Plunge in Mortgage Rates Spurs Refinancing Surge - Consider PFSI, VEL, GHLD

All through the year, affordability issues dented homebuyers’ sentiments. Elevated interest rates also stretched their income. However, the Federal Reserve’s recent dovish stance lowered mortgage rates and boosted refinancing activities. This makes PennyMac Financial Services, Inc. PFSI, Velocity Financial, Inc. VEL and Guild Holdings Company GHLD enticing buys at the moment. Let’s have a closer look –

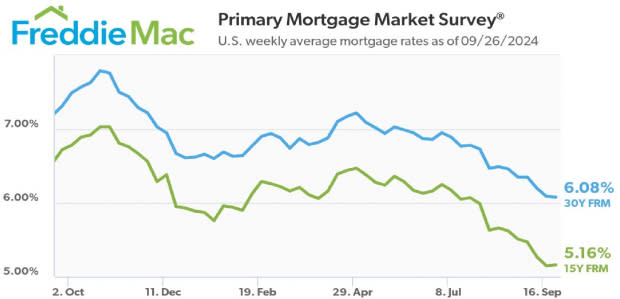

Freddie Mac Report: Mortgage Rates at 2-Year Low

For the week ending Sept. 26, the 30-year fixed mortgage averaged 6.08% compared with 7.31% in the same period a year ago, according to Freddie Mac. The 30-year mortgage rate’s 4-week and 52-week averages were 6.18% and 6.89%, respectively. The 30-year loan has now touched its lowest level since mid-September 2022.

The 15-year fixed-rate mortgage slipped to 5.16% from 6.72% in the same period last year, added the Freddie Mac report. The 4-week and 52-week average rates on the 15-year loan were 5.26% and 6.16%, respectively.

Image Source: Freddie Mac

Why Are Mortgage Rates Falling?

In the September monetary policy meeting, the Fed’s move to cut interest rates by a 50 basis point, with more such jumbo rate cuts expected to come has pushed long-term bond yields lower, eventually leading to a drop in mortgage rates.

The Fed trimmed interest rates for the first time in four years to spur economic activity and stabilize the labor market. The Fed slashed rates as price pressures have shown considerable signs of ebbing (read more: Fed Rate Cuts Make This Beaten-Down Cathie Wood Stock a Buy Now).

Refinancing Activity Surges Due to Low Mortgage Rates

Lower mortgage rates led to an uptick in refinancing activities as potential homeowners capitalized on the savings. The Mortgage Bankers Association noted that mortgage application volumes climbed to their highest level in more than 2 years last week.

Most importantly, applications for refinancing a home loan soared 20% in the week ending Sept. 20 from the prior week. From the previous year, applications for refinancing jumped 175%.

With mortgage rates falling, home-buying activities could well pick up. However, the drop in mortgage rates spurred refinancing activity among homeowners who purchased homes at around 7% or a higher debt obligation. Mortgage rates hovered around the 7% mark for most of the year. It had only begun to cool off since late July (read more: Mortgage Rates Are Falling: A Boon for 2 Warren Buffett Stocks).

Time to Buy PFSI, VEL, GHLD

With the decline in mortgage rates lifting mortgage application volume and demand for refinancing, stocks such as PennyMac, Velocity Financial and Guild are poised to gain. This is because PennyMac provides retail loan services, Velocity Financial offers property loans, and Guild sells residential mortgage loans.

Investors, therefore, should buy these stocks due to the promising mortgage rate scenario and positive earnings estimate revisions. An increase in earnings estimates indicates a sound company whose shares are poised to scale upward in the long run.

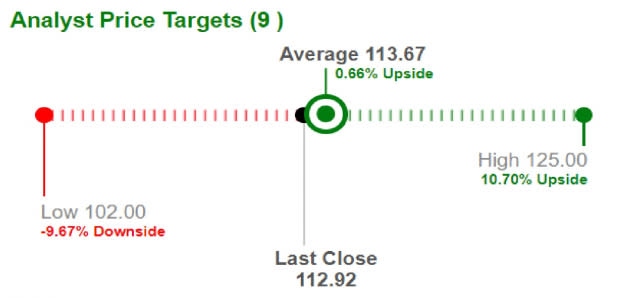

PFSI Stock – Strong Price Upside Up to 10.7%

The Zacks Consensus Estimate for PFSI’s current-year earnings has increased 0.7% over the past 60 days. The Zacks Rank #2 (Buy) company’s expected earnings growth rate for the current year is 102.5%. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Brokers, meanwhile, have jacked up the average short-term price target of PFSI by 0.7% from the stock’s last closing price of $112.92. The highest price target is $125, an upside of 10.7%.

