8% at cc. The gross profit margin is anticipated to be between 17.2% and 17.4%.

The company expects EBITA margin to be between 1.7% and 1.9%. Operating profit margin is anticipated in the 1.5-1.7% band.

ManpowerGroup currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshot

Automatic Data Processing, Inc. ADP reported impressive second-quarter fiscal 2024 results, wherein earnings and revenues beat the respective Zacks Consensus Estimate.

Adjusted EPS of $2.13 beat the consensus estimate by 1.4% and grew 8.7% from the year-ago fiscal quarter’s figure.

Total revenues of $4.67 billion surpassed the consensus estimate by 0.2% and improved 6.3% from the year-ago fiscal quarter’s reading on a reported basis as well on an organic constant-currency basis.

Booz Allen Hamilton Holding Corp. BAH reported better-than-expected third-quarter fiscal 2024 results.

Quarterly adjusted EPS of $1.41 surpassed the Zacks Consensus Estimate by 24.8% and exceeded the year-ago quarter by 31.8%. The company reported revenues of $2.57 billion, which beat the consensus estimate by 1.5% and increased 12.9% year over year. Revenues, excluding billable expenses, were $1.77 billion, up 13% year over year.

Xerox Holdings Corporation XRX reported lower-than-expected fourth-quarter 2023 results, wherein earnings and revenues declined from the year-ago quarter. Despite the earnings miss, the stock gained 5% since the company’s earnings release on Jan 25.

Adjusted EPS of 43 cents missed the Zacks Consensus Estimate by 15.7% and decreased 51.7% year over year. Total revenues of $1.77 billion lagged the consensus mark by 1.6% and decreased 9.1% year over year on a reported basis. Revenues declined 7.4% on a constant-currency basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Xerox Holdings Corporation (XRX) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經