Select Medical (SEM) Expands in Florida With UF Health JV

Select Medical Corporation SEM partnered with UF Health Jacksonville via a joint venture (JV) to open an inpatient rehabilitation hospital with a capacity of 48 beds. This new hospital will function within UF Health North in Jacksonville, FL.

This move bodes well for SEM as it will expand its footprint in inpatient rehabilitative care in the Northern Florida region. The company currently consists of more than 33 inpatient rehabilitation centers across multiple brands. Select Medical will manage operations and the new hospital will be branded as UF Health Rehabilitation Hospital. It will contribute its clinical expertise and programs, which will further attract commercial payors, thereby improving the financial performance of the JV.

This JV reflects SEM’s efforts to grow its existing networks and improve its financial results as a by-product. SEM has been quite active in pursuing opportunistic acquisitions and identifying JVs. The company has many upcoming projects in the inpatient rehabilitation space and it expects this business to continue with its strong performance in 2024. It expects to complete or be under construction of 533 inpatient rehab beds in 2024, which will begin operation in the current year or next year.

Hence, these growth endeavors should provide an impetus to revenues of the SEM’s Rehabilitation segment, which contributed 14.7% to the total revenues in 2023.This JV will serve patients recovering from traumatic brain injury, stroke and other debilitating medical conditions.

Pursuing JVs with large healthcare systems is a major strategy of Select Medical to grow its Inpatient Rehabilitation business. UF Health Jacksonville would refer patients to rehabilitation and those patients will receive specialized treatments from SEM. Moves like this should aid the company in achieving its targeted revenues between $6.9 billion and $7.1 billion in 2024.

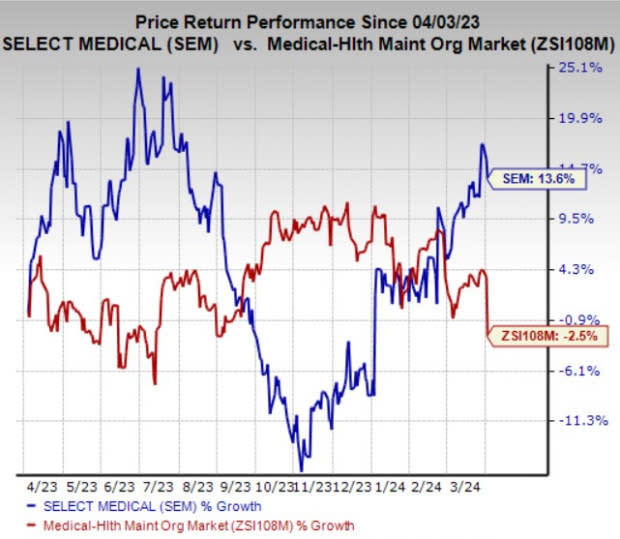

Price Performance

Select Medical’s shares have gained 13.6% in the past year against the 2.5% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Select Medical currently has a Zacks Rank #4 (Sell).

Enhancing the array of healthcare options, some better-ranked and promising stocks in the Medical sector are Universal Health Services, Inc. UHS, The Cigna Group CI and Health Catalyst, Inc. HCAT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Universal Health Services’ 2024 bottom line suggests 27% year-over-year growth. UHS has witnessed two upward estimate revisions over the past 30 days against one movement in the opposite direction. It beat earnings estimates in all the last four quarters, with an average surprise of 5.9%.

The Zacks Consensus Estimate for Cigna’s 2024 earnings indicates a 13% year-over-year increase. CI beat earnings estimates in each of the past four quarters, with an average surprise of 2.9%. The consensus mark for revenues suggests 20.4% growth from the year-ago period.

The Zacks Consensus Estimate for Health Catalyst’s 2024 earnings implies a 120% increase from the year-ago reported figure. HCAT beat earnings estimates in each of the last four quarters, with an average surprise of 247.9%. The consensus mark for its current-year revenues is pegged at $308.2 million, which indicates a 4.2% year-over-year increase.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

Health Catalyst, Inc. (HCAT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經