Strong Brand, Innovation Craft Molson Coors' (TAP) Growth Story

Molson Coors Beverage Company TAP has been in a good spot, courtesy of brand strength, and strong performances across its portfolio and both business units. Additionally, the company is well-placed on the back of its revitalization plan, commitment toward innovation and the premiumization of its global portfolio. Strong portfolio performance, strength in both business units, and continued momentum in Coors Light and Miller Lite in the United States have been aiding TAP’s performance.

Driven by these trends, Molson Coors reported top and bottom-line beats in the fourth quarter of 2023. Net sales grew 6.1% year over year and 5% on a constant-currency basis. Sales growth was driven by a positive price and sales mix, increased financial volumes, and the positive impacts of foreign currency.

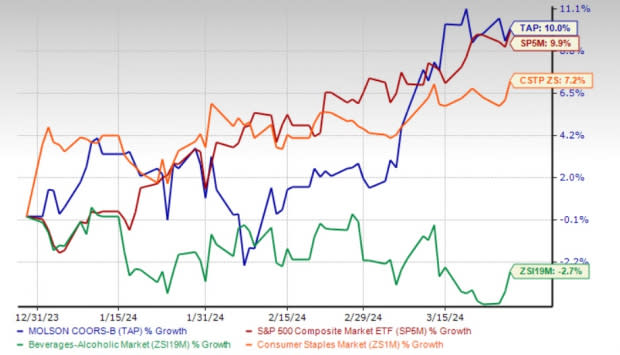

Additionally, the company’s business trends and initiatives have been well-reflected in its share price. Shares of this Zacks Rank #2 (Buy) company have risen 10% in the year-to-date period against the industry’s decline of 2.7%. TAP also fared better than the sector and the S&P 500’s growth of 7.2% and 9.9%, respectively, in the same period.

The Zacks Consensus Estimate for Molson Coors’ 2024 sales and earnings suggests growth of 1.4% and 4.2%, respectively, from the year-ago reported numbers.

Image Source: Zacks Investment Research

What’s Working Well for TAP?

TAP boasts a strong portfolio of well-established brands. The company has been committed to growing its market share through innovation and premiumization. With a view to accelerating portfolio premiumization, it has been aggressively growing its above-premium portfolio in the past few years.

The company is making efforts to change the shape of its product portfolio and expand in growth areas. Its U.S. above-premium portfolio witnessed sales that outpaced its U.S. economy portfolio, driven by rapid growth of its hard seltzers, the launch of Simply Spiked Lemonade, and continued strength in Blue Moon and Peroni’s.

Molson Coors, one of the largest brewers in the world, is on track with its revitalization plan. The plan is focused on achieving sustainable top and bottom-line growth by streamlining the organization, and reinvesting resources into its brands and capabilities.

The company intends to invest in iconic brands and growth opportunities in the above-premium beer space. It also plans to develop digital competencies for employees, supply-chain-related system capabilities and commercial functions. As part of the plan, it has been expanding in adjacencies and beyond beer without hampering the support for its existing large brands.

Molson Coors is also building on the strength of its iconic core brands. Additionally, its cost-saving program announced in 2020 targets delivering cost savings of $600 million over three years.

Strength in Coors Light, Miller Lite and Coors Banquet resulted in total industry share growth in the United States, driven by brand positionings and better marketing. Molson Canadian and Carling beer in the U.K., and national champion brands witnessed significant market share gains.

Other Stocks to Consider

We have highlighted three other top-ranked stocks from the Consumer Staple sector, namely Vita Coco Company COCO, Coca-Cola FEMSA KOF and Celsius CELH.

Vita Coco, which develops, markets and distributes coconut water products in the United States, Canada, Europe, the Middle East and the Asia Pacific, currently sports a Zacks Rank #1 (Strong Buy). COCO shares have declined 7.3% year to date. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vita Coco’s current financial year’s sales and earnings per share suggests growth of 1.8% and 24.3%, respectively, from the year-ago reported figures. COCO has a trailing four-quarter earnings surprise of 31.3%, on average.

Coca-Cola FEMSA produces, markets and distributes soft drinks throughout the metropolitan area of Mexico City. The company has a trailing four-quarter negative earnings surprise of 2.1%, on average. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and earnings suggests growth of 10.1% and 25%, respectively, from the prior-year reported levels. KOF shares have risen 2.2% in the year-to-date period.

Celsius, which specializes in commercializing healthier, nutritional functional foods, beverages and dietary supplements, currently carries a Zacks Rank #2. CELH shares have rallied 53% in the year-to-date period.

The Zacks Consensus Estimate for CELH’s current financial-year sales and earnings suggests growth of 41.6% each from the year-earlier actuals. CELLH has a trailing four-quarter earnings surprise of 67.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經