VALE Q1 Earnings Miss Estimates, Decline Y/Y on Low Prices

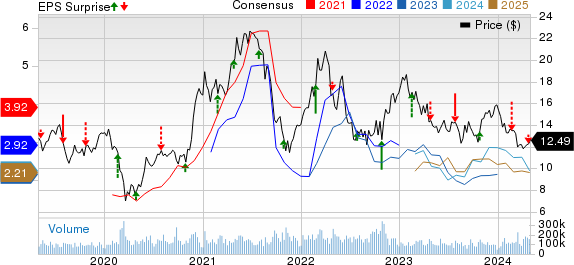

Vale S.A. VALE reported first-quarter 2024 adjusted earnings per share of 39 cents, which missed the Zacks Consensus Estimate of 42 cents. The bottom line was down 5% from 41 cents reported in the year-ago quarter.

While there was an improvement in sales volumes of iron ore and copper courtesy of continued operational improvements, this was negated by reduced sales volumes of nickel, as well as declines in prices for iron ore, copper and nickel. Additionally, elevated costs and expenses contributed to the decline in the bottom line.

Revenues

Net operating revenues inched up 0.3% year over year to around $8.46 billion. The top line surpassed the Zacks Consensus Estimate of $8.35 billion.

VALE S.A. Price, Consensus and EPS Surprise

VALE S.A. price-consensus-eps-surprise-chart | VALE S.A. Quote

In the first quarter of 2024, the Iron Solutions segment generated net operating revenues of $7 billion, marking a 10% increase compared with the same quarter last year. While the segment witnessed a 15% improvement in sales volume, attributed to Vale’s continuous operational enhancements, this was somewhat offset by lower prices. Notably, during the quarter, the S11D mine attained its highest production levels since 2020, bolstered by ongoing asset reliability initiatives that ensured enhanced operational stability even amid the rainy season.

The Energy Transition Metals segment’s net operating revenues plunged 28% year over year to $1.4 billion. Nickel revenues plunged 45% year over year to $558 million due to an 18% decline in sales volume and a 33% decline in prices. Copper revenues inched up 1% to $587 million as a 22% improvement in sales volumes was negated by an 18% drop in prices. Improved performance at the Salobo complex, coupled with the Salobo 3 plant ramp-up led to higher copper production and sales during the quarter.

Operating Performance

In the first quarter of 2024, the cost of goods sold was around $5.4 billion, which marked an 8% increase from the year-ago quarter. The gross profit declined 11% year over year to $3.1 billion. The gross margin was 36.6% compared with 41.3% in the year-ago quarter.

Selling, general and administrative expenditures rose 19% year over year to $140 million. Research and development expenses were $156 million, 12% higher than the year-ago quarter.

Adjusted operating income was $2.7 billion in the reported quarter. The figure marked an 11% decline from the year-ago quarter. Adjusted EBITDA was $3.4 billion in the quarter compared with $3.7 billion in the year-ago quarter.

Pro-forma adjusted EBITDA (including associates & Joint ventures) was down 9% year over year to $3.5 billion. The downfall was mainly due to lower iron ore fines, and nickel and copper realized prices. This was partially offset by increased iron ore and copper sales volumes. Higher costs and unfavorable currency also led to the decline.

The Iron Solutions segment’s adjusted EBITDA was $3.46 billion, which was in line with the first quarter of 2023 as gains from higher sales volumes were offset by lower prices.

The Energy Transition Metals segment’s EBITDA slumped 55% to $257 million from $573 million in the year-ago quarter. Copper operations witnessed a 29% year-over-year improvement in adjusted EBITDA to $284 million attributed to increased sales volumes. Adjusted EBITDA for nickel slumped 95% year over year to $17 million due to declining average prices and lower volumes sold.

Balance Sheet & Cash Flows

Vale exited the first quarter of 2024 with cash and cash equivalents of around $3.8 billion compared with $3.6 billion at the end of 2023. Cash flow generated from operations was $3.58 billion in the first quarter compared with $3.61 billion in the year-ago quarter.

Gross debt and leases at the end of the quarter were $14.7 billion compared with $13.9 billion at the end of 2023. The increase reflected new loans raised by Vale Base Metals Ltd. and Vale, per the company’s liability management plan.

Vale paid around $2.33 billion to shareholders in the form of dividends and repurchased shares for $275 million in the first quarter of 2024.

Other Updates

Vale recently entered into an agreement to acquire the entire 45% stake held by Cemig Geração e Transmissão S.A. in Aliança Geração de Energia S.A. for R$ 2.7 billion ($0.53 billion), effectively securing 100% ownership of Aliança Energia’s shares.

Aliança Energia's power generation asset portfolio comprises seven hydroelectric power plants and three wind farms in Brazil, with an installed capacity of 1,438 MW and an average physical guarantee of 755 MW. This strategic move is in line with Vale's objective to have an energy matrix based on renewable sources in Brazil and its commitment to decarbonize operations at competitive costs.

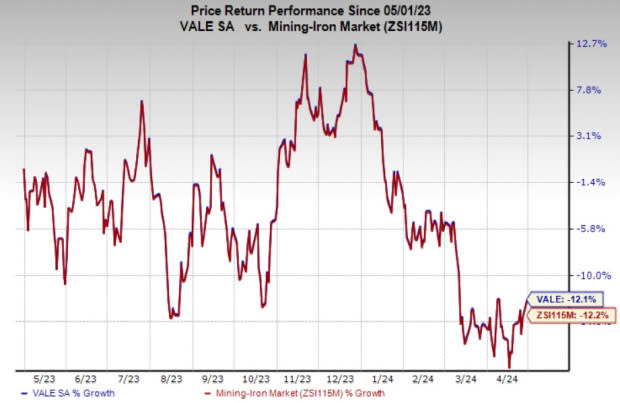

Price Performance

In the past year, shares of Vale have lost 12.1% compared with the industry’s 12.3% decline.

Image Source: Zacks Investment Research

Zacks Rank

Vale currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Performances

Except gold and silver, other metals (copper, zinc, nickel) experienced declines in prices in the first quarter, which was reflected in the results of other mining companies as well.

Teck Resources TECK reported first-quarter 2024 adjusted earnings per share (EPS) of 56 cents, missing the Zacks Consensus Estimate of 87 cents. The bottom line marked a 58% year-over-year plunge.

Gains from increased prices for steelmaking coal and higher copper sales volumes were offset by decreased zinc and copper prices and lower steelmaking coal sales volumes. Teck’s earnings were also impacted by increased unit costs at the steelmaking and Quebrada Blanca operations.

Southern Copper’s SCCO first-quarter 2024 EPS was 95 cents, which marked a 9.5% decline year over year. However, SCCO’s bottom line beat the Zacks Consensus Estimate of 78 cents.

The company reported year-over-year improvement in sale volumes for copper and molybdenum, However, this was offset by the impact of lower prices for copper, molybdenum and zinc.

Freeport-McMoRan Inc. FCX reported adjusted EPS of 32 cents, topping the Zacks Consensus Estimate of 27 cents.

Gains from higher copper and gold sales, and elevated gold prices were offset by lower copper prices. This resulted in a 38% year-over-year decline in Freeport-McMoRan’s earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Freeport-McMoRan Inc. (FCX) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Southern Copper Corporation (SCCO) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經