Image Source: Zacks Investment Research

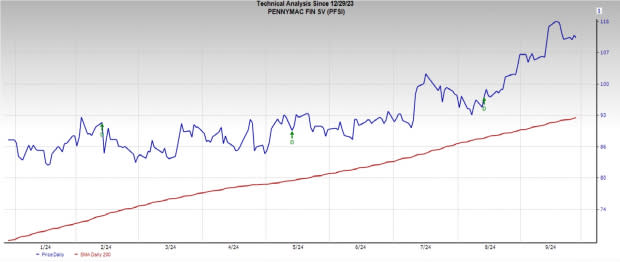

Moreover, the PFSI stock has been trading above the 200-day moving average (DMA) this year, indicating a long-term uptrend.

Image Source: Zacks Investment Research

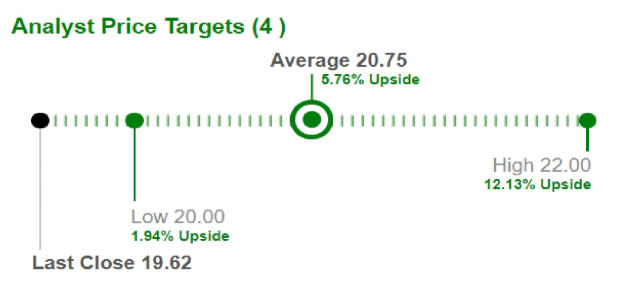

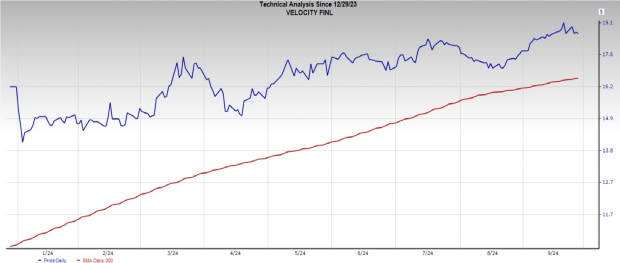

VEL Stock – Strong Price Upside Up to 12.1%

The Zacks Consensus Estimate for VEL’s current-year earnings has increased 4.4% over the past 60 days. The Zacks Rank #1 company’s expected earnings growth rate for the current year is 24%.

Meanwhile, brokers have increased VEL’s average short-term price target by 5.8% from the stock’s last closing price of $19.62. The highest price target is $22, an upside of 12.1%.

Image Source: Zacks Investment Research

Additionally, the VEL stock has been trading above the 200-DMA year to date, signifying a lasting uptrend.

Image Source: Zacks Investment Research

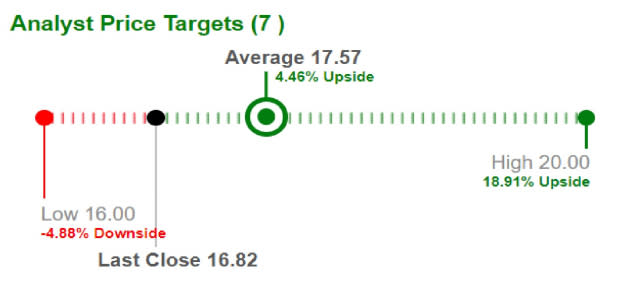

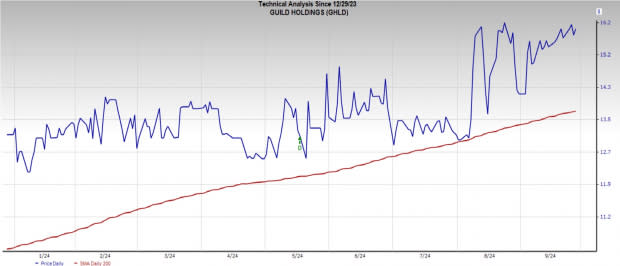

GHLD Stock – Strong Price Upside Up to 18.9%

The Zacks Consensus Estimate for GHLD’s current-year earnings has increased 26.5% over the past 60 days. The Zacks Rank #1 company’s expected earnings growth rate for the current year is 96.2%.

In the meantime, brokers have increased the average short-term price target of GHLD by 4.5% from the stock’s last closing price of $16.82. The highest price target is $20, an upside of 18.9%.

Image Source: Zacks Investment Research

So far this year, the GHLD stock has traded above the 200-DMA, a tell-tale bullish trend.

Image Source: Zacks Investment Research

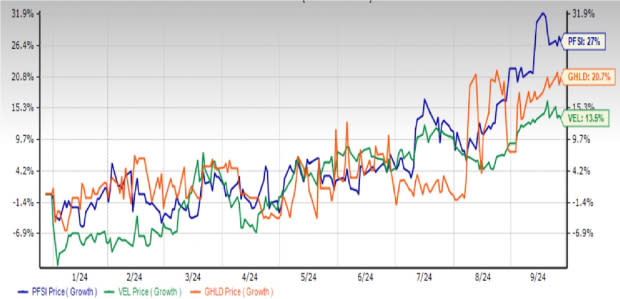

Shares of PennyMac, Velocity Financial and Guild have soared 27%, 13.5% and 20.7%, respectively, so far this year.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PennyMac Financial Services, Inc. (PFSI) : Free Stock Analysis Report

Velocity Financial, Inc. (VEL) : Free Stock Analysis Report

Guild Holdings Company (GHLD) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經