NuScale Power Corp CEO John Hopkins Sells 59,768 Shares

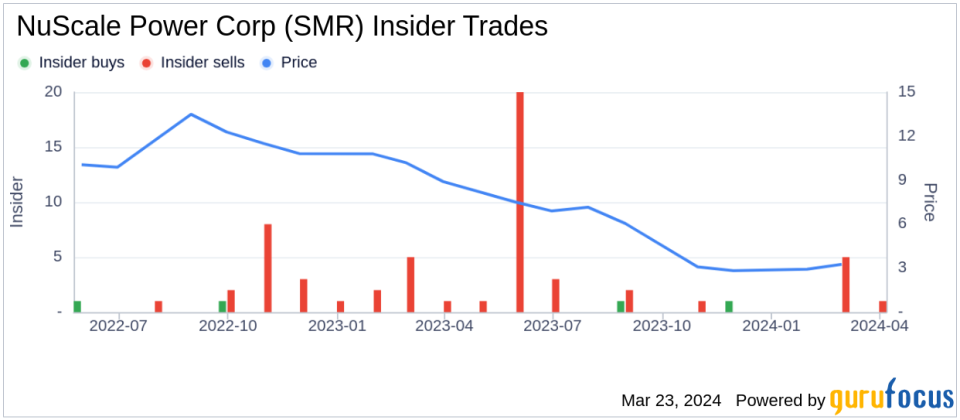

NuScale Power Corp (NYSE:SMR) has reported an insider sale according to the latest SEC filings. CEO John Hopkins sold 59,768 shares of the company on March 22, 2024. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this SEC Filing.NuScale Power Corp is a company that specializes in small modular reactor (NYSE:SMR) technology. The company is focused on offering scalable advanced nuclear technology for the production of electricity, heat, and clean water to meet the growing global energy demand.Over the past year, the insider has sold a total of 88,305 shares and has not made any purchases of the company's stock. The recent sale by John Hopkins represents a significant portion of these transactions.The insider transaction history for NuScale Power Corp shows a pattern of insider activity. In the past year, there have been 2 insider buys and 33 insider sells. This trend can be visualized in the following insider trend image:

On the valuation front, shares of NuScale Power Corp were trading at $4.2 each on the day of the insider's recent sale, giving the company a market capitalization of approximately $339.196 million.For investors monitoring insider behaviors, such transactions can provide valuable insights into the company's financial health and insider perspectives on the stock's value. However, it is important to consider a wide range of factors when evaluating the implications of insider trading activities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

雅虎香港財經

雅虎香港財經