Sandstorm Gold (SAND) Posts Y/Y Preliminary Q1 Revenue Decline

Sandstorm Gold Ltd. SAND announced preliminary revenues and cash operating margins for the first quarter of 2024. Revenues in the quarter fell 2.7% year over year. The company’s cash operating margins moved up 7.8%.

SAND sold nearly 20,300 attributable gold equivalent ounces (GEOs) in the quarter. This marks a 28.4% decline from the 28,368 ounces of GEOs sold in first-quarter 2023. Sandstorm Gold delivered preliminary revenues of $42.8 million, down from the prior-year quarter’s $44 million.

SAND reported a preliminary cost of sales (excluding depletion) of $5.7 million, lower than the $6.5 million reported in the first quarter of 2023. The cash operating margin was $1,781 per attributable GEO in the quarter under review, higher than the prior-year quarter's $1,652.

The company will report its first-quarter results for 2024 on May 2, 2024.

At the end of the fourth quarter of 2023, Sandstorm Gold announced expectations of attributable gold equivalent ounces of 75,000-90,000 for 2024. Within the next five years, the company anticipates producing 125,000 attributable gold-equivalent ounces.

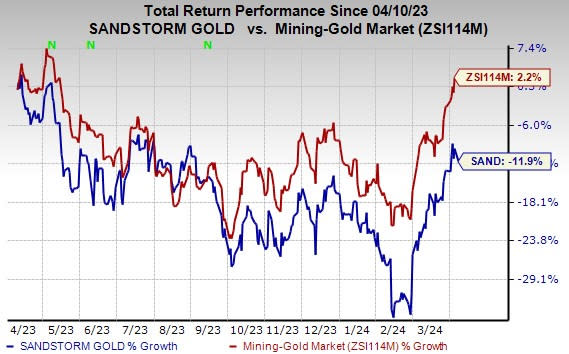

Price Performance

Shares of the company have lost 11.9% in the past year against the industry’s growth of 2.2%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Sandstorm Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Ecolab Inc. ECL, Carpenter Technology Corporation CRS and Innospec Inc. IOSP. ECL and CRS sport a Zacks Rank #1 (Strong Buy) at present, and IOSP has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 41.8% in a year.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.00 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 33.5% in a year.

The Zacks Consensus Estimate for Innospec’s 2024 earnings is pegged at $6.72 per share, indicating a year-over-year rise of 10.3%. The Zacks Consensus Estimate for IOSP’s current-year earnings has been revised 2% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 10.5%. The company’s shares have rallied 19.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經