Neumora (NMRA) Down on FDA Clinical Hold on Neurology Drug

Neumora Therapeutics, Inc. NMRA announced that the FDA has placed a clinical hold on the phase I study, which evaluated NMRA-266, its positive allosteric modulator (PAM) of the M4 muscarinic receptor, for treating some types of neuropsychiatric disorders.

The regulatory body placed the clinical hold after pre-clinical data showed convulsions in rabbits following treatment with NMRA-266.

Shares of NMRA were down 17.5% on Apr 15 following the announcement of the news.

Following the FDA’s clinical hold, the phase I single ascending dose/multiple ascending dose study investigating NMRA-266 has been paused.

However, around 30 participants who were already dosed in the above mentioned early-stage study have not experienced any evidence of convulsions as of now. The company is currently working closely with the FDA to resolve the clinical hold.

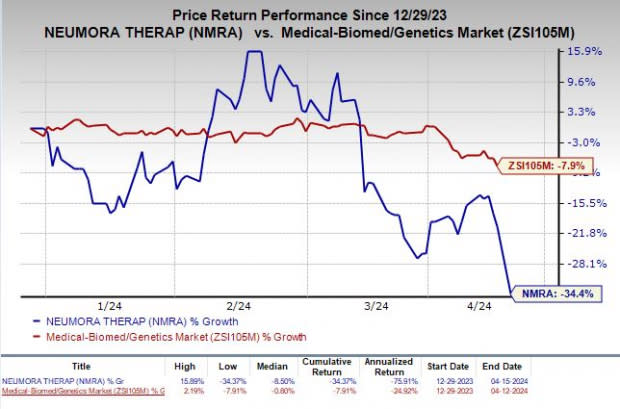

Shares of Neumora have plunged 34.4% so far this year compared with the industry’s decline of 7.9%.

Image Source: Zacks Investment Research

NMRA-266 is being developed as a treatment for schizophrenia and other neuropsychiatric disorders.

In March 2024, Neumora announced that a phase Ib study evaluating NMRA-266 in schizophrenia was expected to be initiated in the second half of 2024, with data from the same anticipated in 2025.

The company also intended to announce data from the phase I single ascending dose/multiple ascending dose study on NMRA-266 in healthy adult participants by the middle of 2024.

The FDA’s clinical hold is likely to delay further development of NMRA-266. This, in a way, is likely to nullify the company’s prior guidance regarding the development plan of NMRA-266.

It remains to be seen whether the company will move ahead with the development of NMRA-266 for treating schizophrenia or any other neuropsychiatric disorders or whether it will scrap all development plans for NMRA-266.

Neumora’s lead pipeline candidate is navacaprant (NMRA-140), which is being developed in the phase III KOASTAL program (KOASTAL-1, KOASTAL-2, and KOASTAL-3 studies) as a potential monotherapy treatment for major depressive disorder (MDD) and other neuropsychiatric disorders.

Top-line data from the KOASTAL-1 study is expected in the second half of 2024, while top-line data from the KOASTAL-2 and KOASTAL-3 studies are expected in the first half of 2025.

Neumora also plans to begin a phase II study on navacaprant for treating bipolar depression in the first half of 2024.

Zacks Rank & Stocks to Consider

Neumora currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are ADMA Biologics, Inc. ADMA, Ligand Pharmaceuticals Incorporated LGND and ANI Pharmaceuticals, Inc. ANIP, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Year to date, shares of ADMA have rallied 32.3%.

ADMA’s earnings beat estimates in three of the trailing four quarters and met the same once, the average surprise being 85.00%.

In the past 60 days, estimates for Ligand’s 2024 earnings per share have improved from $4.42 to $4.56. Year to date, shares of LGND have gained 11.7%.

Earnings of LGND beat estimates in each of the trailing four quarters, the average surprise being 84.81%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have improved from $4.06 to $4.43. Year to date, shares of ANIP have jumped 20.2%.

Earnings of ANIP beat estimates in each of the trailing four quarters, the average surprise being 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Neumora Therapeutics, Inc. (NMRA) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經