Skyworks (SWKS) Q2 Earnings Beat Estimates, Revenues Down Y/Y

Skyworks Solutions SWKS reported non-GAAP earnings of $1.55 per share in second-quarter fiscal 2024, beating the Zacks Consensus Estimate by 1.97% and declining 23.3% year over year.

Revenues of $1.04 billion dropped 9.3% on a year-over-year basis and missed the consensus mark by 0.01%.

Mobile revenues contributed nearly 66% to total revenues and declined 19% sequentially.

In the second quarter of fiscal 2024, SWKS provided integrated platforms to the top 5G smartphone OEMs, including flagship and mid-tier releases for Samsung, Google and Oppo.

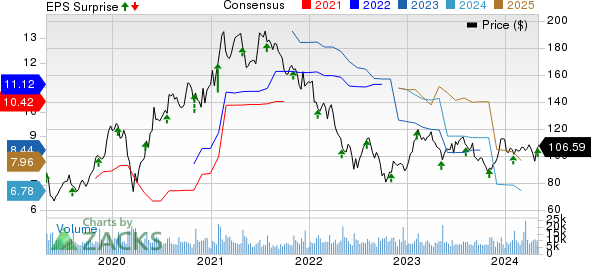

Skyworks Solutions, Inc. Price, Consensus and EPS Surprise

Skyworks Solutions, Inc. price-consensus-eps-surprise-chart | Skyworks Solutions, Inc. Quote

Skyworks launched new initiatives in automotive, including infotainment systems, traction inverters, cloud-enhanced driver-assist and CV2X on-board units.

Skyworks also highlighted its solid portfolio of Wi-Fi 6E and Wi-Fi 7 design wins in the edge IoT segment.

Broad markets contributed nearly 34% to total revenues and up 1% sequentially.

Operating Details

Non-GAAP gross margin contracted 500 basis points (bps) on a year-over-year basis to 45%.

Research & development expenses, as a percentage of revenues, increased 190 bps year over year to 14.8%.

Selling, general and administrative expenses increased 50 bps to 7.3% in the reported quarter.

Non-GAAP operating margin contracted 680 bps on a year-over-year basis to 26.7% in the reported quarter.

Balance Sheet & Cash Flow

As of Mar 29, 2024, cash & cash equivalents and marketable securities were $1.2 billion compared with $1.04 billion as of Dec 29, 2023.

Long-term debt remained steady at $993.6 million as of Mar 29, 2024, compared with $993.2 million as of Dec 29, 2023.

Cash generated by operating activities was $300 million in the quarter under discussion compared with $775 million in the previous quarter.

Free cash flow was $273 million, with a 26% free cash flow margin.

Skyworks paid out dividends worth $109 million in the reported quarter.

Guidance

For the third quarter of fiscal 2024, the company currently expects revenues to be $900 million plus or minus 2%. Earnings are expected to be $1.21 per share at the mid-point of this revenue guidance.

The gross margin is expected to be between 45% and 47%. Operating expenses are expected to be in the range of $192-$198 million.

Zacks Rank & Stocks to Consider

Skyworks currently carries a Zacks Rank #3 (Hold).

SWKS’s shares have returned 1% compared with the Zacks Computer and Technology sector’s rise of 39.7% year to date.

Here are some better-ranked stocks worth considering in the broader sector.

Arista Networks ANET, Criteo CRTO and Dell Technologies DELL are some better-ranked stocks that investors can consider in the broader sector. ANET and CRTO sport a Zacks Rank #1 (Strong Buy), while DELL carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have surged 60.2% year to date. ANET is set to report its first-quarter 2024 results on May 7.

Criteo’s shares have gained 12.8% year to date. CRTO is set to report first-quarter 2024 results on May 2.

Dell Technologies’ shares have skyrocketed 184.4% year to date. DELL is set to report its first-quarter fiscal 2025 results on May 30.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Criteo S.A. (CRTO) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經