Perrigo (PRGO) to Report Q1 Earnings: Here's What to Expect

Perrigo Company plc PRGO is scheduled to report first-quarter 2024 results on May 7, before the opening bell. In the last reported quarter, the company posted an earnings surprise of 3.61%.

Let’s see how things have shaped up for this announcement.

Factors at Play

The Zacks Consensus Estimate for Perrigo’s total revenues is pegged at around $1.1 billion, while the same for earnings stands at 24 cents per share. Both metrics indicate a decline from the year-ago quarter’s levels.

Perrigo reports its results under the following segments — Consumer Self Care Americas (CSCA) and Consumer Self Care International (CSCI). While we expect first-quarter sales in the CSCA segment to have suffered a decline due to lower net product sales in the United States, performance in the CSCI segment is expected to have been aided by products added through its HRA Pharma acquisition, partially offset by unfavorable currency movements.

The Zacks Consensus Estimate and our model estimate for CSCA sales stand at $654 million and $656 million, respectively. For sales in the CSCI segment, both the Zacks Consensus Estimate and our model estimate are pegged at $439 million.

Perrigo reported higher net price realization for its products through strategic price increases in recent quarters. The improving price trend will likely be reflected in first-quarter sales, contributing to the top line.

Investors are likely to be curious about potential product launches this year. We also expect management to provide an update on the expectedimpact of macroeconomic pressures in 2024.

Earnings Surprise History

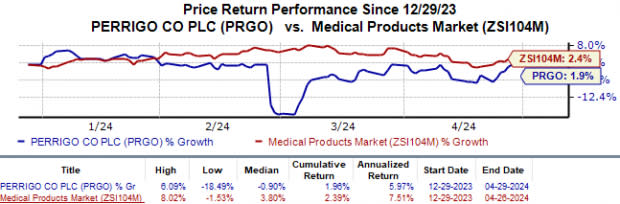

Perrigo’s shares have gained 2.00% year to date compared with the industry’s 2.4% rise.

Image Source: Zacks Investment Research

The company’s earnings performance has been decent over the trailing four quarters. Its earnings beat estimates in three of the last four quarters and missed the mark on one occasion, registering an earnings surprise of 6.47% on average.

Perrigo Company plc Price and EPS Surprise

Perrigo Company plc price-eps-surprise | Perrigo Company plc Quote

Earnings Whispers

Our proven model does not predict an earnings beat for Perrigo this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Perrigo has an Earnings ESP of 0.00% as both the Most Accurate Estimate and Zacks Consensus Estimate are pegged at 24 cents.

Zacks Rank: Perrigo currently carries a Zacks Rank #5 (Strong Sell). You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Akero Therapeutics AKRO has an Earnings ESP of +28.89% and a Zacks Rank #3.

Akero Therapeutics’ stock has lost 16.0% year to date. AKRO beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions. On average, Akero delivered a negative earnings surprise of 2.28% in the last four quarters.

argenx ARGX has an Earnings ESP of +10.00% and a Zacks Rank #3.

argenx’s stock has lost 2.0% year to date. ARGX beat earnings estimates in two of the last four quarters and missed the mark on one occasion while meeting the mark on another. On average, argenx witnessed an earnings surprise of 14.18% in the last four quarters. ARGX will report first-quarter 2024 results on May 9.

Sarepta Therapeutics SRPT has an Earnings ESP of +108.99% and a Zacks Rank #3.

Sarepta Therapeutics’ shares have increased 33.6% in the year-to-date period. Earnings of SRPT beat estimates in each of the last four quarters, delivering an average earnings surprise of 464.56%. Sarepta will report first-quarter 2024 results on May 1, after market close.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

argenex SE (ARGX) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經