How to Play Norwegian Cruise (NCLH) Ahead of Q1 Earnings?

Norwegian Cruise Line Holdings Ltd. NCLH is scheduled to report first-quarter 2024 results on May 1, before the opening bell.

The Zacks Consensus Estimate for earnings is pegged at 12 cents per share. It reported an adjusted loss per share of 30 cents a year ago. The consensus mark for revenues is pegged at $2.24 billion, implying a 22.7% jump from the year-ago level.

Robust demand for its Norwegian Cruise Line brand, record-high bookings and higher pricing levels are likely to have aided the company’s performance. Our model predicts passenger ticket revenues, and onboard and other revenues to improve 25.8% and 4.1%, respectively, from the year-ago levels to $1,520.4 million and $638.2 million. We expect occupancy to be 104.8%.

The cruise industry giant's performance outlook appears promising, but investors must weigh potential risks against anticipated rewards before making investment decisions.

Booking & Fleet Expansion Drive Optimism

NCLH continues to benefit from robust booking. It is witnessing healthy demand across all markets, brands and products. Management intends to focus on strategic marketing efforts to drive demand and high-value bookings in the upcoming periods. For 2024, it expects healthy net yield growth of approximately 5.4% on a constant currency basis on the back of improved occupancy and pricing strength.

Norwegian Cruise is constantly looking to expand its fleet size, which is currently at 32. In 2023, the company added three new world-class ships to its fleet, one for each of its three award-winning brands. It introduced Oceania Cruises Vista in May, Norwegian Viva in August and Regent Seven Seas Grandeur in November.

It plans to introduce five more ships through 2028. For the Oceania Cruises brand, NCLH has one Allura Class Ships to be delivered in 2025. For the Norwegian brand, it has four Prima Class Ships on order, with scheduled delivery dates from 2025 through 2028. These additions are expected to increase its total berths to approximately 82,500.

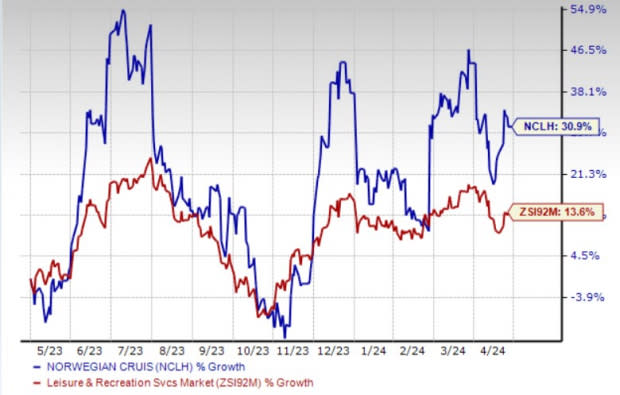

Image Source: Zacks Investment Research

High Costs Pose Challenges

Despite the positive outlook, Norwegian Cruise faces challenges associated with high operating expenses, particularly payroll, fuel and transportation costs. The company remains cautious of increased expenses, particularly in terms of fuel and capacity additions. Total cruise operating expenses for the first quarter of 2024 are projected to rise 7.7% from the year-ago level.

Wrapping Up

While Norwegian Cruise’s long-term prospects appear promising amid solid booking trends and new ship additions, investors are advised to exercise caution. Despite a notable 30.9% increase in its stock price over the past year, concerns over high operating costs suggest the need for prudence. As the travel industry continues its recovery, NCLH's performance outlook remains positive, but potential investors may prefer to await a more opportune entry point.

What the Zacks Model Unveils

Per our proven model, stocks with a combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increase the chances of an earnings beat. At present, Norwegian Cruise has an Earnings ESP of -9.41% and a Zacks Rank of 3. Hence, it is presumed that Norwegian Cruise is unlikely to beat estimates this season.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks Poised to Beat

Here are some stocks from the Zacks Consumer Discretionary sector that investors may consider, as our model shows that these have the right combination of elements to post an earnings beat this time around.

Fox Corporation FOXA has an Earnings ESP of +8.73% and a Zacks Rank of 3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

FOXA is expected to register a 23.4% year-over-year increase in earnings for the to-be-reported quarter. It reported better-than-expected earnings in each of the trailing four quarters, the average surprise being 71.1%.

DraftKings Inc. DKNG currently has an Earnings ESP of +12.65% and a Zacks Rank of 3.

DKNG’s earnings for the to-be-reported quarter are expected to increase 67.8% year over year. It reported better-than-expected earnings in two of the trailing four quarters and missed on the other two occasions, with an average negative surprise of 57.1%.

Funko, Inc. FNKO currently has an Earnings ESP of +6.90% and a Zacks Rank of 3.

FNKO’s earnings for the to-be-reported quarter are expected to increase 40.8% year over year. It reported better-than-expected earnings in three of the trailing four quarters and missed on one occasion, the average surprise being 42.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

Funko, Inc. (FNKO) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經