NVIDIA (NVDA) a Solid Buy as it Squashes Bubble Fears

After concluding 2023 on a high note, NVIDIA Corporation’s NVDA shares are off to a flying start this year. The pioneer in graphic processing units (GPUs) recorded the largest one-day gain in the history of Wall Street on Feb 22, banking on an artificial intelligence (AI) frenzy.

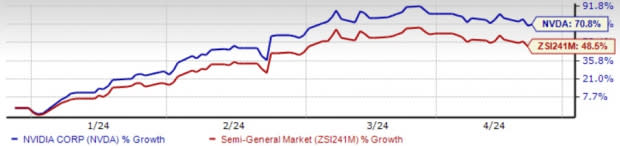

NVIDIA’s shares have skyrocketed 70.8% this year and have surpassed the Semiconductor – General industry’s gain of 48.5%. So far this year, NVIDIA has outshined other magnificent seven stocks and is now the third-largest company in the United States, lagging only behind Microsoft Corporation MSFT and Apple Inc. AAPL.

Image Source: Zacks Investment Research

However, NVIDIA’s stellar surge has made skeptics believe that the stock is in a bubble. After all, stretched valuations and any potential decrease in AI-linked demand for NVIDIA’s chips may lead to a significant decline in the stock price. But NVIDIA isn’t in a bubble! The company’s share prices aren’t gathering momentum based on speculation but due to strong fundamental factors.

The unquenchable demand for AI models is here to stay since it is a major driving force behind productivity gains across multiple industries. While Meta Platforms, Inc. META confirmed that the adaptation of AI tools has boosted returns from its ad campaigns, UBS Group AG UBS expects the integration of AI to drive productivity growth over the next three years.

Now, NVIDIA’s chips are required for AI models deployed across several verticals from manufacturing to cloud computing. This explains why NVIDIA’s H100 graphic cards are the most sought-after commodity in the AI chip market. Such massive demand, thus, has justifiably led to an uptick in NVIDIA’s revenues and earnings.

NVIDIA’s revenues for the fiscal fourth quarter came in at $22.1 billion, up a solid 265% from a year ago. For the quarter ending on Jan 28, 2024, the company’s earnings per share came in at $4.93, up a whopping 765% from a year ago. What’s more, the company’s data center business, which is involved in the production of the H100 graphic cards, was able to dismiss the negative impact of government restrictions on exporting AI semiconductors to China.

In reality, NVIDIA is expected to introduce the B200 Blackwell graphics card to the market. NVIDIA, in collaboration with Taiwan Semiconductor Manufacturing, will produce the powerful AI graphics card, which incidentally has received funding from the U.S. government. This explains why NVIDIA is cheerful about its forthcoming growth and expects revenues of $24 billion for the ongoing quarter, easily beating estimates.

But it’s just not about NVIDIA, the euphoria behind the broader AI-boom is not hype, unlike the dot-com era. Tech leaders are primarily involved in commercializing generative AI technology and they have more than double the market capitalization that companies had during the tech bubble in the late 1990s. Their profit margins and return on capital are also way more than the companies in the Internet bubble period. Hence, the strength in their underlying business validates the higher stock prices.

On this promising note, NVIDIA remains a market darling and razor-sharp investors should encash on its likely long-term upward movement. NVIDIA’s expected earnings growth rate for the current and next year is 84% and 14.1%, respectively. Its estimated revenue growth rate for the current and next year is 73.8% and 17.9%, respectively. The Zacks Consensus Estimate for NVIDIA’s current-year earnings has moved up 17.2% over the past 60 days.

To top it, NVIDIA’s net profit margin is an outstanding 48.9%, way more than the 20% threshold, signifying a high margin. This means the company is capable of generating the required profit from sales and has successfully kept operational costs under control. NVIDIA is also a cash-rich company making it immune to market upheavals. The company’s cash and cash equivalents were $25.98 billion as of Jan 28, 2024, up from $18.28 billion on Oct 29, 2023.

NVIDIA, rightfully, has a Zacks Rank #1 (Strong Buy) and a Growth Score of B, a combination that offers the best opportunities in the growth investing space. You can see the complete list of today’s Zacks Rank #1 stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經