Telefonica's (TEF) Q1 Earnings and Revenues Increase Y/Y

Telefonica, S.A. TEF reported a first-quarter 2024 net income of €532 million, which increased 78.9% year over year. Furthermore, earnings per share (EPS) was €0.08 compared with €0.04 in the year-ago quarter.

Quarterly total revenues increased 0.9% year over year to €10,140 million. The company has decided to discontinue reporting organic revenues to streamline its reporting and improve user-friendliness.

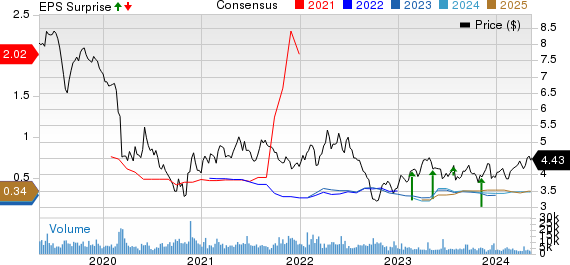

Telefonica SA Price, Consensus and EPS Surprise

Telefonica SA price-consensus-eps-surprise-chart | Telefonica SA Quote

Results by Business Units

Telefonica Espana: Quarterly revenues in Spain increased 1% year over year on a reported basis to €3,118 million. This is due to the momentum of higher handset sales and service revenues. The quarterly EBITDA margin was 35.8%. Capital expenditure (CapEx) on a reported basis increased 4.8% to €337 million in the quarter.

Telefonica Deutschland: Quarterly revenues fell 0.1% to €2,098 million. The downtick was due to MTR headwinds and weakness in the handset business. The quarterly EBITDA margin was 31.1%. CapEx decreased 5.1% to €233 million in the quarter.

VirginMedia-O2 U.K.: Quarterly revenues increased 2.6% due to a rise in mobile service revenues, partly offset by a decline in handset revenues. The quarterly EBITDA margin stood at 36%.

Telefonica Brasil: Quarterly revenues in Brazil grew 10.4% to €2,520 million, mainly due to growth in fixed and mobile revenues. The quarterly EBITDA margin was 40.6%. CapEx decreased 15.2% to €349 million in the quarter.

Telefonica Infra (Telxius): In the first quarter, Telxius launched an underwater cable route, which links the Dominican Republic to the United States and extends Sam-1 from Puerto Cana to Puerto Rico.

Telefonica Tech: Revenues increased 11% year over year to €476 million owing to solid momentum across Cybersecurity and IoT business segments.

Telefonica Hispam: Quarterly revenues in the Telefonica Hispam segment decreased 8.2% to €2,054 million, mainly due to lower handset sales. The quarterly EBITDA margin was 17.9%. CapEx has decreased 14.6% to €110 million in the quarter.

Other Details

Quarterly EBITDA was €3,205 million, up 1.9% year over year. Operating income was €1,042 million in the quarter under review, which increased 7.4% year over year.

Cash Flow & Liquidity

For the year that ended Mar 31, 2024, Telefonica generated €2,212 million of net cash from operating activities compared with €2,301 million generated in the comparable period in the prior year. The free cash outflow for the same period totaled €41 million.

As of Mar 31, 2024, the company had €6,391 million in cash and cash equivalents, with €34,122 million of non-current financial liabilities.

2024 Outlook

The company expects revenues to grow by approximately 1%. EBITDA is expected to grow by approximately 1% to 2%. CapEx-to-sales ratio is expected to be up to 13%.

In addition, the company announced a cash dividend of €0.30 per share, payable on December 2024 (€0.15 per share) and June 2025 (€0.15 per share).

Zacks Rank & Stocks to Consider

Telefonica currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology space are Badger Meter BMI, Watts Water Technologies WTS and Arista Networks ANET. Badger Meter sports a Zacks Rank #1 (Strong Buy), whereas Watts Water Technologies and Arista Networks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2024 EPS has increased 9.9% in the past 60 days to $3.89. BMI’s long-term earnings growth rate is 15.6%.

Badger Meter’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 12.7%. BMI shares have risen 35% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies’ fiscal 2024 EPS has improved 2.5% in the past 60 days to $8.54. WTS’ long-term earnings growth rate is 8%.

WTS’ earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 11.7%. Shares of WTS have risen 16.5% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.9% in the past 60 days to $7.53. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 62.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Telefonica SA (TEF) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經